Identification of Credit Risk

Fundamentals of Credit Risk

Definition of credit risk

- Credit risk:is the possibility of losing money due to the inability, unwillingness, or nontimeliness of a counterparty to honor a financial obligation.不能、不愿、不及时履行金融义务

- The borrower (issuer of debt) failing to make full and timely payments of interest and/or principal.

- Credit migrations which bond issuer's creditworthiness deteriorates.

- Credit risk components

- Obligor债务人:Counterparties that have the responsibility of making good on an obligation

- The obligations: a legal liability(written word or oral form)

- Insolvency资不抵债: describes the financial state of an obligor whose liabilities exceed its assets.

- It is common to use insolvency as a synonym for bankruptcy but these are different events.资不抵债不代表就破产了

- Default: is failure to meet a contractual obligation Due either to insolvency or illiquidity.

- Bankruptcy破产: occurs when a court steps in upon default after a company files for protection under either Chapter 11or Chapter 7 of the bankruptcy laws (in the United States).

- Chapter 7清算 Chapter 11破产重组

Ability and willingness

- Ability还款能力: an obligor's inability to pay a financial obligation.

- A company funds a rapid expansion plan by borrowing and later finds itself with insufficient cash flows from operations to repay the lender.扩展太快还不了钱

- Businesses whose products or services become obsolete or whose revenues simply no longer cover operating and financing costs.企业的产品或服务过时或收入减少

- Inability to pay follows an unexpected and uninsured event that destroys an entity in a short time.意外和未投保事件

- Willingness还款意愿: Credit losses can also stem from the unwillingness of an obligor to pay.

- In instances in which unwillingness is at issue, if the dispute ends up in litigation and the lender prevails 胜诉,there is recovery of the amount owed, and ultimate losses are lessened or even avoided entirely because the borrower has the ability to pay.在不还款意愿成为争议焦点的情况下,如果争议最终诉诸诉讼,且出借人胜诉,可收回欠款,损失会减少甚至完全避免

Credit loss

- Credit losses can arise in the form of timing.

- Credit risk can be coupled with political risk.

- The longer the term of a contract, the riskier that contract is.

Transactions and entities

Who is exposed to credit risk?

- Financial Institutions

- Banks:

Extend credit

Asset-based lending (repurchase agreements; securities lending)

Derivative counterparty exposure - Asset Managers: face credit risk exposures on behalf of their clients

- Hedge Funds: may purchase distressed loans, sell protection against a decline in a borrower's creditworthiness, or assume the riskiest positions in commercial real estate financing

Unique: hedge funds also view the possibility of an entity defaulting as an opportunity to deploy capital 如通过CDS和short selling - Insurance Companies: underwriting activities, the investment portfolio, and reinsurance recoverables.承保活动、投资组合和再保险可收回款项

- Pension Funds: a significant portion of these funds is invested in credit risky assets.

- Banks:

- Corporates:

- From customer: The bankruptcy of a customer creates negative publicity and can have a negative effect

- Account receivables: corporates have effectively extended short-term credit to their customers.

- Significant amounts of cash to invest

- Derivative trading activities

- From supply chain: manufacturing companies and service companies like retailers are dependent on their suppliers

Why manage credit risk?

- Survival: It's a concern primarily for financial institutions for which large losses can lead to bankruptcy, but even a nonfinancial corporation can have credit losses that can cause bankruptcy.

- Profitability: the less money one loses the more money one makes.

- Return on equity: The key to long-term survival is a sufficiently high amount of equity capital complemented by prudent risk management.

Governance

The bankruptcy of a company

- Serious problems that lead to bankruptcy occur when portfolios of toxic transactions are built. In the absence of fraud, what allows this to occur is a poor risk management framework and corporate governance failure.在没有欺诈的情况下,导致这种情况发生的原因是风险管理框架不完善和公司治理失效

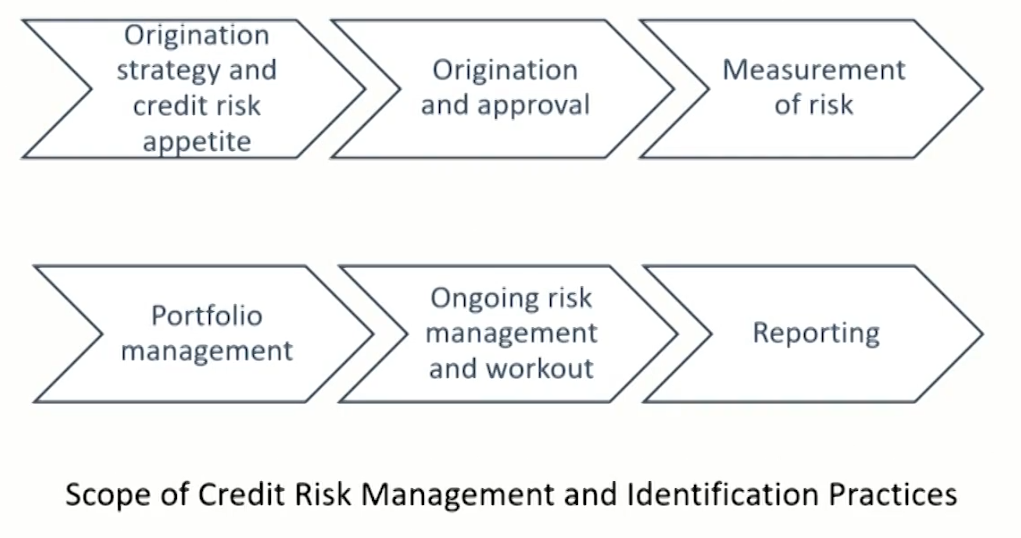

The processes that lead to risk taking

- The best way to avoid losses is to not enter into bad transactions to start with.避免损失的最佳方法是一开始就 不要进行不良交易

- The processes that lead to risk taking:

- Primarily origination 发起

- Credit risk assessment信用风险评估

- Approval processes审批流程

The Three Lines of Defense 三道防线

- First line: business owners, who primarily own and manage risk

- Second line: monitors and oversees risk performed by enterprise risk management, compliance, and legal. They establish policies and procedures and serve as management oversight for the first line.

- Third line: provides independent assurance of the risk management and risk monitoring provided by first and second lines of defense: internal audit, external auditors, and special audit committees.

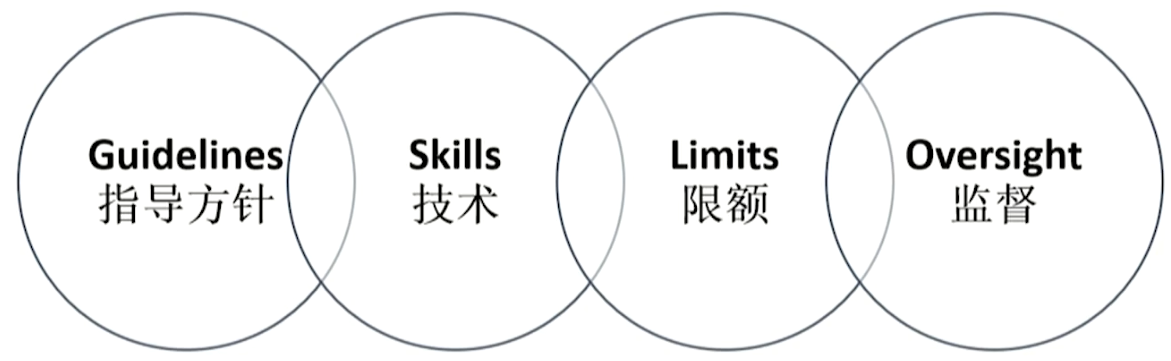

Four key principles for governance system

Guidelines

- Guidelines: are a set of documents that explain the rules that must be complied with before a transaction is concluded. 有时也被称为"credit policies," "risk management standards,"或采用其他的叫法

- Understandable 易于理解

- Concise 简明扼要

- Precise 准确

- Accessible 易于获取

- Creation and approval process 创建和审批流程

- Guidelines must be sponsored by a senior executive such as the chief risk officer or the chief financial officer and the approval of guidelines must be done by the Board of Directors.

- Promulgating and maintaining guidelines 颁布和维护准则

- The chief risk officer's office will own the guidelines, and it is this department's responsibility to draft, seek approval for, promulgate, and maintain the guidelines.

- Content of guidelines

- Purpose of the guidelines 目的

- Methodology for defining a transaction's key parameters确定交易参数的方法

- Transaction approval and delegation of authority 交易的审批和授权

- Process to deal with new products and new markets

- Process to review and update the guidelines

- Consequences_of failure to follow guidelines不遵守的后果

- Breach of guidelines: a breach is a serious act, and in most financial firms, it leads to immediate termination of employment.违反准则会导致立即解聘

Skill

- The authority granted by the Board of Directors to the executive management of a firm has to be delegated further.

- The delegation of authority 权力下放

- The assignment of fundamental parameters that characterize, from a risk management point of view, each and every transaction.从风险管理的角度,确定每笔交易的基本参数

- The delegation of the approval authority based on these parameters. 根据这些参数下放审批权

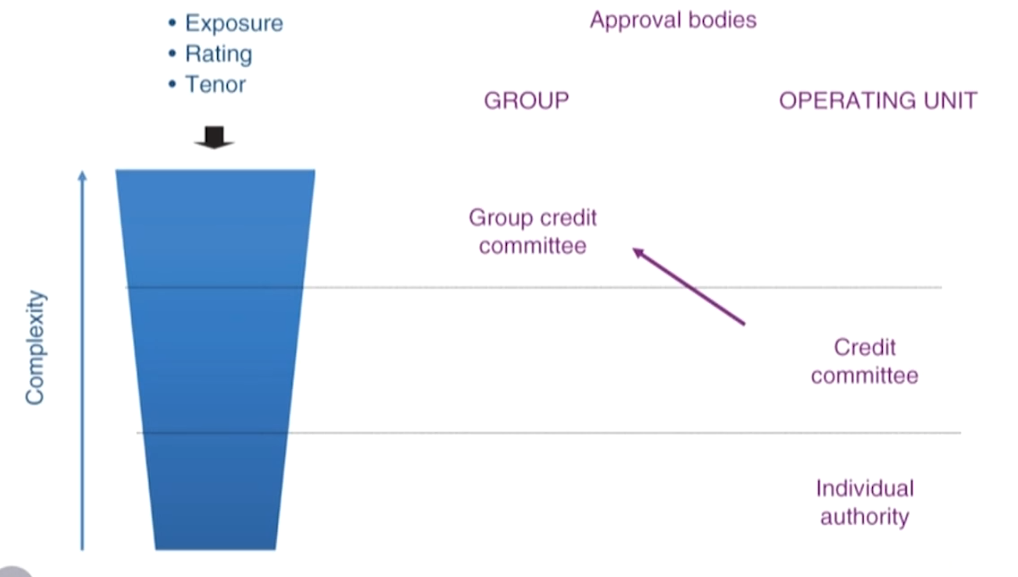

- Defining risk parameters of a credit-sensitive transaction

- Amount of exposure 敞口

- Credit quality 信用质量

- Tenor期限

- Delegation of authority: the simple rule is that the riskier the transaction, the higher the approval level must be.

- Transactions with a high exposure or a low credit quality or a long tenor大额低质量长期限:necessitate senior-management attention and must be approved by committees staffed with people.

- High-quality counterparty: can be approved at a lower level

- Simple and straightforward transactions: single individual

- Delegation of authority

- Credit committees信贷委员会: the highest level of approval is often called the credit committee and is staffed with the firm's most senior executives

- Authority delegation is cumulative, meaning each delegation level must approve the transaction.这种授权是累积性的,即每一级授权都必须批准交易

- A transaction cannot go directly from the originator directly to the credit committee without first being endorsed by the intervening levels.一项交易如果没有经过中间层级的批准,就不能从发起人直接转到信贷委员会

Limits

- Limits: represent the absolute dollar (or other currency) amount of risk that a company wants to take, or, in other words, the maximum loss that a company is prepared to withstand.

- Are frequently called credit lines. 信用额度

- Can be attached to counterparties, industries, countries

- The existence and size of the credit lines are actually a frequent source of tension between front offices and risk management teams.

Oversight

- Independence: there must not be any compromise affecting the independence of the risk management unit.风控独立性

- It should never be located within a business unit with a profit center.

- A risk manager's compensation should never be based on the profitability of the business.

- CRO reports directly to the chief executive officer and has privileged access to the risk committee and or the audit committee of the Board of Directors

- Qualifications: getting the respect of the business partner is a goal of risk managers.

- Proximity to the business unit 靠近业务部门: risk managers must be located organizationally and physically near operations since they need to have a full understanding of the underlying business.

- Open mind开放的心态: the art of risk management is not to refuse transactions, but to make suggestions that enable their acceptance.

Credit risk modeling and analysis

Introduction to Credit Risk Modeling and Assessment

Development

- Credit risk management has changed dramatically over the past couple of decades, and it still evolves at all levels.

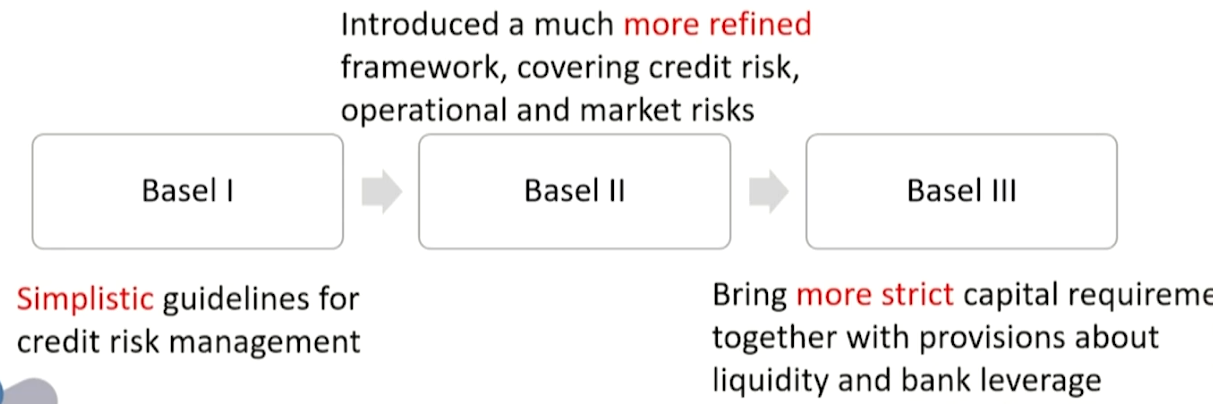

- The first major development: regulatory framework: Capital adequacy ratio(CAR)

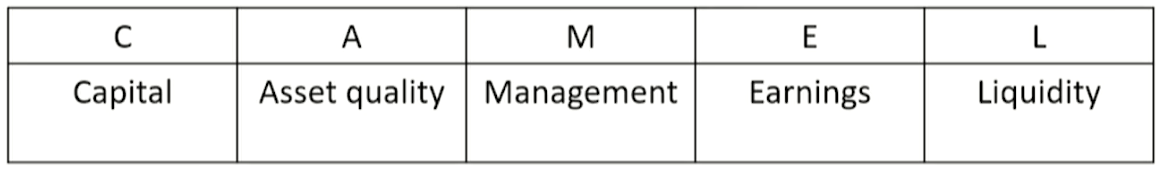

- The second major development: the widespread use of analytical methods for credit risk modeling and management: CAMEL

- Regulatory framework

- Credit risk is a highly regulated topic in financial services, with a very broad set of rules and requirements imposed on the design, implementation, and monitoring of credit risk management practices.

- Capital adequacy ratio(CAR)

Higher capital adequacy standards(CAR>10.5%).

Leverage and liquidity requirements are also imposed

Emphasis on counterparty credit risk.

Introduces a new framework to achieve better governance and more effective risk management

- Credit risk is a highly regulated topic in financial services, with a very broad set of rules and requirements imposed on the design, implementation, and monitoring of credit risk management practices.

- Analytical methods

- CAMEL(骆驼评级法): has been the most widely used system for credit risk modeling.

- Empirical systems cannot provide a solid and objective basis for credit risk management.

- CAMEL(骆驼评级法): has been the most widely used system for credit risk modeling.

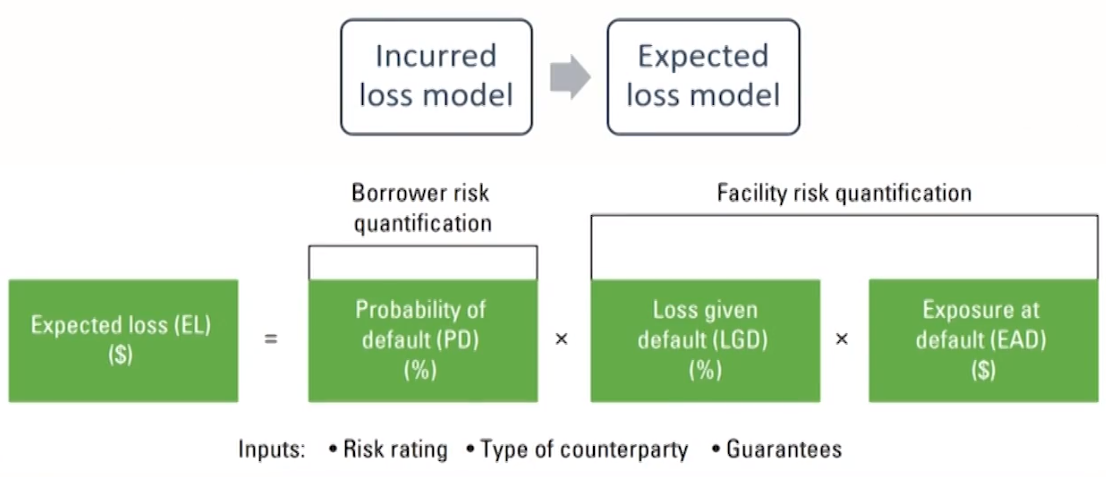

Quantitative measurement

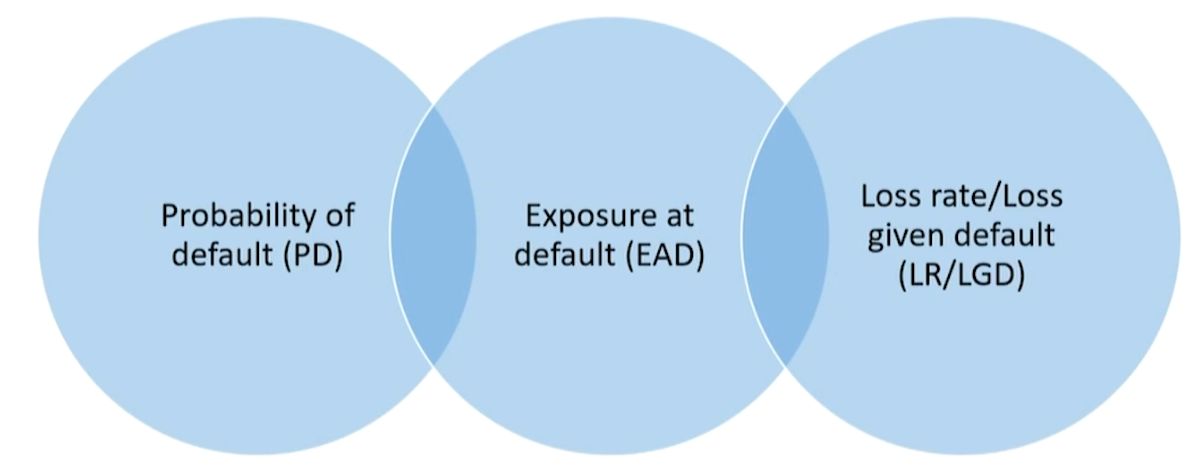

- Expected loss (EL): the amount a bank can expect to lose over a given period of time as a result of credit events.

- Usually set to be one year: EL = PD × EAD × LGD

- Probability of default(PD): represents the likelihood that the obligor will not meet scheduled loan payments during the period of the analysis (i.e., the likelihood of default).

A payment delay by at least 90 days - Exposure at default(EAD): is the risk exposure at the time of default (i.e., the amount of capital that is due to be repaid).

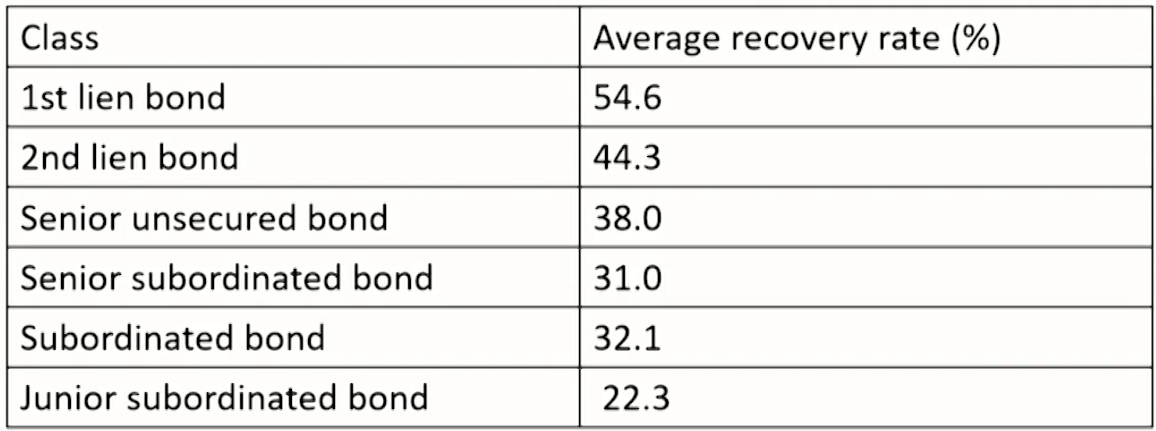

Depends on the characteristics of the loan, rather than the obligor. - Loss given default(LGD): is the loss in the case default occurs.(Recovery rate = 1-LGD)

Characteristics of the obligor: the size of the firm, its business sector, and its financial status

Characteristics of the loan: collateral and loan seniority(抵质押物和清偿顺序)

The macroeconomic environment

Types of Credit Risk Assessment Approaches

- Judgmental approaches(判断法)

- Data-drivenempirical models(数据驱动的经验模型)

- Financial models(金融模型)

- Structural models(结构化模型)

- Reduced form models(简约模型)

Judgmental approaches

- Judgmental approaches: are based solely on the expert judgment of credit analysts of the fundamental qualitative and quantitative characteristics of the borrower

- Also referred to as qualitative approaches or expert systems 专家系统

- Considering a broad range of qualitative and quantitative factors

- 5C analysis

- Character: the personality of the borrower.

- Capacity: the ability of the borrower to repay the loan,based on the existing income, expenses, and other debt obligations

- Capital: the own capital of the borrower that is at risk

- Collateral: the guarantees provided about the payment of the obligation

- Conditions: general conditions that describe the status of the business environment and the characteristics of the loan (e.g., The interest rate).

- Limitations

- Assess the quality of the obtained results (validation)

- Update the structure of the evaluation process and the actual results to changes in the decision environment and the available information

- Examine scenarios that may affect the creditworthiness of a single borrower or the risk of a whole credit portfolio.

Data-driven empirical models

- Data-driven empirical models: are based of models constructed based on historical data about loans accepted,rejected, paid as agreed, and cases in default.

- Are applicable to both corporate and consumer loans

- Are constructed to identify non-trivial patterns from the data, thus leading to the formulation of explicit relationships between the likelihood of default and the input variables/risk factors. 构建经验模型来从数据中识别出模式,找到违约和输入变量/风险因子的关系

- Limitations

- Reliance on historical data for predictive modeling. 依赖历史数据

- Data used in empirical models are often considered as backward-looking and static. 实证模型中使用的数据通常被认为是后视的和静态的

- Fail to incorporate the most recent facts about the status of theborrower.经验模型中考虑的信息并不是实时更新的

Financial Models

- Financial models: are mostly based on theory.

- A normative approach, which is founded on basic economic and financial principles that underlie the financial world.大多以理论为基础

- Describe the mechanism of the default process.

- Structural model: assumes that default is an endogenous process(内生过程) that is linked to a firm's structural characteristics, such as the value of its assets and debt.

- Reduced form models: adopt a different approach assuming the default is a random event that may happen at any time driven by shift in an exogenous random variable(外生随机变量) (usually a Poisson jump process).

Credit Rating

Credit scoring system to the credit rating system

- Data-driven approaches - credit scoring and credit rating: quantify the level of credit risk for a borrower (obligor), taking into consideration all the available information that is related to the borrower's ability and willingness to repay a debt obligation based on the agreed terms

- Credit scoring(信用打分): models and systems that provide a numerical credit score for each borrower.The credit score is an indicator of the borrower's creditworthiness and probability of default

- Automated analytical models

- Credit rating(信用评级): is a risk rating expressed on an ordinal qualitative scale.Each riskgrade/is associated to an empirically estimated PD that describes all borrowers who are assigned to that grade.

- Used for corporate loans, bond issues, and countries (e.g.,sovereign credit ratings), and often they are publicly available. 用于公司贷款、债券发行及主权评级

- Involve a combination of analytical and judgmental assessments分析和判断相结合

External ratings

- External models: are typically developed by credit rating agencies, credit bureaus, and consultancy companies, and their outputs are provided to users, including credit institutions, corporate clients, and investors.

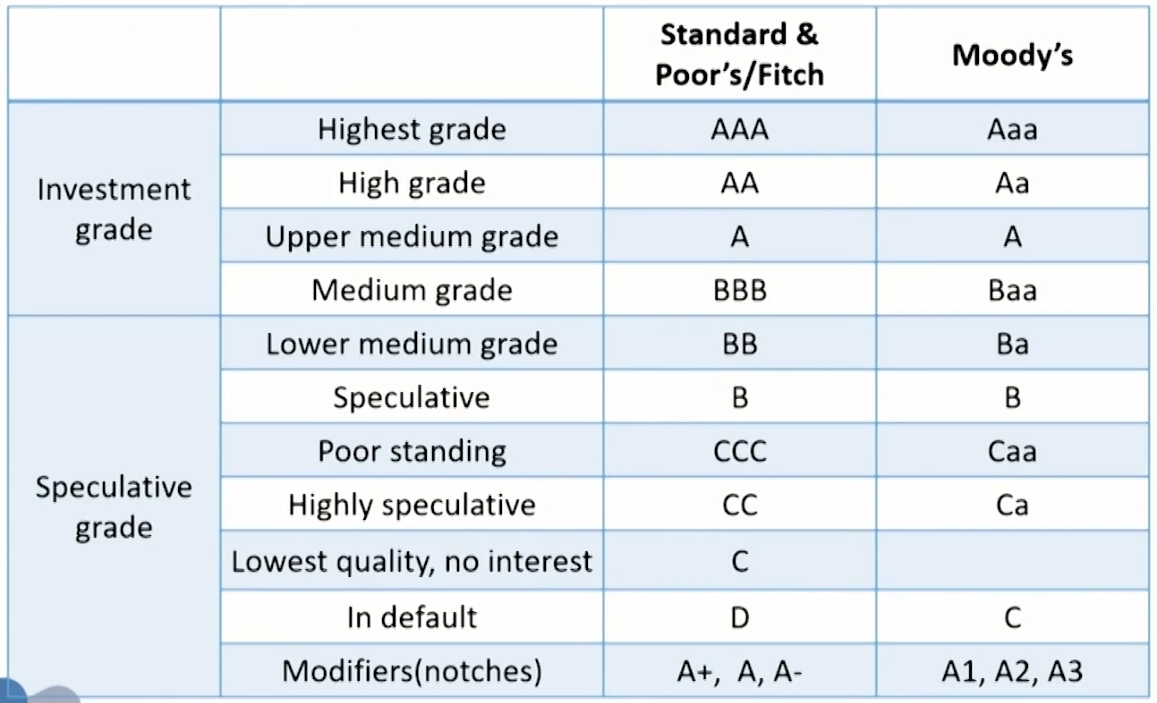

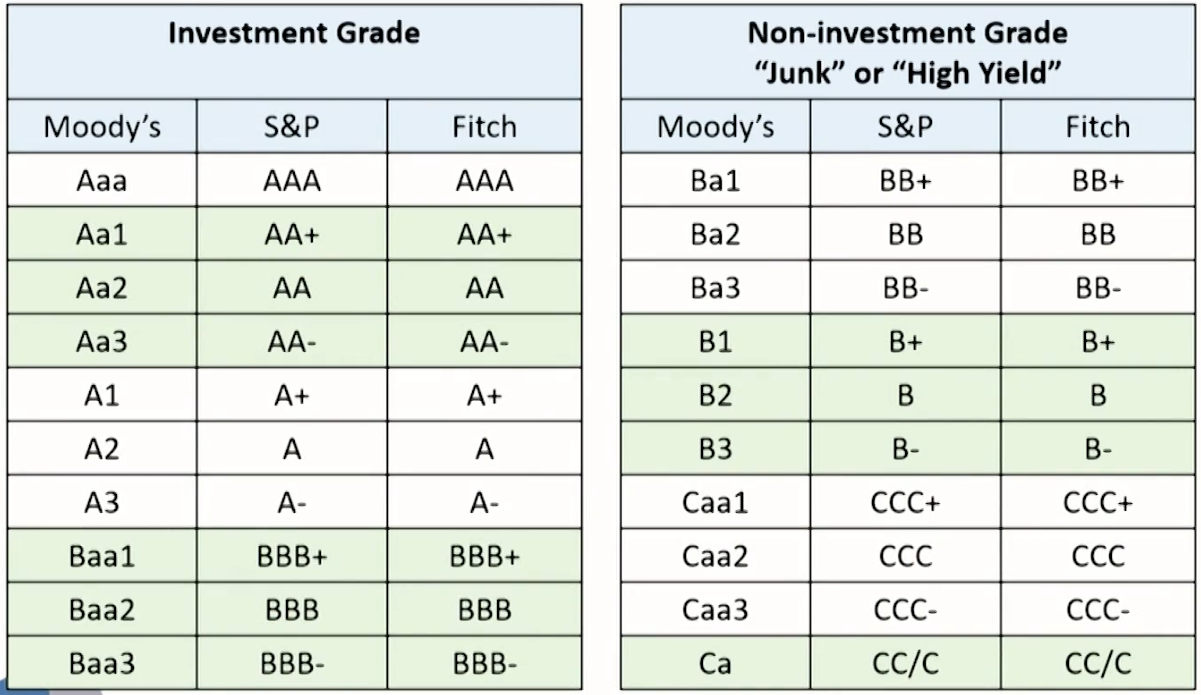

- Rating agencies such as Moody's, S&P, and Fitch provide ratings describing the creditworthiness of corporate bonds.

- Through the cycle assessments(跨周期评估法): have a long term orientation covering at least one business cycle, rather than short-term estimates.

- For major credit rating agencies

- Less frequent updates

- Point in time assessments(时点评估法): focus on the current and short-term condition of a borrower for major credit rating agencies

- More volatile

- Updated in a timely manner to reflect any new information

- The choice: mostly on the scope and requirements of the analysis取决于分析的范围和要求

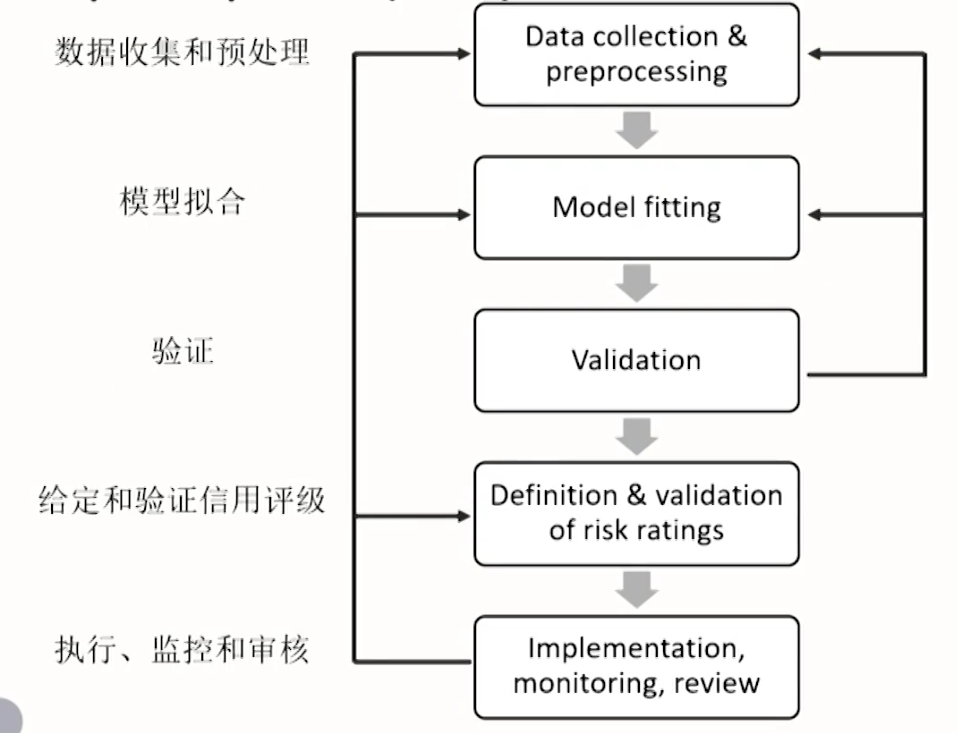

Development process

- The development: is a complex and data intensive process that requires both judgmental expertise by the analysts as well as technical sophistication.评级是一个复杂和数据密集的过程,既需要分析人员的专业判断能力,也需要精湛的技术

- Data collection and preprocessing: data for defaulted and non-defaulted cases are collected.

- Model Fitting: the identification of the model's parameters that best describe (fit) the training data.确定最能描述(拟合)训练数据的模型参数

- Validation: The model derived from the above training process should be validated against a sample different from the one used for model fitting.用训练集以外的样本验证

- Validation or holdout sample验证样本或保留样本

- Definition and Validation of Ratings: once the model is judged satisfactory through the above validation process, the derived credit scores should be mapped to risk rating classes.

- Implementation, monitoring, review:

- Used to derive real time credit risk estimates for all new loan applications

- Under frequent monitoring and review, and updates

Credit rating agencies (CRAs)

- Long-term credit ratings: medium and long-term ratings

- Short-term credit ratings: measure credit risk over a short time period (typically one year) and reflect a debtor's ability to fulfill his short-term financial obligations.

- Credit ratings issued by major CRAs combine analytical and judgmental approaches.

- Data: proprietary databases, industry/market reports,onsite meetings of expert rating analysts with executives of the rated companies(受评公司高管的现场会议)

Criticism of credit rating agencies

- Lack of transparency and accountability, conflict of interest 缺乏透明度和问责制,利益冲突

- Promoting debt explosion 债务爆炸

- Poor predictive ability 预测能力差

- Pro-cyclicality 顺周期性

Internal ratings vs. External ratings

- External ratings: a credit rating is designed to provide information about credit quality.

- Usually available only for companies that have issued publicly traded debt.

- Internal ratings: are used by credit institutions such as banks, who have access to the historical data needed for developing and calibrating the models to their specific credit portfolio.

- Focus on cash: it is cash rather than profits that is necessary to repay a loan.

Altman Z-score model

- Z-score model: using a statistical technique known as discriminant analysis(区分分析或判别分析), attempted to predict defaults from five accounting ratios:

\text{Z}=1.21x_1+1.40x_2+3.30x_3+0.6x_4+0.999x_5- {x_1}: Working capital to total assets 营运资本/总资产

- {x_2}: Retained earnings to total assets留存收益/总资产:

- {x_3}: Earnings before interest and taxes to total assets息税前利润/总资产

- {x_4}: Market value of equity to book value of total liabilities股票市值/负债账面总额

- {x_5}: Sales to total assets 销售收入/总资产

- Z-score

- Above 3: the firm was unlikely to default

- Between 2.7 and 3.0: on alert

- Below 1.8: a firm had a very high probability of defaulting.

- Model performance: proved to be fairly accurate when tested out of sample. Both Type I and Type ll errors were small.

- Variations on the model have been developed for manufacturing companies that are not publicly traded and for non-manufacturing companies.

Definitions related to probability of default

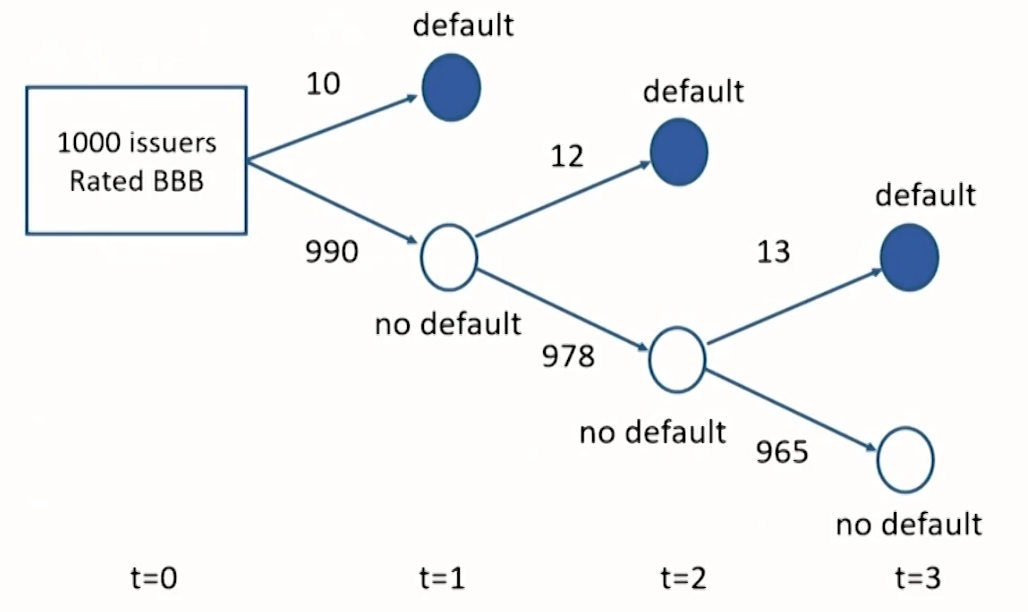

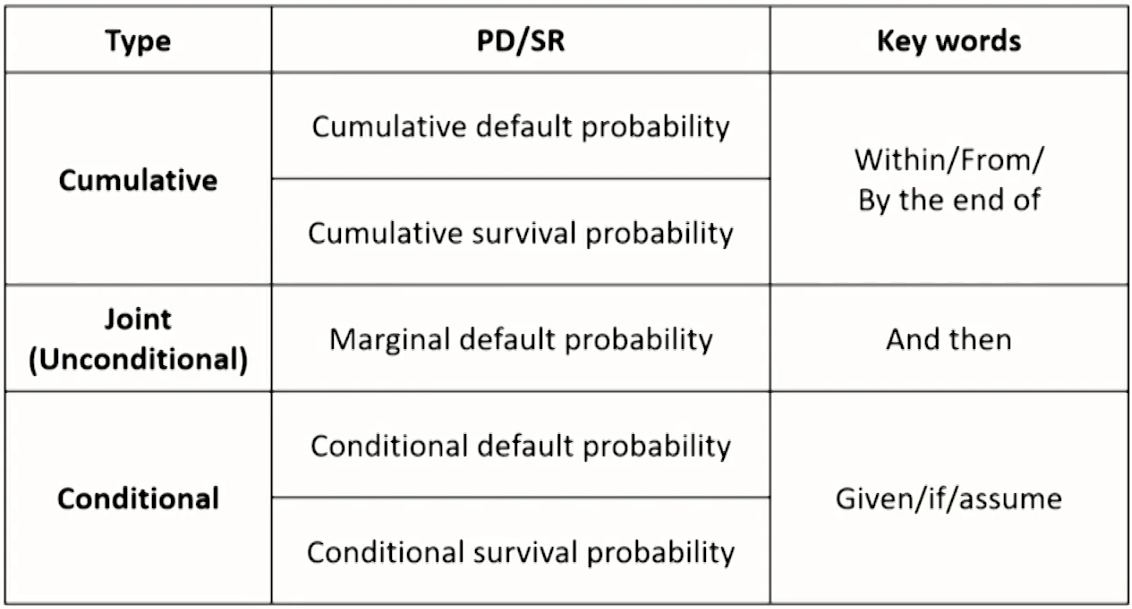

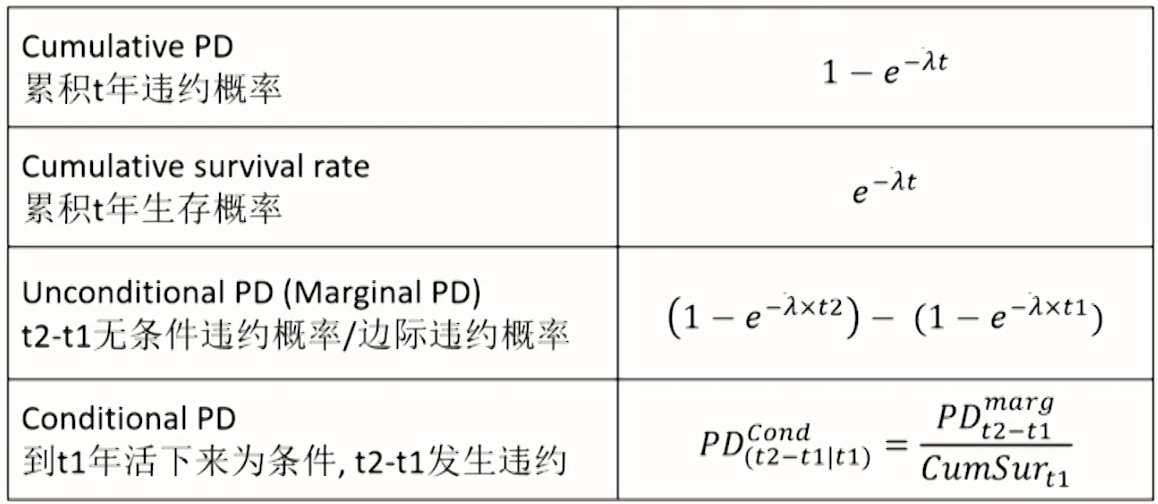

- Cumulative default probability(累积违约概率): an issuer with a certain rating will default within one year, within two years, within three years, and so on.

- Cumulative survival rate(累积生存概率) = 1 - cumulative PD

- 累积三年违约概率: \frac{10 + 12 +13}{1000}=3.5\%

- 累积三年生存概率: 1 - 3.5\% = 96.5\%

- Marginal default probability(边际违约概率,Joint PD,Unconditional default probability): the probability of a bond defaulting between time t, and t2

P D_{t2-t1}^{\text {marginal }}=P D_{t2}^{\text {cumulated }}-P D_{t1}^{\text {cumulated }}- 第二年边际违约概率:\frac{10+12}{1000}-\frac{10}{1000}=1.2\%

- 第三年边际违约概率:\frac{10+12+13}{1000}-\frac{10+12}{1000}=1.3\%

- Conditional PD(条件违约概率): is contingent to the survival rate at time t1 is defined as:

P D_{(t2-t1\mid t1)}^{\text {conditional }}=\frac{P D_{t2-t1}^{\text {marginal }}}{\text { CSR }_{t1}}- Conditional survival rate(条件生存概率)= 1 - Conditional PD

- 第三年条件违约概率: \frac{1.3\%}{97.8\%}=1.33%

- 第三年条件生存概率: 1-1.33\% = 98.67\%

- 性质

- 条件生存概率相乘等于累积生存概率

\frac{965}{1000}=\frac{990}{1000} \times \frac{978}{990} \times \frac{965}{978} - 平均每年的违约概率

\begin{aligned} &1-3.5\%=96.5\%=\left(1-d_1\right)\left(1-d_3\right)\left(1-d_3\right) \\ & =(1-\bar{d})^3\rightarrow \bar{d}=1.18\%\end{aligned}

- 条件生存概率相乘等于累积生存概率

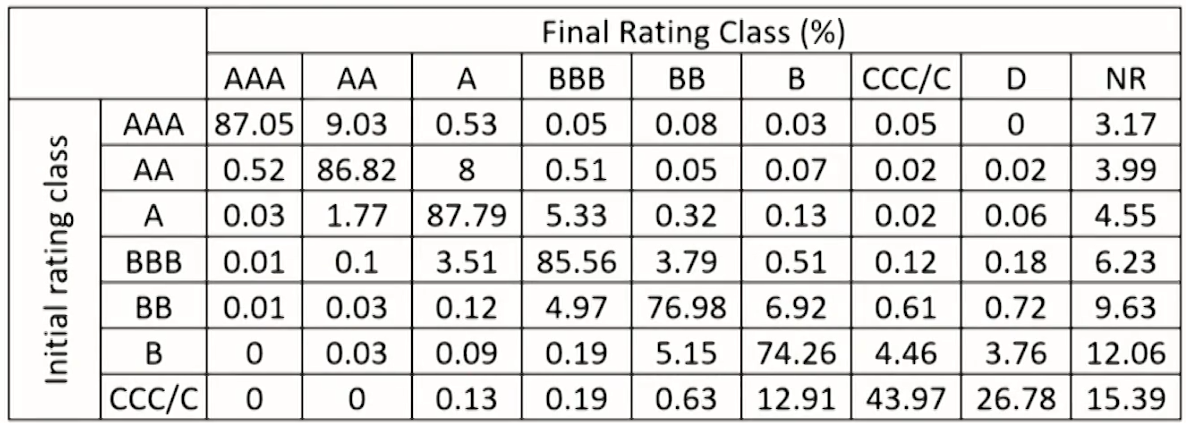

Migration matrix

- Interpretation:

- A AAA-rated firm has an 87.05% chance of staying AAA

- A BB rated firm only has a 76.98% chance of staying BB.

Recovery rate and default rate

- Priorities(清偿顺序)

- Mortgage: 2007-2008 is that the average recovery rate on mortgages is negatively related to the mortgage default rate.

- Corporate bonds: the average recovery rate on corporate bonds exhibits a similar negative dependence on default rates.

Estimating Default Probabilities from Credit Spreads

Estimate PD - Default intensity model

- Poisson Distribution is used to model number of default events over time.

{f(x)}=P(X=x)=\frac{(\bar{\lambda} t)^x e^{-\bar{\lambda} t}}{x!} - No default within T years:

P(X=0)=\frac{(\bar{\lambda} t)^0e^{-\bar{\lambda} t}}{0!}=e^{-\bar{\lambda} t}- \bar{\lambda}:Hazard rate 风险率(default intensity 违约强度)

- \bar{\lambda}:Hazard rate 风险率(default intensity 违约强度)

Using spread to estimate hazard rate

- 预期损失通过定价体现:利差等于平均违约概率乘以损失严重度

\begin{gathered} \bar{\lambda}(T) \times(1-R)=s(T) \\ \rightarrow \bar{\lambda}(T)=\frac{s(T)}{1-R} \end{gathered}- \bar{\lambda}(T): T年平均风险率

- s(T): T年利差

- R: T回收率

- T_1到T_2的\bar{\lambda}

\bar{\lambda}(T_1-T_2)=\frac{T_2\times\bar{\lambda}(T_2)-T_1\times\bar{\lambda}(T_1)}{T_2-T_1}

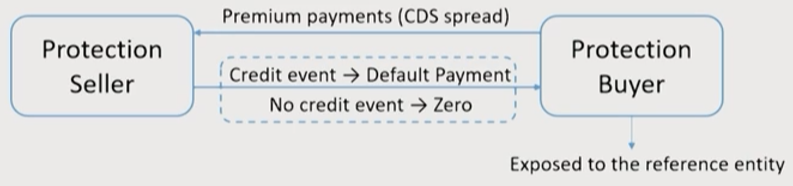

Credit spreads

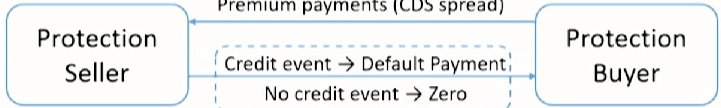

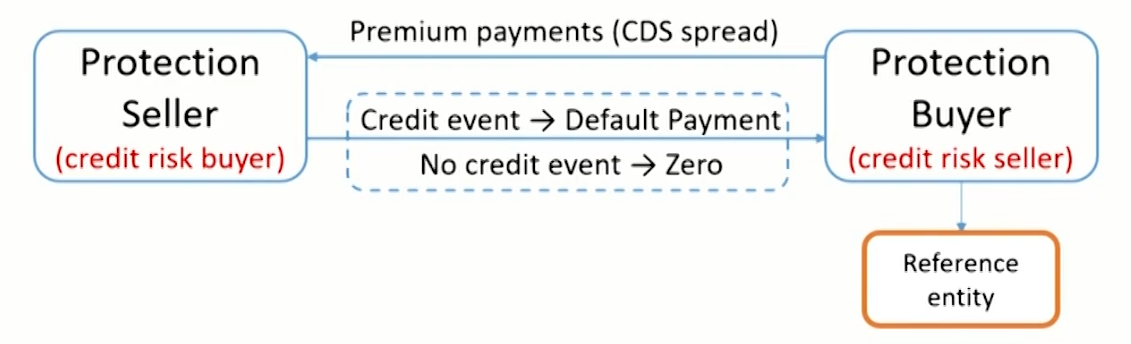

- CDS spread

- A CDS can be used to hedge a position in a corporate bond CDSs provide a direct estimate of the credit spread.

- A CDS can be used to hedge a position in a corporate bond CDSs provide a direct estimate of the credit spread.

- Bond yield spread

- A spread over a Treasury bond of similar maturity

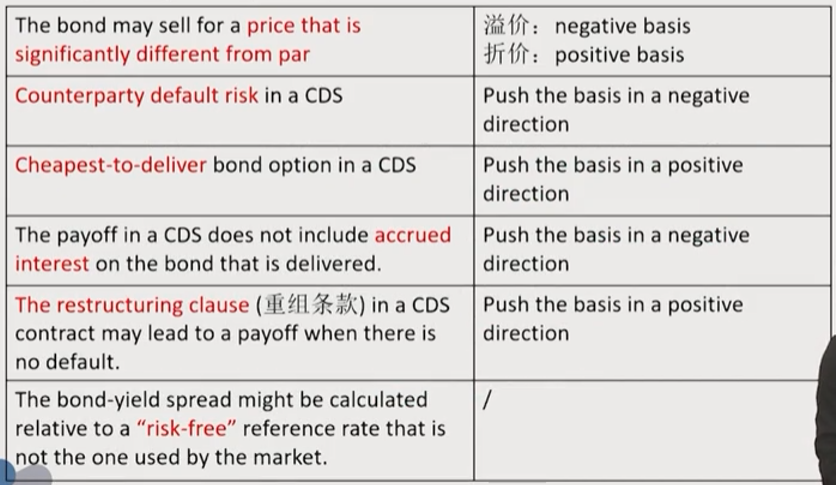

Risky bond + CDS = Risk-free bond - The CDS-bond basis: CDS spread - Bond Yield Spread, should be close to zero but actually deviates from zero

危机前: the basis tended to be positive.

危机时: the basis was at times very negative(difficult to arbitrage because of a shortage of liquidity and other considerations.)

危机后: has usually been small and negative.

- A spread over a Treasury bond of similar maturity

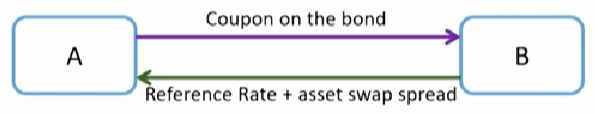

- Asset swap spread

- Asset swaps provide a convenient reference point for traders in credit markets because they give direct estimates of the excess of bond yields over a floating reference rate.

- Asset swaps provide a convenient reference point for traders in credit markets because they give direct estimates of the excess of bond yields over a floating reference rate.

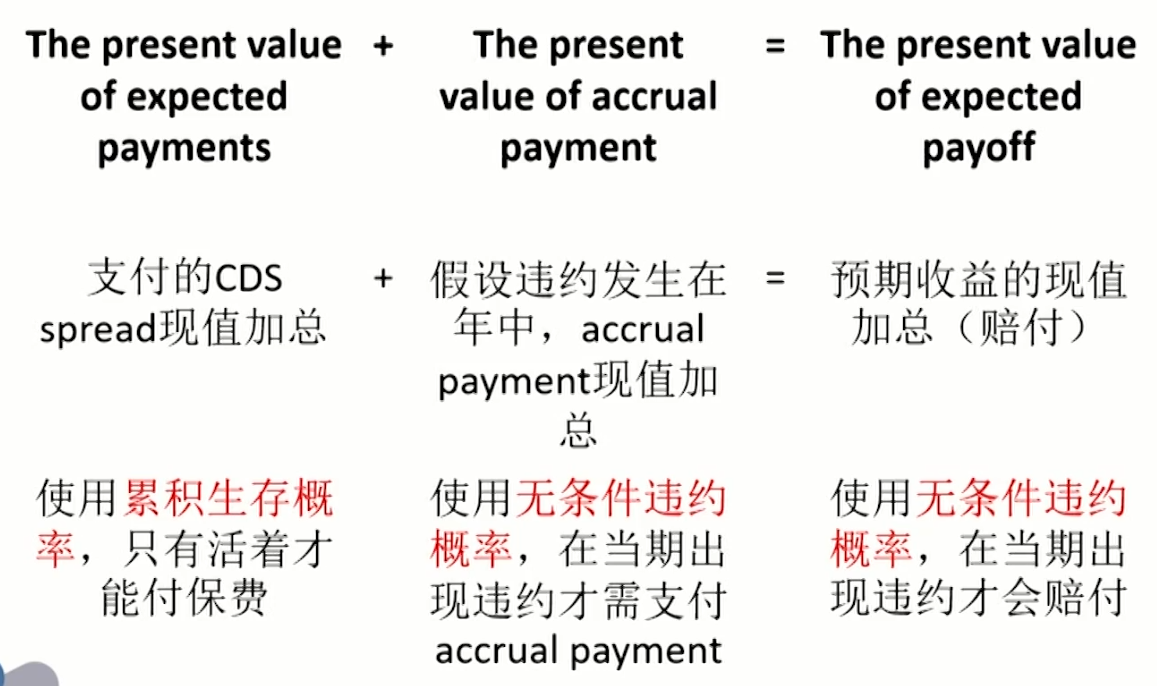

Matching bond prices

- Previous calculation works well for CDS spreads and for bond yield spreads and asset swap spreads when the underlying bond is selling for close to its par value.之前的计算方式更加适用于CDS利差,另外当债券价格趋近于面值时,收益率利差和资产互换利差也能使用.

- 为了使计算更加精确,可以选择通过违约概率使其与债券价格匹配,倒求hazard rate.

- 预期损失 = ∑损失概率×损失现值

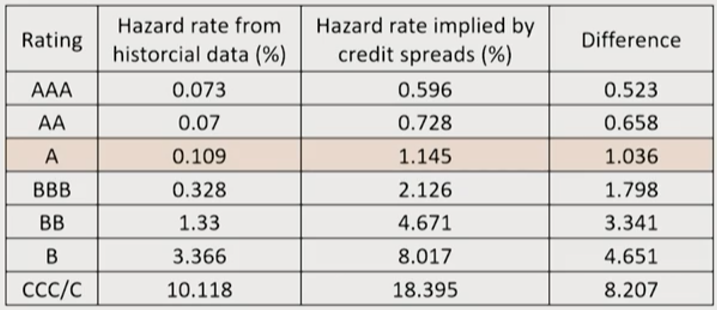

PD from historical data vs. from credit spread

- The table considers data on bond yields only up to the start of the 2008 Global Financial Crisis. During the crisis, credit spreads soared.

- Example: for an A-rated company with 40% recovery rate

- Average 7-year hazard rate from historical data:

0.76\%=1-e^{-\lambda \times7} \rightarrow \lambda=0.1090\% - Average 7-year hazard rate from credit spread

\lambda=\frac{s(T)}{1-R}=\frac{0.006868}{1-40\%} \rightarrow \lambda=1.1447\%

- Average 7-year hazard rate from historical data:

- Difference

- 利差得到的风险率更大 The hazard rates implied by credit spreads before the 2008 Global Financial Crisis are higher than those calculated from a long period of historical data.

- 随着信用质量变差,两者差距增大The difference between the two hazard rates tends to increase as credit quality declines.

- Reason for the Difference

- 债券的非流动性 Corporate bonds are relatively illiquid and the returns on bonds are higher than they would otherwise be to compensate for this.

perhaps 25 basis points of the excess return - 主观违约概率判断 Subjective default probabilities of bond traders are much higher

Bond traders may be allowing for depression scenarios much worse than anything seen in the period covered by their data. - 违约相关性 bonds do not default independently of each other

Systematic risk: bond traders earn an excess expected return for bearing this risk.

Good macroeconomic conditions decrease the probability of default for all companies; bad macroeconomic conditions increase the probability of default for all companies.

Credit contagion 信用危机传染效应 - 债券的非系统性风险 Nonsystematic(or idiosyncratic) risk: bond returns are highly skewed, with limited upside. The nonsystematic component of this risk is difficult to "diversify away.

- 债券的非流动性 Corporate bonds are relatively illiquid and the returns on bonds are higher than they would otherwise be to compensate for this.

Real-world and risk-neutral default probabilities

- Risk-neutral风险中性: for valuation it is common to make estimates in a risk-neutral world.

- The estimates from credit spreads: can be used for valuation the same way the risk-neutral estimates of other variables are used.

- Real-world真实世界: for scenario analysis it is more appropriate to use the "real-world" estimates obtained from historical data.

Estimating Default Probabilities from Equity Prices

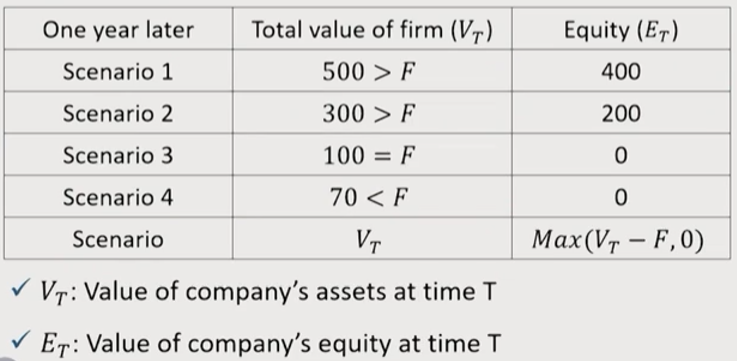

Merton model

- Merton model: is a structural model based on option pricing theory.

- Equity prices can provide more up-to-date information for estimating default probabilities.

- Assumption:

- Assume a firm with a simple debt structure, consisting of a zero-coupon bond outstanding and that the bond matures at timeT.假设一个简化的债务结构,只发行一只零息债券

- The equity of a company: is a call option on the value of the assets of the company with a strike price equal to the repayment required on the debt.

- Example: Consider a firm with total value V that has one bond due in one year with face value F = 100.

- 公司权益价值可看作是看涨期权

- 标的资产为公司价值

- 行权价格为零息债券面值(更确切为唯一现金流总值)

- Example: Consider a firm with total value V that has one bond due in one year with face value F = 100.

- BSM

- 原版BSM: c_0=S_0N\left(d_1\right)-X e^{-r T} N\left(d_2\right)

- 公司场景: E_0=V_0N\left(d_1\right)-F e^{-r T} N\left(d_2\right)

d_1=\frac{\ln \left(\frac{V_0}{F}\right)+\left(r_f+\frac{\sigma_v^2}{2}\right) T}{\sigma_v \sqrt{T}}, d_2=d_1-\sigma_v \sqrt{T}

V_0: Value of company's assets today

E_0: Value of company's equity today

F: Face value of debt (Amount of debt interest and principal due to be repaid at time T )

\sigma_v: Volatility of assets (assumed constant) - Under Merton's model, the company defaults when the option is not exercised.

The risk-neutral probabilityof default can be shown to be N(-d2). - Distant to default (DtD,DD)

d2\rightarrow D t D=\frac{\ln \left(V_0\right)-\ln (F)+\left(r_f-\frac{\sigma_v^2}{2}\right) T}{\sigma_v \sqrt{T}} \approx \frac{\ln V_0-\ln F}{\sigma_v}

Firm value and firm value volatility

- Neither V_0 nor \sigma_v, is directly observable. However, if the company is publicly traded, we can observe E_0.

- N(\mathrm{~d}1)为delta, delta=\frac{\Delta \text {期权}}{\Delta \text {标的}}

- 解联立方程组

\left\{\begin{array}{l}\sigma_E \times E_0=N\left(d_1\right) \times \sigma_v \times V_0\\E_0=V_0N\left(d_1\right)-F e^{-r T} N\left(d_2\right)\\d_1=\frac{\ln \left(\frac{V_0}{F}\right)+\left(r+\frac{\sigma_v^2}{2}\right) T}{\sigma_v \sqrt{T}}\\ d_2=d_1-\sigma_v \sqrt{T}\end{array}\right.

Merton model's Limitations

- Applicable only to liquid, publicly traded names.用于上市公 司,有可观察的活跃交易的股票价格

- Rely on a static model of the firm's capital and assume a simple debt structure.假设一个静态的资本结构以及极简单的债务端

- 从BSM继承的假设:公司价值服从对数正态分布

Risk neutral vs. real-world

- The default probabilities are higher in the risk-neutral world than in the real-world

- the expected return on assets \mu replaces r_f

- The growth rate of the company's assets is usually higher than risk-free rate (risk premium demanded by the market)

- Produce a good ranking of default probabilities.用于排序

Extension of Merton model

- 违约门槛 A default occurs whenever the value of the assets falls below a barrier level.

- 违约时间 payments on debt instruments is required at more than one time.

- Moody's KMV Expected Default Frequency model and Kamakura: provide a service that transforms a default probability produced by Merton's model into a real-world default probability.

- 使用真实数据校准The DD is mapped to a probability of default scale. PDs are calibrated(校准) to actual default data (historical data).

- 违约门槛 the sum of short-term debt and half of long-term debt

- Estimate credit spreads: other organizations have used Merton's model to estimate credit spreads

- The default probability, N(-d2), is in theory a risk-neutral default probability because it is calculated from an option pricing model.

Retail Credit Risk Management

Basel's definition of retail exposures

- Definition:

- Serves both small businesses and consumers and includes the business of accepting consumer deposits as well as the main consumer lending businesses.

- Retail exposures as homogeneous portfolios that consist of:

large number of small, low-value loans. 数量多金额少

With either a consumer or business focus. 分散

Where the incremental risk of any single exposure is small.增量风险低

- Example:

- Home mortgages: secured by the residential properties.

Loan to value ratio(LTV). - Home equity loans(Home equity line of credit,HELOC房屋净值贷款): hybrid between a consumer loan and a mortgage loan, secured by residential properties.

- Installment loans分期付款贷款: revolving loans, such as personal lines of credit that may be used repeatedly up to a specified limit.

E.g., automobile and similar loans.

Credit card revolving loans are unsecured loans. - Small business loans(SBL): are secured by the assets of the business or by the personal guarantees of the owners.

- Home mortgages: secured by the residential properties.

Retail credit risk vs. Corporate credit risk

- Retail credit risk

- Default by a single customer is never expensive enough to threaten a bank.

- Expected loss can be treated like other costs of doing business and can be built into the price charged.通过提高价格应对风险

- Corporate credit risk

- Large exposures to single name; concentrations of exposures.

- Dominated by the risk that credit losses will rise to some unexpected level.

Dark side of retail credit risk

- Four prime causes

- Not all innovative retail credit products can be associated with enough historical loss data to make risk assessments reliable.历史数据少

- Even well-understood retail credit products might behave in unexpected fashion under change economic environment.经济环境变化可能会有意外的表现

- The tendency of consumers to default is a product of a complex social and legal system that continually changes.客户违约的复杂性

- Operational issue affects the credit assessment of customers can have a systematic effect on the whole consumer portfolio.贷款评估中的实操问题

- Measures to avoid

- Warning signal: a change in customer behavior.

Alter the amount of money it lends to existing customers.

Alter marketing strategies and customer acceptance rules.

Price in the risk by raising interest rates for certain customers.

- Warning signal: a change in customer behavior.

From default risk to customer value

- Trade-off between creditworthiness and profitability

- Often a trade-off to be made between the creditworthiness of customers and their profitability.

- There's not much point in issuing costly credit cards to creditworthy customers who never use them.

- Customers who are marginally more likely to default might still be more profitable than customers with higher scores.

- Customer relationship cycle

- Marketing initiatives: targeting new and existing customers for a new product

- Screening applicants: decide which applications to accept or reject on the basis of scorecards.

- Managing the account: dynamic process involves a series of decisions based on observed past behavior and activity.

- Cross-selling: induce existing customers to buy additional retail products.

- Risk based pricing基于风险的定价

- Idea that customers with different risk profiles should pay different amounts for the same product.

- Tiered pricing policy that sets price as an increasing function of riskier score bands can make risk-based pricing more effective.

- Pricing is a key tool for retail bankers as they balance the goal of increasing market share against the goal of reducing the rate of bad accounts.

Definition of credit score

- Credit scoring model: use a statistical procedure to convert information about a credit applicant into numbers that are then combined to form a score.

- The higher the score, the lower the risk

- Allows banks to avoid the riskiest customers.

- Assess whether certain kinds of businesses are likely to be profitable by comparing the profit margin.

- Also important for reasons of cost and consistency.

Types of credit score model

- Credit bureau scores信用局评分

- known as Flco scores, developed by Fair Isaac Corporation.

- Can be tailored to the preferences of a financial institution.

- Range from 300 to 850.

- Pooled models

- Using data collected from a wide range of lenders with similar credit portfolios.

- Tailored to industry but not company specific.

- Custom models

- Developed in-house using data collected from the lender's own unique population of credit applications.

- Tailored to screen for a specific applicant profile for a specific lender's product.

- A strong competitive edge in selecting the best customers and offering the best risk-adjusted pricing.

- Cost: Credit bureau scores < Pooled Models < Custom models.

Key variables in mortgage credit assessment

- Risk Score = f(Doc Type, Transaction Type, FICO, LTV,DTI,Occup Type, Prop Type, Pmt,Economic Cycle)

- FICO: Number score of the default risk.

- DTI: Debt-to-income ratio.

- LTV: the Loan-to-value ratio.

- Payment type (Pmt): e.g., adjustable rate mortgage.

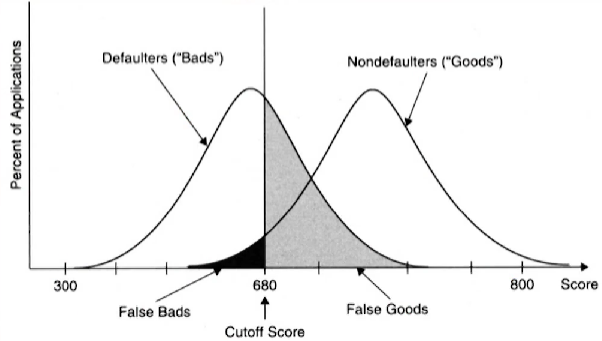

From cutoff scores to default rates and loss rates

- Cutoff scores 临界值

- Not to generate an absolute measure of default probability but to choose an appropriate cutoff score.

- Not to generate an absolute measure of default probability but to choose an appropriate cutoff score.

- Cutoff scores: set the minimum acceptable score at 680 points.

- Avoid lending money to the body of bad customers to the left of the vertical line but would forgo the smaller body of good accounts to the left of the line.

- Moving the minimum score line to the right will cut off an even higher fraction of bad accounts but forgo a larger fraction of good accounts.

- Default Rate and Loss Rate (Expected loss)

- Each score band corresponding to a risk level.

- The bank can estimate the loss rate using historical data.

Given an estimate of the LGD, the bank can infer the implied PD.

Measuring the performance of scorecard

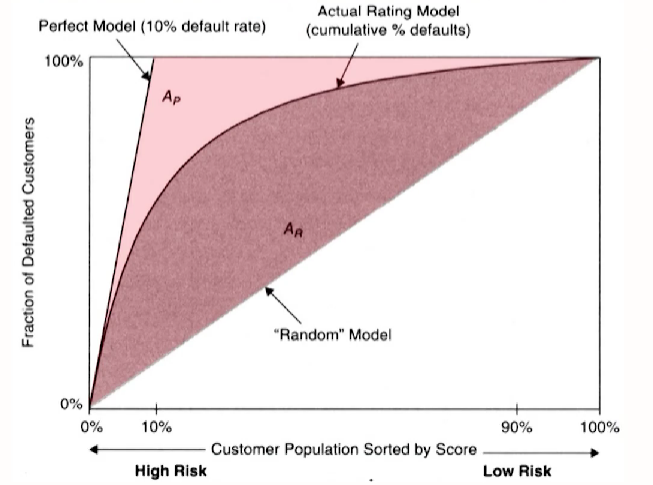

- Cumulative accuracy profile(CAP)累积准确曲线

- Goal: differentiate between the two by assigning high scores to good credits and low scores to poor ones.

Minimize the overlapping area of the distribution of the good and band credits

- Goal: differentiate between the two by assigning high scores to good credits and low scores to poor ones.

- On the horizontal axis are the population sorted by score from the highest risk score to the lowest risk score.

3 On the vertical axis are the actual defaults in percentage terms taken from the bank's records.

- The area under the perfect model is denoted Ap, while the area under the actual rating model is denoted Ar, AR (Accuracy ratio) = Ar/Ap

- The closer this ratio is to 1, the more accurate is the model

- The 45-degree line corresponds to a random model that cannot differentiate between good and bad customers.

- Monitor the score model

- Characteristics of the underlying population change overtime.

- Bank has changed the nature of the products.

Country Risk

Life cycle

- Risk exposure: A country that is still in the early stages of economic growth will generally have more risk exposure than a mature country, even it is well governed and has a solid legal system.一个国家处于早期发展阶段,会有更多的风险敞口暴露

- Recession and recovery:

- Mature markets:经济情况好3-4% GDP growth rate,经济 情况差1-2% drop

- Emerging markets: double-digit growth in positive or negative terms

- Equity markets: emerging market equity will often show much greater reactions.

Economic structure

- Dependency 依赖性: some countries are dependent upon a specific commodity, product or service for their economic success.

- That dependence can create additional risk for investors and businesses, since a drop in the commodity's price or demand for the product/service can create severe economic pain that spreads well beyond the companies immediately affected.

- Why don't countries that derive a disproportionate amount of their economy from a single source diversify their economies?为何不改变对于单一资源的依赖?

- 大国小国: it is feasible for larger countries to broaden their economic bases, it is much more difficult for smal countries to do the same.

- 自然资源带来的财富:the wealth that can be created by exploiting the natural resource will usually be far greater than using the resources elsewhere in the economy.

Political risk

- Continuous versus discontinuous risk:

- Authoritarian governments: dictatorships create more discontinuous risk.

The change may happen infrequently

It is difficult to protect against - Democratic governments: the chaos of democracy does create more continuous risk(policies that change as governments shift)

- Authoritarian governments: dictatorships create more discontinuous risk.

- Corruption and side cost: If those who enforce the rules are capricious(变化莫测的), inefficient or corrupt in their judgments, there is a cost imposed on all who operate under the system.

- Corruption is an implicit tax on income: reduces the profitability and returns

- Physigal violence: Countries that are in the midst of physical conflicts, either internal or external, will expose investors/businesses to the risks of these conflicts.

- Not only economic: taking the form of higher costs for buying insurance or protecting business interests

- Physical: with employees and managers of businesses facing harm).

- Nationalization/Expropriation risk

- Expropriation risk征收风险: arbitrary and specific taxes imposed

- Nationalization risk国有化风险: business can be nationalized

- Natural resource companies are more exposed to nationalization risk than others

Legal risk

- 财产权和合同权是否获得保护Whether it pays heed to property and contract rights

- Also affect potential investor

- 法律系统的有效性 How efficiently the system operates.

Composite risk measure

- Political Risk Services (PRS): uses 22 measures of political,financial, and economic risk to calculate its index.

- Euromoney: bases its scores on a survey of 400 economists

- The Economist: develops country risk scores internally based on currency risk, sovereign debt risk, and banking risk.

- The World Bank: provides country risk data measuring corruption, government effectiveness, political stability,regulatory quality, the rule of law, and accountability.

- Limitation:

- Measurement models/methods: not business entities. the scores in some of these services are more directed at policy makers and macroeconomists than businesses. 某些打分更适合给政策制定者和宏观经济学家使用,并不是针对商业决策范畴

- No standardization: each service uses its own protocol.

- More rankings than scores

Sovereign debt

- Foreign currency defaults:

- A large proportion of sovereign defaults have occurred with foreign currency defaults

Cannot repay the debt by simply printing more money

Short of the foreign currency to meet its obligation - Countries have been more likely to default on bank debt owed than on sovereign bonds issued.

Bank loans were the only recourse available to governments that wanted to borrow prior to the 1960s 上个世纪60年代前,银行贷款是政府借贷的唯一途径 - In dollar value terms, Latin American countries have accounted for the biggest portion of sovereign defaulted debt in the last 50 years.

- A large proportion of sovereign defaults have occurred with foreign currency defaults

- Local currency defaults: countries have shifted more towards defaults, under domestic law, rather than foreign law, in recent decades, reflecting both the willingness to default on local currency debt and the speedier restructurings that follow domestic-law defaults.反映了本币债务违约的意愿,也反映了国内法违约后的重组速度更快.

- Gold standard 金本位: was a system prior to 1971 in which a country's currency was converted into fixed amounts of gold so that there was a limit on how much currency could be printed.

- Shared currency共同货币: such as Eurozone.

- Trade-off 权衡: printing more currency will debase and devalue the currency and cause inflation to increase exponentially - can cause the real economy to shrink.

The consequences of a country's default

- Reputation loss 声誉损失:tagged with the "deadbeat" label

- Capital Market turmoil 资本市场动荡:Investors withdraw from equity and bond markets

- Real Output 实际产出: has ripple effects on real investment and consumption

- Political Instability 政治不稳定: can put the leadership class at risk

- Default has a negative impact on the economy, with real GDP dropping between 0.5% and 2%

- Default does affect a country's long-term sovereign rating and borrowing costs.

- Sovereign default can cause trade retaliation.贸易报复

- Sovereign default can make banking systems more fragile. 会使银行系统更加脆弱

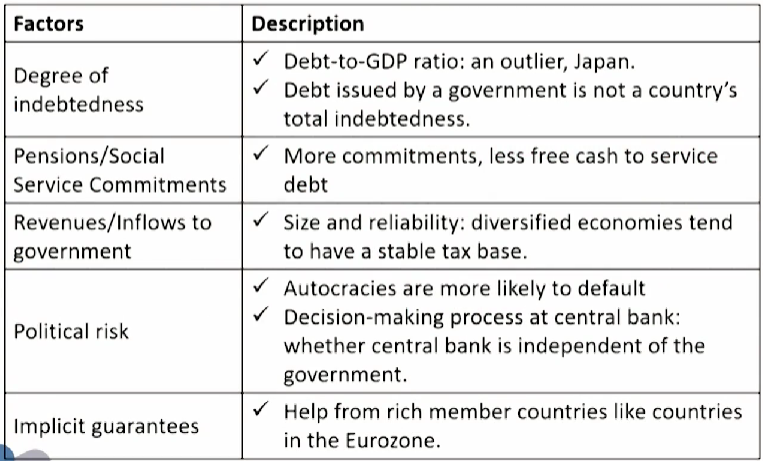

Factors determining sovereign default risk

Sovereign credit rating

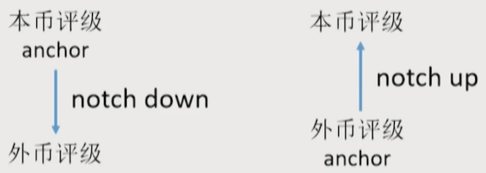

- Local currency rating: for domestic currency debt/ bonds

- Foreign currency rating: for government borrowings in a foreign currency

- Do sovereign ratings change over time?

- While one of the critiques of these ratings is that they were sticky, the rate of change has increased over the last few years.

- Rating measures评级衡量:

- 服务对象 focused on the creditworthiness of the sovereign to private creditors (bondholders and private banks) and not to official creditors (which may include the World Bank, the IMF and other entities).

- 反映内容 probability of default or also incorporates the expected severity 每个评级机构不一样

违约定义相同: outright default-failure to pay interest or principal; rescheduling, exchange or other restructuring

- Determinants of ratings评级的决定因素:Political risk,economic structure, economic growth prospects, fiscal flexibility, general government debt burden, offshore and contingent liabilities, monetary flexibility.

- Rating process: draft report → debate each analytical category and vote → decided by a vote of the committee

- Local versus foreign currency ratings:

- The differential between foreign and local currency ratings is primarily a function of monetary policy independence.

Floating rate exchange fund borrowing from deep domestic markets:本币外币评级差异大

Dollarization or monetary union:本币评级向外币靠拢

- The differential between foreign and local currency ratings is primarily a function of monetary policy independence.

Shortcomings of the sovereign rating systems

- Ratings are upward biased

- Herd behavior羊群行为:When one ratings agency lowers or raises a sovereign rating, other ratings agencies seem to follow suit.

- Too little, too late: ratings agencies take too long to change ratings

- Vicious Cycle恶性循环

- Ratings failures: changes the rating for a sovereign multiple times in a short time period

- Ratings failures

- Information problems

- Limited resources

- Revenue Bias: ratings agencies offer sovereign ratings gratis(免费的) to most users

- Other Incentive problems: other businesses, including market indices, portfolio performance evaluation and risk management services, which may be lucrative enough to influence sovereign ratings.

Sovereign default spread

- Sovereign default spread: when a government issues bonds,denominated in a foreign currency, the interest rate on the bond can be compared to a rate on a riskless investment in that currency to get a market measure of the default spread for that country.

- 外币国债收益率和此货币无风险利率相减 √E.g.:巴西发行了10年期以美元计价的国债,收益率为 6%,同期美国发行的10年期国债收益率为3.02%

- Sovereign default spread: 6% -3.02% =2.09%

- Sovereign default spread vs. sovereign ratings:

- Strong correlation: between credit spreads and

- More granular 同样评级,信用质量还是会有差别,主权违约利差给与更多信息

- The market-based spreads are more dynamic than ratings,with changes occurring in real time

- There has to be a default free security in the currency必须有发行债券的货币的无违约证券

- Adjust quickly: provide earlier signals; more volatile

- Credit default swap: The last decade has seen the evolution of the Credit Default Swap (CDS) market, where investors try to put a price on the default risk in an entity and trade at that price.

- Trigger: the market price of the bond collapses → no compensation

- Counterparty credit risk

- CDs spread vs. sovereign ratings:

- 反应新信息更快In contrast to ratings,that get updated infrequently, CDS prices should reflect adjust to reflect current information on default risk.

- CDS spreads and default risk

- Changes in CDS spreads lead changes in the sovereign bond yields and in sovereign ratings.

- Evidence is emerging that sovereign CDS spread changes are better predictors of sovereign default events than sovereign ratings

- Sovereign CDS spreads increases:(1)greater economic policy uncertainty; (2) currency depreciation

- Clustering in CDS market

- CDS spreads and default risk(limitations)

- The exposure to counterparty and liquidity risk, endemic to the CDS market, can cause changes in CDS prices that have little to do with default risk.

- The narrowness of the CDS market can make an individual CDS susceptible to illiquidity problems, with a concurrent effect on prices市场狭小,单个CDs易出现流动性不足

- There is little to indicate that it is superior to market default spreads

Credit VaR and Capital

Credit Loss Distribution

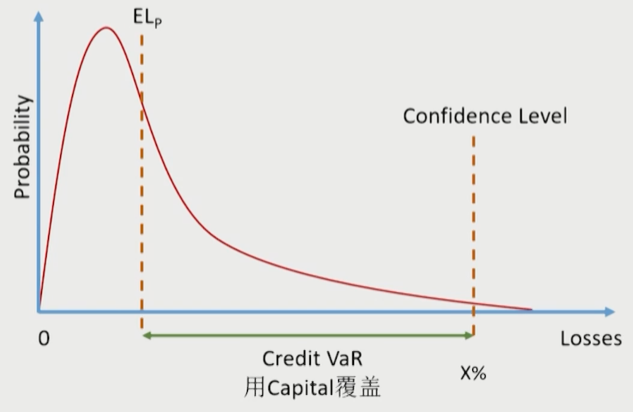

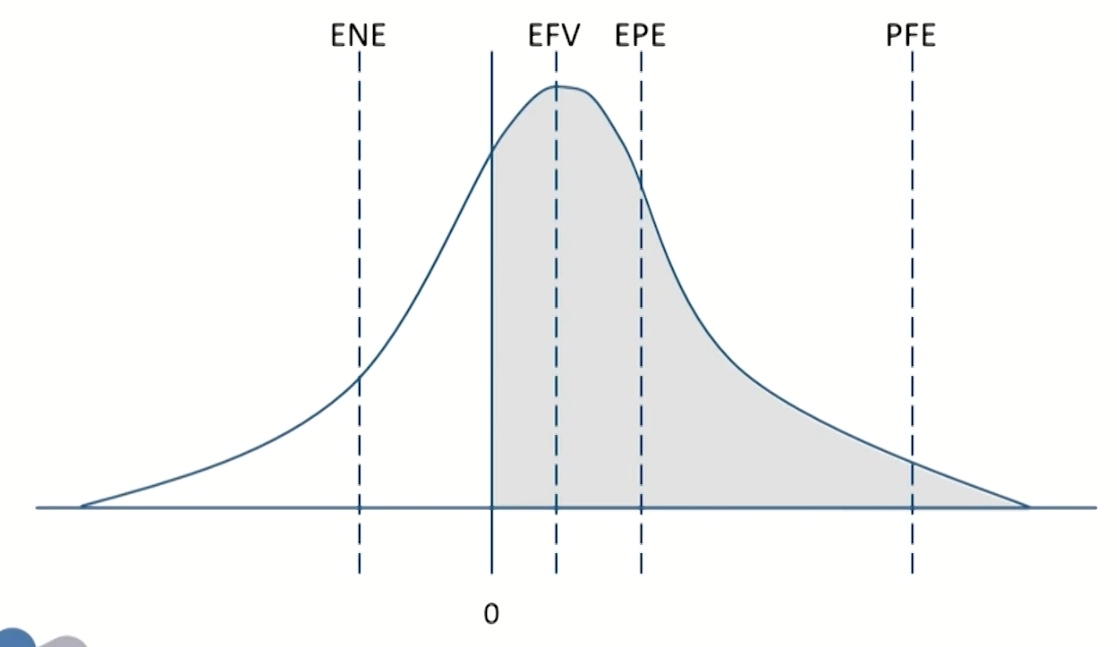

Credit loss distribution

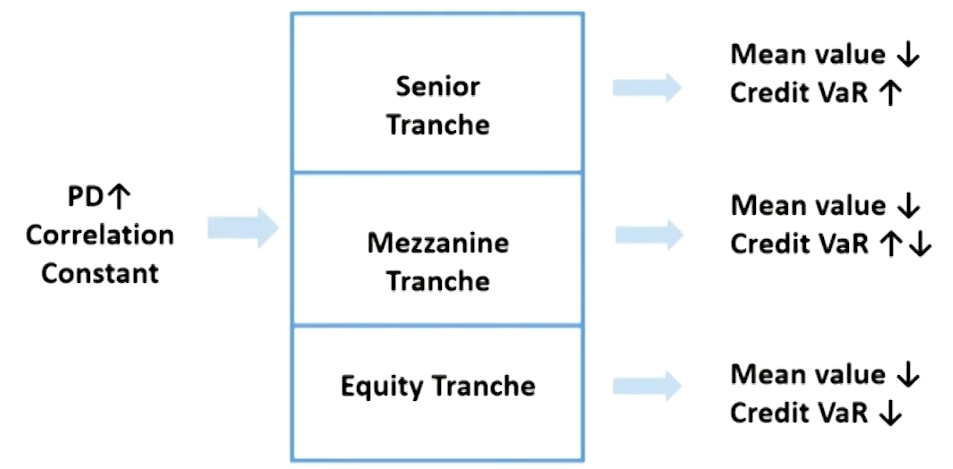

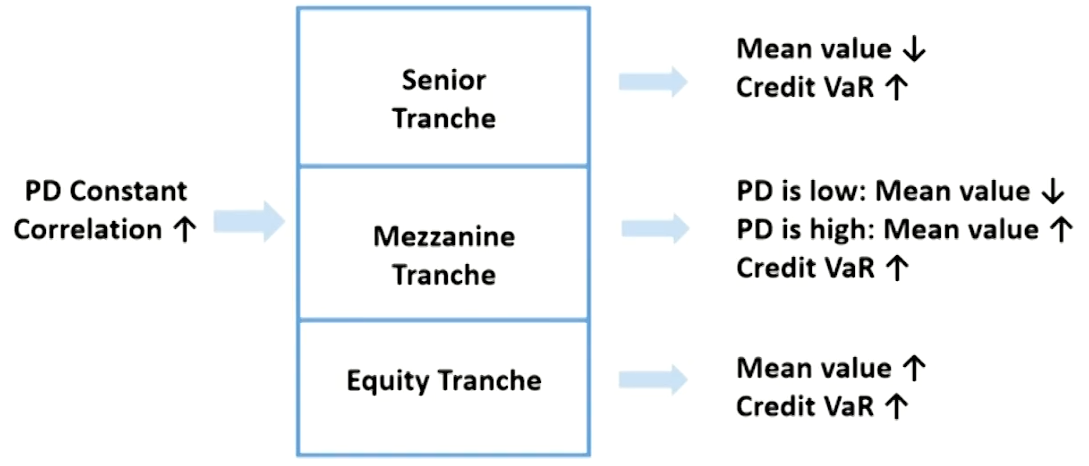

- Credit VaR: defined as the difference between the maximum loss rate at a certain confidence level and the expected loss rate, in a given time horizon.

- CreditVaR = WCL - EL

- Worst case loss(WCL): Loss at the confidence level

Expected loss(Standalone)

- Expected loss(EL): A bankcan expect to lose, on average, a certain amount of money over a predetermined period of time when extending credits to its customers.

- Default event D is a Bernoulli variable.伯努利随机变量

E L_i=P D_i \times E A D_i \times L G D_i- EAD_i: The amount borrowed in the ith loan (assumed constant throughout the year)

- {P D}_i : The probability of default for the ith loan

- LR/LGD: The loss rate in the event of default by the ith loan

Unexpected loss(Standalone)

- Unexpected loss: is the standard deviation of credit losses Risk arises from the variation in loss levels

- 注意:此处的信用非预期损失为信用损失的标准差, 和一级以及其他科目中表达的含义不同,请格外注意

- 其他科目中的unexpected loss表示资本金需要覆盖的部分

- 由于二级原版书选自不同教材, 学者的定义和命名会有所区别

- Unexpected loss (UL)

U L_i=E A D_i \times \sqrt{P D_i \times \sigma_{i, L G D}^2+L G D_i{ }^2\times \sigma_{i, P D}^2}- The default is a Bernoulli variable with a binomial distribution:

\sigma_{P D}^2=P D \times(1-P D)

- The default is a Bernoulli variable with a binomial distribution:

Portfolio EL and UL

- Portfolio EL:

E L_p=\sum_{i=1}^n E L_i=\sum_{i=1}^n E A D_i \cdot P D_i \cdot L G D_i - Portfolio UL:

U L_p=\sqrt{\sum_i \sum_j \rho_{i j} U L_i U L_j} \leq \sum_i U L_i- \rho_{i j}: correlation that default or a credit migration (in the same direction) of asset i and asset j

- A portfolio with two assets: \mathrm{UL}_{\text {two assets }}=\sqrt{U L_1^2+U L_2^2+2\rho_{12} U L_1U L_2}

- Unexpected loss contribution (ULC)非预期损失贡献:measures the marginal impact of the involvement of an individual loan on the overall credit portfolio risk.

U L C_i=\frac{U L_i \sum_j U L_j \rho_{i j}}{U L_p}- A portfolio with two assets:

\begin{aligned} & U L C_1=\frac{U L_1^2+U L_1U L_2\rho_{12}}{U L_p} \\ & U L C_2=\frac{U L_2^2+U L_1U L_2\rho_{12}}{U L_p}\end{aligned}

- A portfolio with two assets:

- The relationship between ULC, and UL;(assume that the portfolio consists of n loans that have the same characteristics and size and correlations between credits are the same)

U L C_i=\frac{U L_P}{n}=\frac{1}{n} U L_i \sqrt{n+\rho\left(n^2-n\right)}=U L_i \sqrt{\frac{1}{n}+\rho\left(1-\frac{1}{n}\right)}- For large n: U L C_i=U L_i \sqrt{\rho}

- The correlation is critical to measuring the potential portfolio loss. As the correlation increases, the bank suffers form concentrations risk.

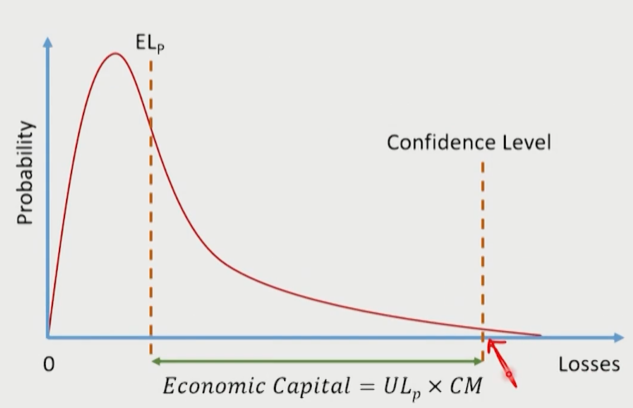

Derive economic capital for credit risk

- Economic capital is dependent on confidence level and riskiness of the bank's assets.

- A bank will typically set the confidence level to be consistent with its target credit rating. 银行内部设置的置信水平和银行的目标评级相关

Consider a bank that wants to target a very high credit rating, the bank must choose a very high confidence level (e.g.,99.97%), which corresponds to a higher capital multiplier(CM)资本乘数.

\begin{aligned} & \text { Economic Capital }_p=U L_p \times C M \\ & \text { Economic Capital }_i=U L C_i \times C M\end{aligned}

\begin{aligned} & \text { Economic Capital }_p=U L_p \times C M \\ & \text { Economic Capital }_i=U L C_i \times C M\end{aligned}

- The required economic capital at the single credit transaction level is directly proportional to its contribution to the overall portfolio credit risk.单个资产非预期损失贡献加总等于整体组合非预期损失,故单个资产的经济资本等于单个资产非预期损失贡献乘以资本乘数

- A bank will typically set the confidence level to be consistent with its target credit rating. 银行内部设置的置信水平和银行的目标评级相关

Credit loss distribution

- Credit risks are not normally distributed but highly skewed because the upward potential is limited to receiving at maximum the promised payments and only in very rare events to losing a lot of money. 信用损失分布是极度有偏的,债权类资产的收益是有上限的,但小概率下会面临损失极大的情况

- The beta distribution can be recommended.

- The tail-fitting exercise is best accomplished by combining the analytical (beta distribution) solution with a numerical procedure such as a Monte Carlo simulation.

- Taking the inverse of the beta function at the chosen confidence level, we can determine CM, the capital multiplier.给定置信水平,拟合完分布,倒求出资本乘数

Problems with the Quantification of Credit Risk

- 只考虑违约,没考虑价值变化This approach assumesthat credits are illiquid assets.

- More liquid asset: a value approach would be more suitable.

- 借款人信用质量会变 Multi-period nature of credits: the expected and unexpected changes in the credit quality of the borrowers (and their correlations).

- 只考虑信用风险All other risk components(such as market and operational risk) are separated.

Default Correlation and Credit VaR

Definition of default correlation

- Default correlation违约相关系数: measures the likelihood of having multiple defaults in a portfolio of debt issued by several obligors.

- 联合违约概率Suppose two firms whose PD over the next time horizon t are π1 and π2. There is a joint probability that both firms will default over time t equal to π12.

\rho_{12}=\frac{\pi_{12}-\pi_1 \pi_2}{\sqrt{\pi_1\left(1-\pi_1\right)} \sqrt{\pi_2\left(1-\pi_2\right)}}

- 联合违约概率Suppose two firms whose PD over the next time horizon t are π1 and π2. There is a joint probability that both firms will default over time t equal to π12.

- Drawbacks of default correlation

- Default is a relatively rare event 违约概率本就是小概率事件

Default correlation is hard to measure or estimate using historical default data. Estimated correlations vary widely for different time periods, industry groups and are often negative.

Default correlations are small in magnitude, small correlation can have a large impact. - Computationally intensive 计算量大

We require N(N -1) correlations with N credits.

- Default is a relatively rare event 违约概率本就是小概率事件

Reduced form model vs. Structural model

- Reduced form models: the hazard rates for different companies follow stochastic processes and are correlated with macroeconomic variables.

- Are mathematically attractive and reflect the tendency for economic cycles to generate default correlations. 数学形式吸引人,反应经济周期带来违约相关性的倾向

- 缺点: the range of default correlations that can be achieved is limited.即便两家公司的违约率具有完美的相关性,在段时间区间内同时违约的概率会很低

- Structural form models: similar to Merton's model.

- A company defaults if the value of its assets is below a certain level.

- Default correlation: assuming that the stochastic process followed by the assets of company A is correlated with the stochastic process followed by the assets of company B. 公司价值作为随机变量,两者的相关性

- 优点: the correlation can be made as high as desired

- 缺点:computationally quite slow

Credit VaR

- Credit VaR: Defined as the difference between the maximum loss rate at a certain confidence level and the expected loss rate, in a given time horizon.

\text{Credit VaR}=\text{WCL}-\text{EL}- Worst case loss(WCL): Loss at the confidence level

- Some credit risk VaR models consider onlylosses from defaults只考虑违约

- Others consider losses from downgrades or credit spread changes as well as from defaults考虑信用迁移

- Worst case loss(WCL): Loss at the confidence level

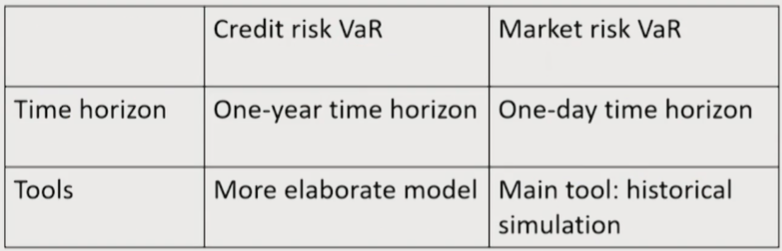

- Credit VaR vs.Market VaR

- A key aspect of any credit risk VaR model is credit correlation.Defaults for different companies do not happen independently of each other

- Default correlation: has a tremendous impact on portfolio risk, and affects volatility and extreme quantiles of loss rather than EL.主要影响损失的波动以及高分位点损失

- If default correlation in a portfolio of credits is equal to 1: then the portfolio behaves as if it consisted of just one credit.

- If default correlation is equal to 0: the number of defaults in the portfolio is a binomially distributed random variable. Significant credit diversification may be achieved.

The effect of granularity on Credit VaR

- The higher confidence level, the higher Credit VaR.

- Granular: is contains more independent credits, each of which is a smaller fraction of the portfolio 颗粒度更高指的是内含更多笔相互独立的贷款(债权资产)

- 颗粒度更高 Credit VaR更低 For a given default probability Credit VaR decreases as the credit portfolio becomes more granular.

- 违约概率越高,这个降低效果越好 The convergence is more drastic with a high default probability.

- 反之,违约概率越低,越难通过增加颗粒度降低VaR It is harder to reduce VaR by making the portfolio more granular, if the default probability is low.

- For a credit portfolio containing a very large number of independent small positions, the probability converges to100 percent that the credit loss will equal the expected loss.

- The portfolio then has zero volatility of credit loss, and the Credit VaR is zero.

Regulatory Capital

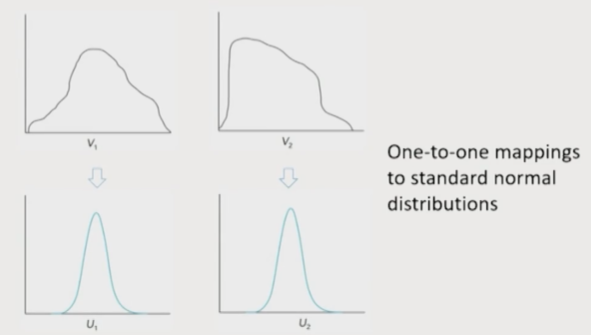

The Gaussian copula model for time to default

- "Percentile-to-percentile" transformations 点对点转换

- Define t_1 as the time to default of company 1 and t_2 as the time to default of company 2.

a_1=N^{-1}\left[Q_1\left(t_1\right)\right], \quad a_2=N^{-1}\left[Q_2\left(t_2\right)\right] - Q: the cumulative probability distributions

- N^{-1} : the inverse of the cumulative normal distribution

- Define t_1 as the time to default of company 1 and t_2 as the time to default of company 2.

- Gaussian copula: a_1 and a_2 have standard normal distributions. The model assumes that the joint distribution of ay and az is bivariate normal.二维正态分布

Single Factor Model

- Single-factor model is used to examine the impact of varying default correlations based on a credit position's beta.

- Now suppose we have many variables, X_i(i=1,2, \ldots). Each X_i can be mapped to a standard normal distribution a_i.

a_i=\beta_i m+\sqrt{1-\beta_i^2} \varepsilon_i

\varepsilon_i : firm's idiosyncratic shock

m: market index

\beta_i: own correlation between market value. - m \sim \mathrm{N}(0,1), \varepsilon_i \sim \mathrm{N}(0,1) \rightarrow a_i \sim \mathrm{N}(0,1)

- The variable m and the variables \varepsilon_i have independent, standard normal distributions. \varepsilon_i, \varepsilon_j are independent

- \beta_i are parameters with values between -1 and +1

- \rho=\frac{E\left(a_i a_j\right)-E\left(a_i\right) E\left(a_j\right)}{S D\left(a_i\right) S D\left(a_j\right)} \rightarrow \rho=\beta_i \beta_j

- Now suppose we have many variables, X_i(i=1,2, \ldots). Each X_i can be mapped to a standard normal distribution a_i.

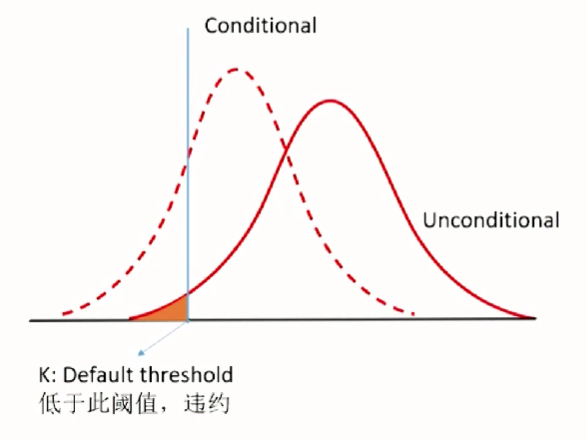

Unconditional default distribution

- Assume the probability of default (PD) is the same for all companies in a large portfolio.

- The \beta_i are assumed to be the same for all i. Setting \beta_i=\beta

a_i=\beta m+\sqrt{1-\beta^2} \varepsilon_i

Conditional default distribution

a_i=\beta \bar{m}+\sqrt{1-\beta^2} \varepsilon_i- The factor m can be thought of as an index of the recent health of the economy.

- If \overline{\boldsymbol{m}} is high: the economy is doing well and all the ai will tend to be high (making defaults unlikely).

- If \overline{\boldsymbol{m}} is low: all the ai will tend to be low so that defaults are relatively likely.

a_i \sim\left(\beta \bar{m},1-\beta^2\right)

- The conditional probability of default is greater or smaller than the unconditional probability of default, unless:

- Market factor shock happens to be zero

- The firm's returns are independent of the state of the economy.

- The conditional variance is reduced from 1

Impact of correlation parameter

- β → 1 (perfect correlation)

- m < default threshold, nearly all the credits default

- m > default threshold, almost none default

- β → 0 (zero correlation): If there is no statistical relationship to the market factor, so idiosyncratic risk is nil, then the loss rate will very likely be very close to the default probability p.

- In less extreme cases, a higher correlation leads to a higher probability of either very few or very many defaults, and a lower probability of intermediate outcomes.

Vasicek's Gaussian copula model

- Vasicek's Gaussian copula model, Basel lIl internal-ratings-based (IRB): is a way of calculating high percentiles of the distribution of the default rate for a portfolio of loans.

- 巴塞尔协议二内评法.模型的目标:找到一个糟糕市场情况下的条件违约概率

- The Basel Committee sets X = 99.9% for regulatory capital in the internal ratings-based approach.千年一遇的糟糕市场

(W C D R-P D) \times E A D \times L G D- WCDR (worst case default rate)

Worst case default rate

- Conditional default distribution

a_i=\beta \bar{m}+\sqrt{1-\beta^2} \varepsilon_i- 对表达形式做一些调整

a_i \sim\left(\beta \bar{m},1-\beta^2\right) \xrightarrow{\rho=\beta^2} a_i \sim(\sqrt{\rho} \bar{m},1-\rho)

- 对表达形式做一些调整

- The default rate conditional n the factor M:

N\left(\frac{N^{-1}(P D)-\sqrt{\rho} \bar{m}}{\sqrt{1-\rho}}\right) - 99.9% percentile worst case default rate

W C D R=N\left(\frac{N^{-1}(P D)-\sqrt{\rho} N^{-1}(0.001)}{\sqrt{1-\rho}}\right) - Capital requirement/Credit VaR

(W C D R-P D) \times E A D \times L G D

Economic Capital

CreditMetrics Model

- Many banks have developed other procedures for calculating credit VaR. One popular approach is known as CreditMetrics. 除了上个章节介绍的巴塞尔协议二计算CreditVaR的模型,银行内部可以自行开发,建构损失分布,计算经济资本

- CreditMetrics model: involves estimating a probability distribution of credit losses by carrying out a Monte Carlo simulation of the credit rating changes of all counterparties. 通过对所有交易对手的信用评级变化进行蒙特卡洛模拟,来估计信用损失分布

- 模型特点

- It can take account of downgrades as well as defaults. 不仅考虑违约,还考虑了信用质量变化导致的价值变化

- It is based on a rating transition matrix基于评级转移矩阵

- It provides an analytical methodology for risk quantification across a wide range of financial products. 可用于多种工具

- Computationally quite time intensive

Rating transition matrices

- These are matrices showing the probability of a company migrating from one rating category to another during a certain period of time.

- Based on historical data.基于历史数据

- The rating categories can be either those used internally by the financial institution or those produced by rating agencies such as Moody's, S&P, and Fitch.可以是金融机构内部的评级,也可以是外部评级机构的

- 多年期评级转移矩阵: assume that the rating change in one period is independent of that in another period, a transition matrix for two years can be calculated by multiplying the matrix by itself. 假设一年期评级变化是独立于其他时间段的,两年期矩阵等于一年期矩阵相乘

- 小于一年:求6个月矩阵,开根号taking the square root

- Ratings momentum评级冲量:If a company has been downgraded recently, it is more likely to be downgraded again in the next short period of time.

Using CreditMetrics to estimate Credit VaR

- Procedure: 确定现在, 估算变化, 考虑相关

- Step 1 The profile of the exposure is determined.

- Step 2 Estimate the volatility of the value of each financial product caused by revaluations, devaluations and defaults.

On each simulation trial, the credit ratings of all counterparties at the end of one year are determined.每条模拟路径上,交易对手一年后的信用等级被确定.

The credit loss for each counterparty is then calculated.This credit loss is likely to be negative. - Step 3 Considering the correlations between the above events, the volatility of individual financial products is added together to calculate the total volatility of the portfolio.考虑产品(或交易对手)之间的关系

The copula correlation between the rating transitions for two companies is typically set equal to the correlation between their equity returns.

Sampling and the correlation model

- In sampling to determine credit losses, the credit rating changes for different counterparties are not assumed to be independent.

- A Gaussian copula model is used to construct a joint probability distribution of rating changes.

Credit Spread Risk

- Credit-sensitive products in the trading book: calculating VaR or Es for portfolios including these products therefore involves examining potential credit spread changes.

- Historical simulation: problem - If the company is alive today, it did not default in the past and the calculations carried out therefore assume no probability of default in the future.

Constant level of risk assumptions

- 假设一家公司投资与BBB及债券,考虑两种投资策略

- Buy and hold买入并持有: hold bonds for one year

- Constant level of risk strategy恒定风险水平策略: rebalance(调仓) at the end of each month.If bonds are no longer BBB they are sold and replaced with BBB bonds 每月调仓,评级变化,就会卖出该资产,以BBB级别的新资产替代,始终维持BBB不变

- The constant level of risk strategy: VaR and ES are generally smaller when the constant level of risk strategy is used.

- The buy-and-hold strategy: will lead to greater losses from defaults and big downgrades than the constant level of risk strategy. The probabilities of losses from a small rating change are less.

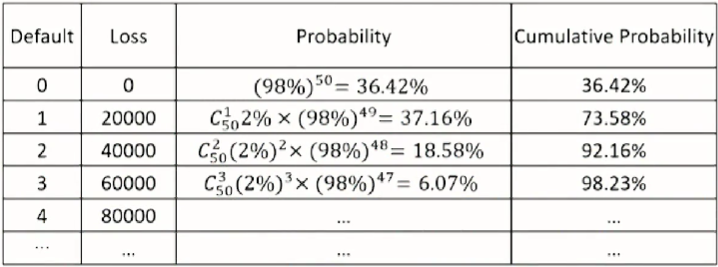

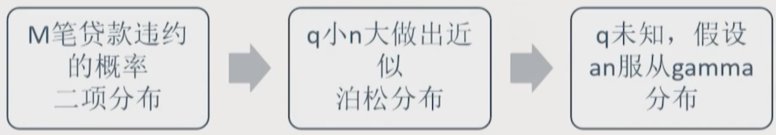

Credit risk plus

- 贷款数量n, 1年内违约概率均为q, 违约数量期望值qn, 假定违约事件之间互相独立

- 二项分布 Binomial distribution: 其中m笔贷款发生违约的概率为

C_n^m q^m(1-q)^{m-n} - 泊松分布 Poisson distribution: If q is small and n large,can be approximated by the Poisson distribution

\operatorname{Prob}(\text{m defaults})=\frac{(q n)^m e^{-q n}}{m!}- 即便各个贷款违约概率不相等,式子仍然成立,只要违约概率都很小,q等于一年中贷款组合的平均违约概率

- Uncertain about what the default rate q.但现实是对于平均违约概率是不确定的,可以假设预期违约数量qn服从gamma分布(均值\mu,标准差\sigma)

- 负二项分布(Negative binomial distribution)

- 泊松分布 → 负二项分布

- \boldsymbol{\sigma} \rightarrow \mathbf{0}: the negative binomial distribution tends to the same probability distribution for the number of defaults as the Poisson distribution.

There is no uncertainty about the default rate. Without this uncertainty, there is no default correlation - As σ increases: the probability of an extreme outcome involving a large number of defaults increases.

Default correlation increases and a large number of defaults becomes more likely

Credit VaR is considerably larger. - Without default correlation, the loss probability distribution is fairly symmetrical.

With default correlation, it is positively skewed.

Comparison between models

- Credit Risk Plus vs.CreditMetrics

- 对于信用风险的定义不同,相关性假设不同

- Credit Risk Plus:

只考虑违约 Does not calculate credit ratings but only default events.

假设相互独立,违约概率低 default rate is very small and independent of the remaining credit events. - Credit Metrics:考虑由于评级变化,信用资产价值的变 化,可通过copula考虑之间的相关性

- Credit Risk Plus vs.KMV model

- Credit Risk Plus: does not use the capital structure of the company 没有考虑公司的资本结构

Counterparty Credit Risk

Derivatives

Counterparty credit risk(CCR)

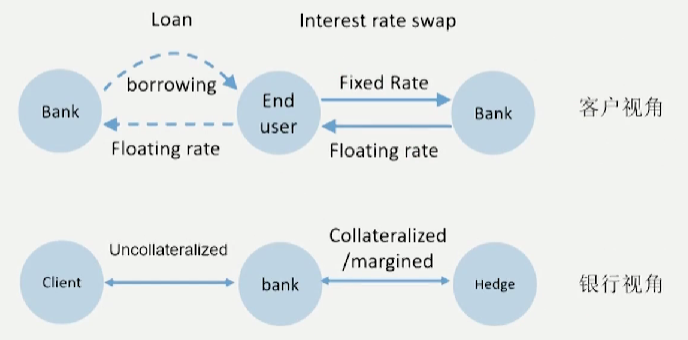

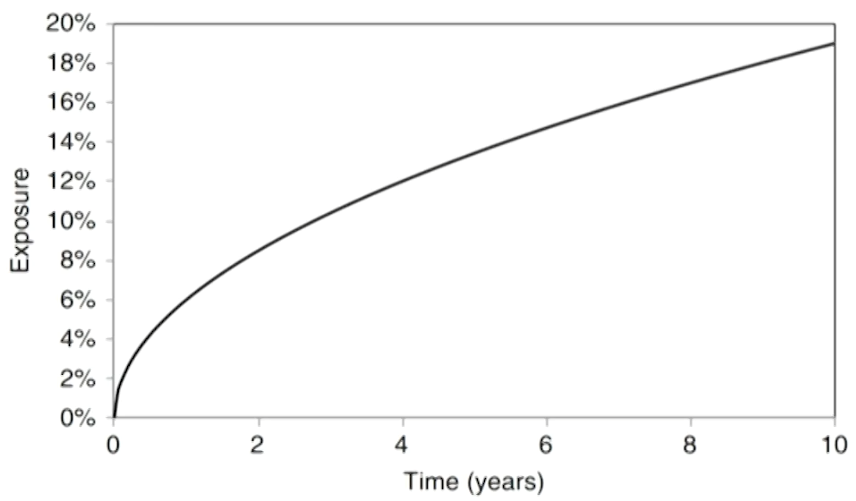

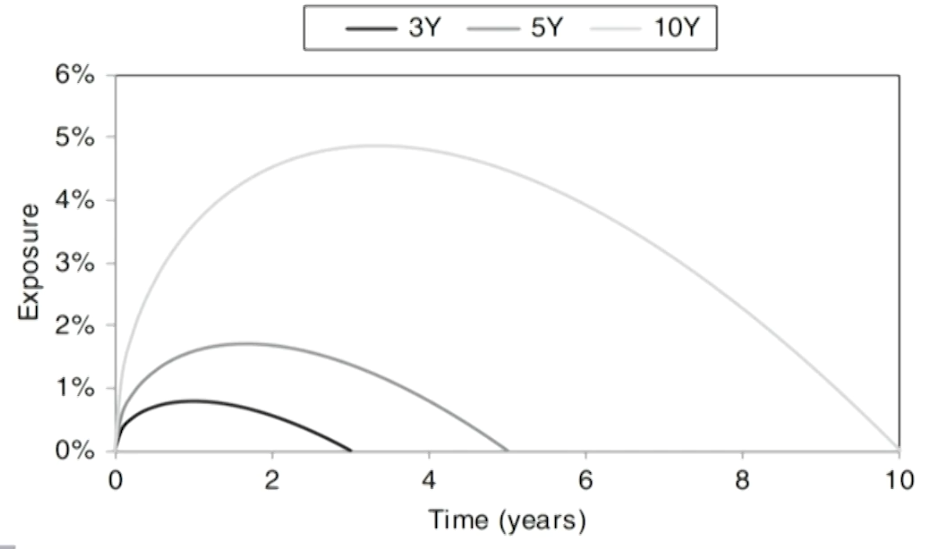

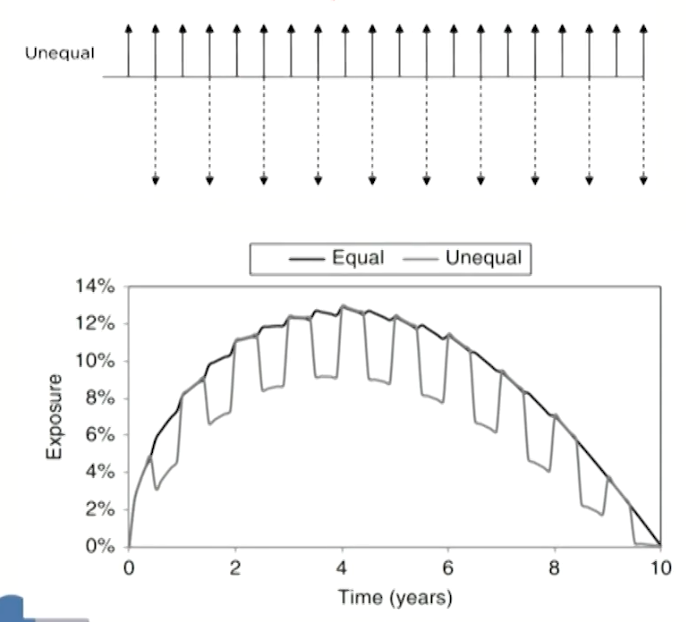

- Derivatives transactions: represent contractual agreements either to make payments or to buy or sell an underlying security at a time or times in the future.

- Financial institutions, mainly banks, provide derivative contracts to their end user clients and hedge their risks with one another.

- are dominated by a relatively small number of large counterparties(dealers)许多市场都被数量相对较少的大型交易方所控制

- Counterparty credit risk: the possibility that a counterparty may not meet its contractual requirements under the contract when they become due.

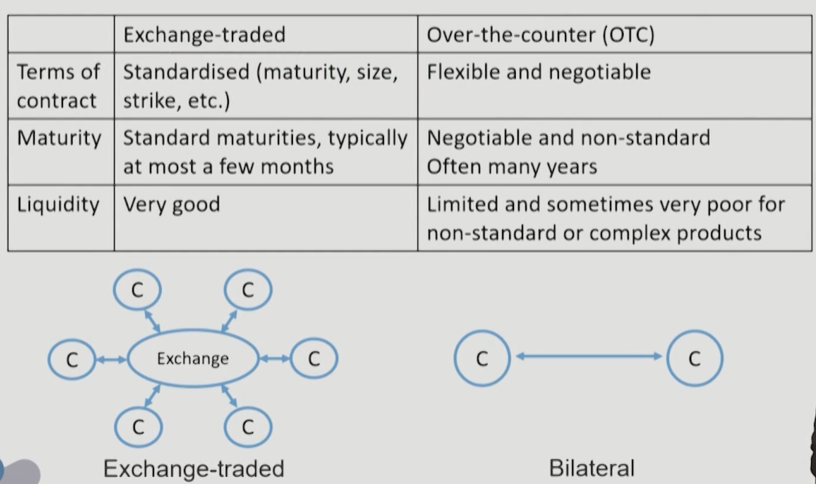

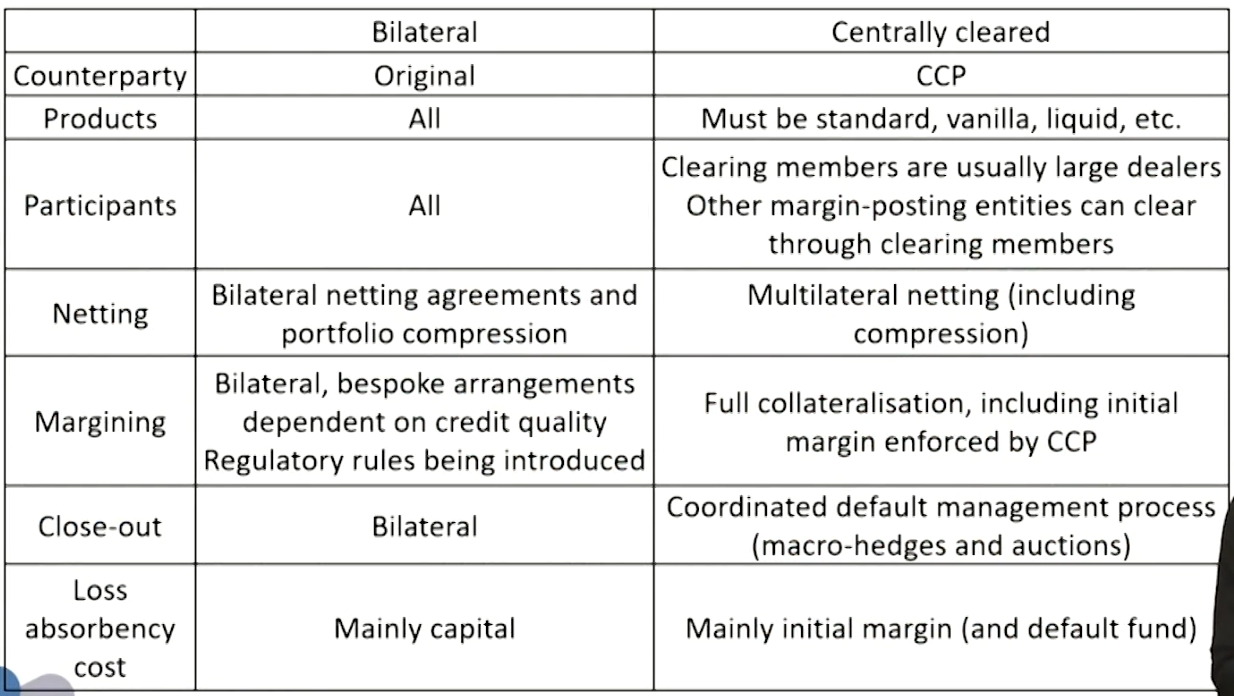

Exchange-traded vs.OTC

Clearing

- Execution: buyer and seller enter into a legal obligation to buy/sell securities or another underlying

- Clearing: Transaction is managed prior to settlement (margining, cashflow payments, etc.)

- Settlement: Transaction is settled via exchange of securities and/or cash and legal obligations are therefore fulfilled.

- Since it requires a certain amount of standardisation, not all OTC derivatives can be centrally cleared.

- 主要的场外衍生品: interest rate (and inflation) derivatives,foreign exchange derivatives, equity derivatives, commodity derivatives, and credit derivatives.

Market participants

- Large player: large global bank, often known as a dealer.

- Have a vast number of derivatives trades on their books and have many clients and other counterparties

- Trade across all asset classes and will collateralize positions

- Will be a member of most or all exchanges and CCP to facilitate trading on their own account and for their clients.

- Medium-sized player: a smaller bank or other financial institution

- Smaller number of clients and counterparties

- Will be a member of local exchanges and may be a member of a number of global ones

- End user: a large corporate, sovereign, or smaller financial institution with derivatives requirements

- Overall position will be very directional

- Unwilling to commit to margining or posting collateral

- Third parties: may offer settlement/margining/collateral management, software, trade compression, and clearing services.

Collateralization

- Exchange-traded derivatives: are effectively settled on a daily

- most simple, liquid, and short-dated derivatives. Margin must be posted against losses on a daily basis.

- OTC derivatives: may be collateralized

- OTC centrally cleared: Daily collateralization in cash (variation margin)

- OTC collateralized: bilateral OTC derivatives. Parties post collateral (which may be cash or securities) to one another in order to mitigate the counterparty risk.

- OTC uncollateralized: parties do not post collateral (or post less and/or lower quality collateral)

One of the parties is an end user such as a corporate

- Banks and end users

- 头寸具有方向性,盯市价值及现金流波动大The overall portfolio will typically be directional. The value of the derivatives, or mark-to-market (MTM) volatility will be significant and any associated margin or collateral flows may vary substantially.

- 一对一对冲敞口而非整体宏观对冲敞口End users may hedge risks on a one-for-one basis rather than macro basis.

- The hedging needs may lead to certain imbalances

ISDA国际互换及衍生品协会

- The International Swaps and Derivatives Association (ISDA) is a trade organization for OTC derivatives practitioners.

- Standard legal documentation to increase efficiency and reduce aspects such as counterparty risk

- The ISDA Master Agreement 主协议: the market standard for OTC derivative documentation

- Master agreement

- Bilateral framework which contains terms and conditions Multiple transactions will be covered under a general

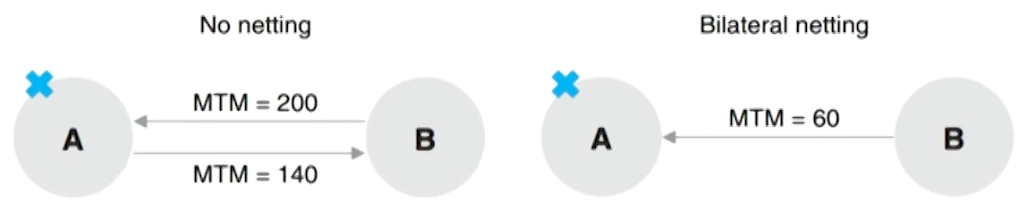

- Master Agreement to form a single legal contract of an indefinite term, covering many or all of the transactions.

- Core section 核心部分+ a schedule containing adjustable terms 附表组(可调整条款)

- 合约条款涉及:netting,collateral, termination events,the definition of default, and the close-out process

- 从交易对手风险视角,ISDA主协议具有以下降低风险的特点:

- The contractual terms regarding the posting of collateral 有 关抵押品的合同条款

- Events of default and termination 违约事件和终止

- All transactions referenced are combined into a single net obligation所有参考交易合并为单一净债务

- The mechanics around the close-out process are defined 确定平仓机制

- ISDA主协议涵盖的违约事件有:

- Failure to pay or deliver 未付款或未交付

- Breach of agreement 违背合约

- Credit support default (collateral terms) 信用支持违约

- Misrepresentation 错误陈述

- Default under the specified transaction特定交易下的违约

- Cross-default(default on another obligation)交叉违约

- Bankruptcy

- Merger without assumption 不承担义务的合并

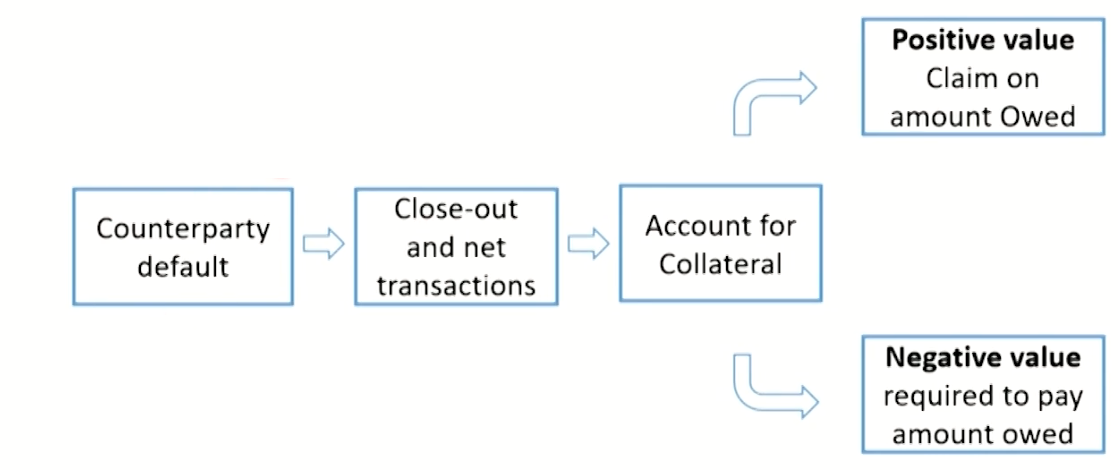

- May lead to the loss for the nondefaulting party:

- The total value of the transactions to the nondefaulting party is positive and greater than the collateral (if any) posted by the defaulting party.非违约方价值为正,但违约方缴纳的抵质押物不足

- The total value of the transactions is positive to the defaulting party and the collateral posted by the nondefaulting party is greater than this value.违约方价值为正,未为违约方缴纳抵质押物超过合约价值

Systemic risk

- Systemic risk: A major concern with respect to OTC derivatives is systemic risk, which generally refers to an uncontained crisis which may cause the failure of an entire financial system or market.系统性风险一般是指可能导致整个金融系统或市场崩溃的无法控制的危机

Historical ways

- SPV

- Derivatives product companies

- Monolines and CDPCs

Special purpose vehicle 特殊目的实体

- Special purpose vehicle (SPV) or special purpose entity(SPE) is a legal entity(e.g. a company or limited partnership) created typically to isolate a firm from financial risk.

- To isolate counterparty risk.

- SPVs aim essentially to change bankruptcy rules

Shift priorities 改变清偿顺序 - An SPV transforms counterparty risk into legal risk.

A bankruptcy court to combine the SPV assets with those of the originator

Derivatives product companies 衍生品公司

- DPCs are generally triple-A-rated entities set up by one or more banks as a bankruptcy-remote subsidiary of a major dealer由一家或多家银行设立的三A级实体,作为主要交易商的破产远程子公司

- Provides external counterparties with a degree of protection against counterparty risk by protecting against the failure of the DPC parent.通过防止 DPc 母公司倒闭

- Maintained a triple-A rating

- Minimizing market risk

Mirror trades: matched book - Support from a parent: If the parent were to default, then the DPC would either pass to another well-capitalized institution or be terminated

- Credit risk management and operational guidelines: Restrictions were also imposed on (external) counterparty credit quality and activities (position limits, margin, etc.)

- Minimizing market risk

- However, was such a triple-A entity of a double-A or worse bank really a better counterparty than the bank itself?

- The GFCessentially killed the already-declining world of DPCs.

- A DPC's fate inextricably with that of its parent.DPCs 的命运与其母公司的命运密不可分地联系在一起

Monolines and CDPCs单一险种公司

- Monoline insurance companies: were financial guarantee companies with strong credit ratings that were utilized to provide 'credit wraps', which are financial guarantees.

- Credit derivative product companies (CDPCs): were an extension of the DPC concept that had business models similar to those of monolines.

- When the GFC developed through 2007, monolines experienced major problems due to the MTM-based valuation losses on the insurance they had sold.

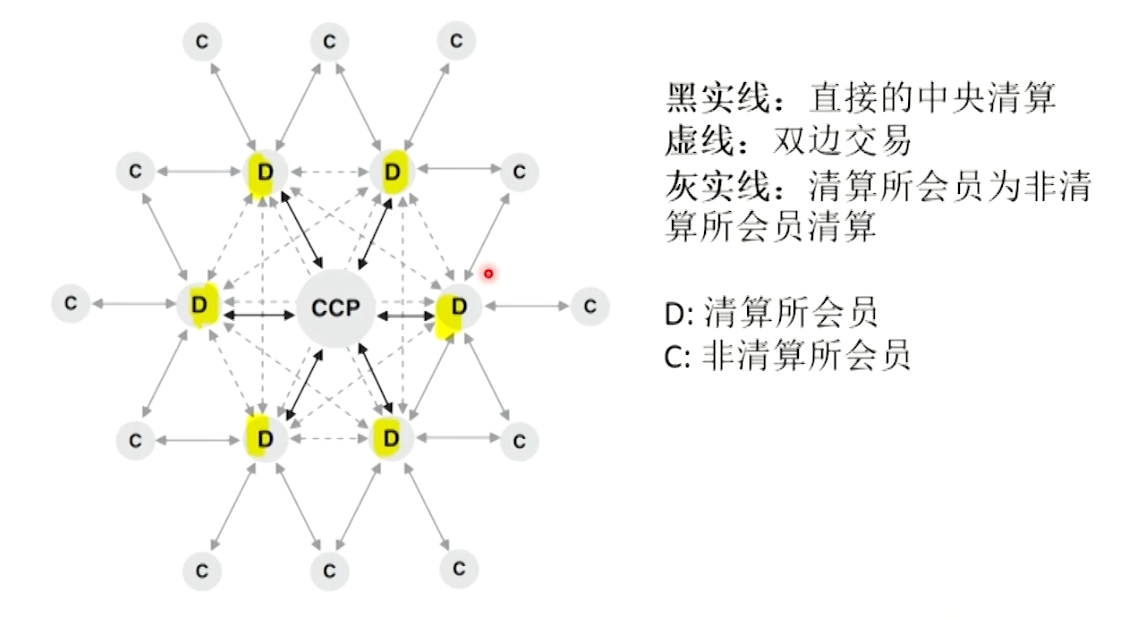

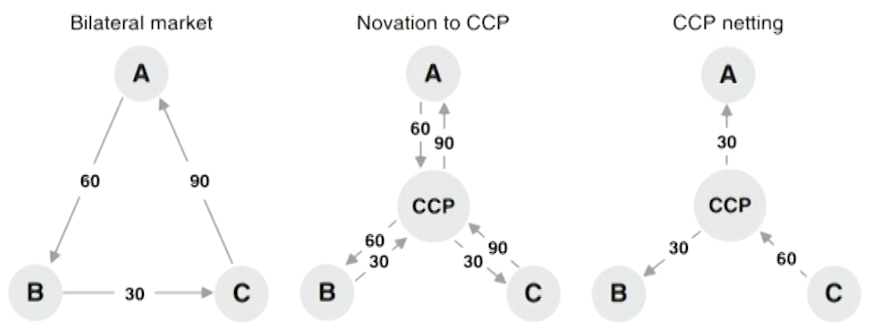

Central clearing of OTC derivatives

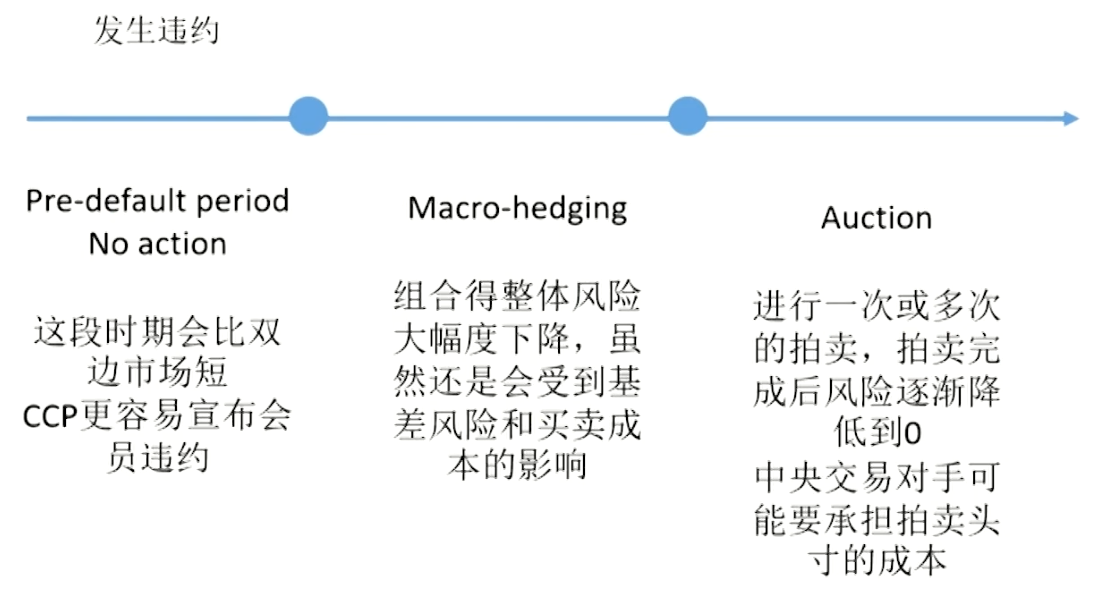

- From the late 1990s, several major CCPs began to provide clearing and settlement services for OTC derivatives and other non-exchange-traded products(repo).

- These OTC transactions are still negotiated privately and off-exchange, but are then novated into a CCP on a post-trade basis.这些场外交易仍然是私下和场外谈判的,但在交易后被更替到中央交易对等中心

- The clearing mandate

- All standardized OTC derivatives to be traded on exchanges or electronic platforms

- Mandatory central clearing of standardized OTC derivatives 标准化场外衍生品的强制性中央结算

- The reporting of OTC derivatives to trade repositories 向交易资料库报告场外衍生工具

- Higher capital requirements for non-centrally cleared OTC derivatives.提高非集中清算场外衍生品的资本要求

- The roles

- To sets certain standards and rules for its clearing members制定一定的标准和规则

- To take responsibility for closing out all the positions of a defaulting clearing member 负责平仓违约会员头寸

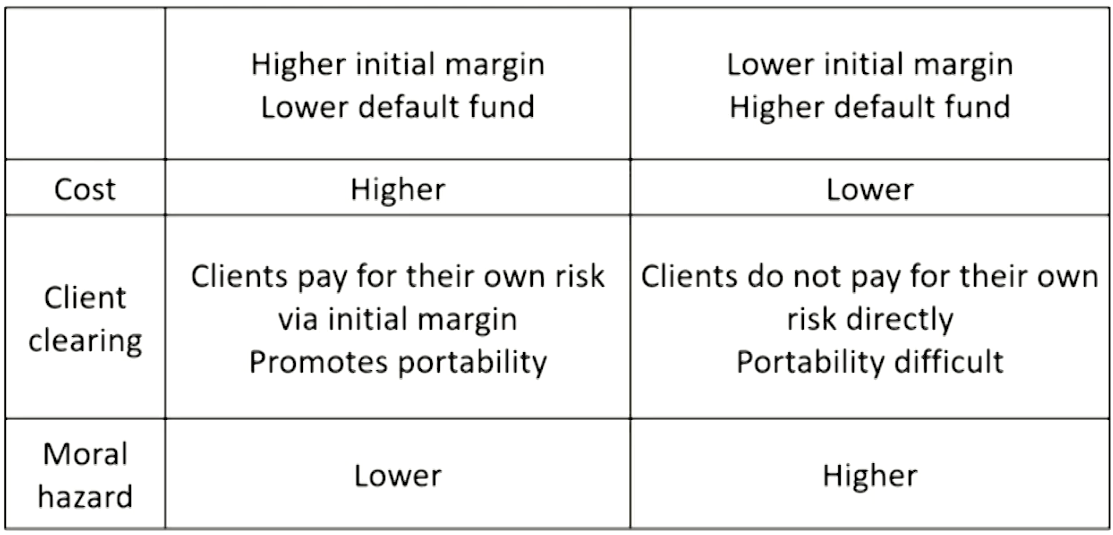

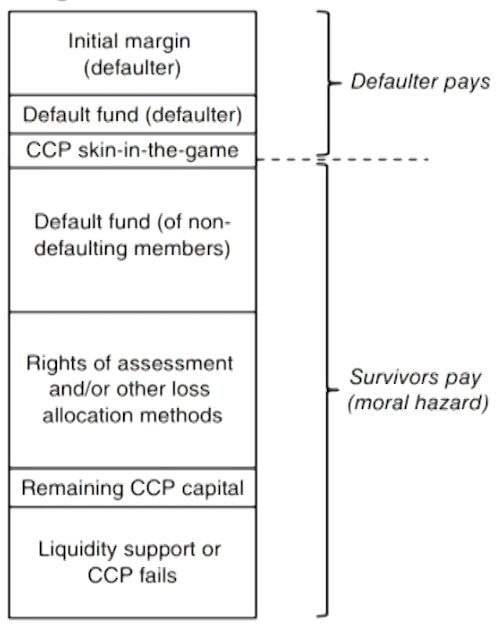

- To maintain financial resources to cover losses in the event of a clearing member default:

Variation margin: closely track market movements

Initial margin: cover the worst-case liquidation or close out costs above the variation margin

A default fund: mutualize losses in the event of a severe default - To have a documented plan for the very extreme situation when all their financial resources (initial margin and the default fund) are depleted 全部耗尽

Additional calls to the default fund

Variation margin haircutting

Selective tear-up of positions

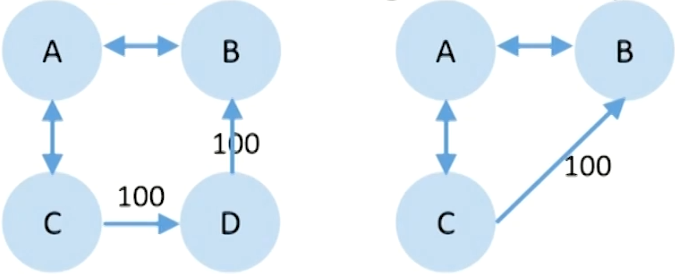

- CCPs provide a number of benefits:

- Allow netting of all trades executed through CCPs

- CCPs manage margin requirements from their members to reduce the risk associated with the movement in the value of their underlying portfolios.

- The CCP absorbs the 'domino effect' by acting as a sort offinancial shock absorber 充当金融冲击吸收器来吸收"多米诺骨牌效应"

- Auctioning the defaulted members' positions

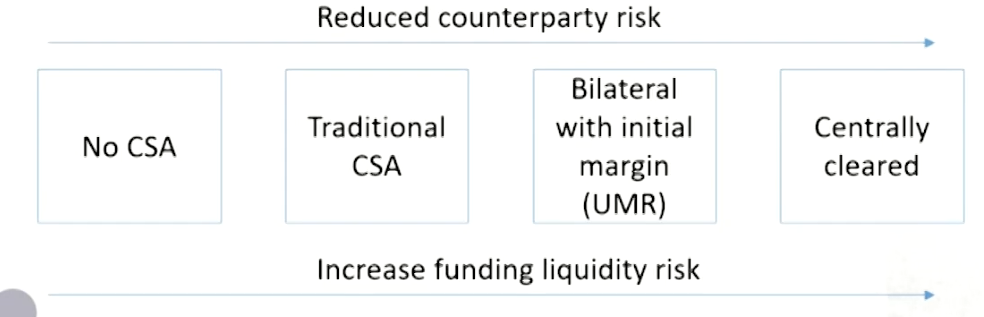

Bilateral margin requirements

- Whilst clearing is mandatory, it can be avoided by trading contracts that are not sufficiently standardized to be cleared

- Regulators introduced mandatory margin (collateral) rules for derivatives that would remain bilateral. 双边合约也进入了强制保证金制度

Derivatives risk modelling

- VaR

- VaR does not give an indication of the possible loss outside the confidence level chosen

- VaR is that it is not a coherent risk measure (not behave in a sub-additive fashion)

- ES: not ignoring completely the impact of large losses; coherent risk measure

- Models: the financial markets have a somewhat love/hate relationship with mathematical models

- The quantitative modelling of counterparty risk is complex and prone to misinterpretation and misuse.

- Counterparty risk involves looking years into the future rather than just a few days, which creates further complexity that is not to be underestimated.交易对手风险涉及未来数年而非短短几天

- Correlation and dependency: counterparty risk takes difficulties with correlation to another level.

Counterparty Risk and Beyond

Definition of counterparty risk

- Counterparty credit risk is the risk that the entity with whom one has entered into a financial contract (the counterparty) will fail to fulfil their side of the contractual agreement.

- Over-the-counter(OTC) derivatives

- Bilaterally cleared

- Uncollateralized

Lending risk vs. counterparty risk

- Lending risk:

- Notional amount at risk during lending period is usually known with a degree of certainty.

- Only one party takeslending risk.(i.e. bondholder).

- Counterparty risk:

- The value of the contract in the future is uncertain.

- Since the value of the contract can be positive or negative,counterparty risk is typically bilateral.

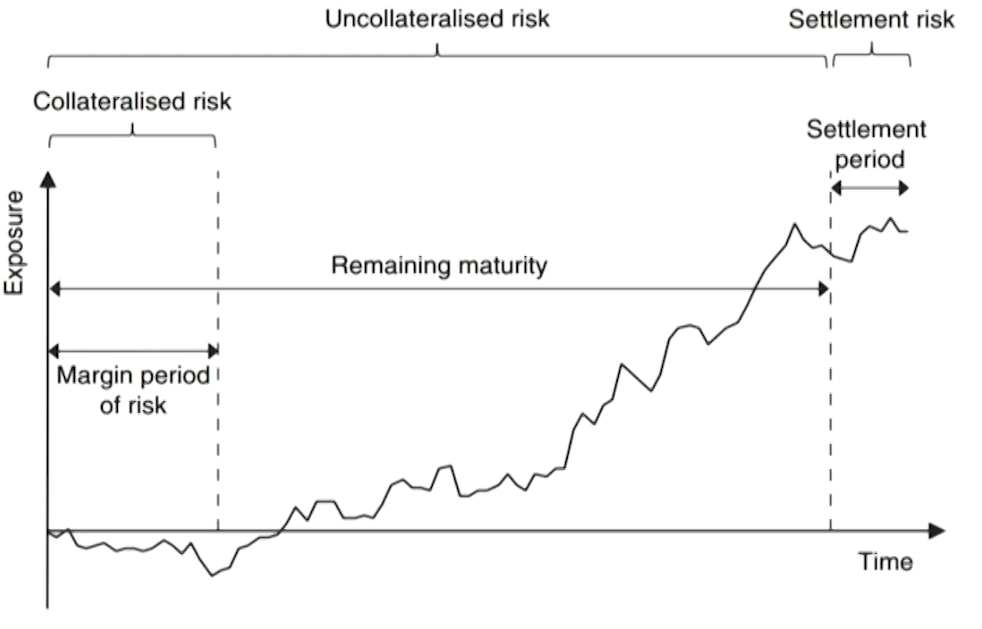

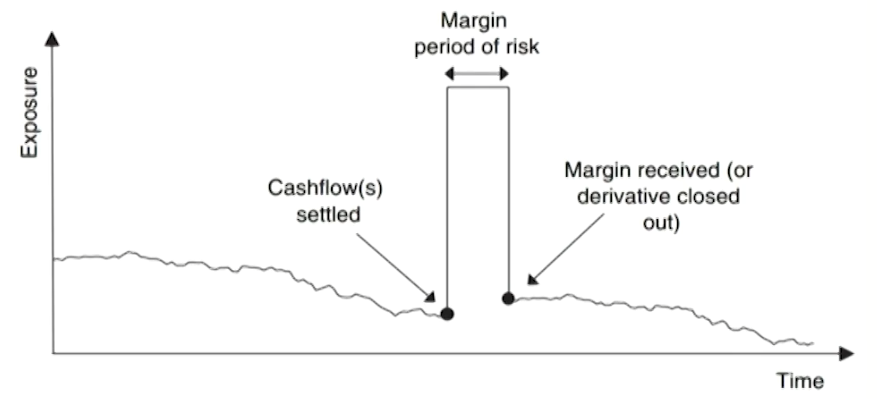

Settlement, pre-settlement, and margin period of risk

- Pre-settlement risk: a counterparty will default prior to the final settlement of the transaction. (counterparty risk)

- Long-dated OTC derivatives

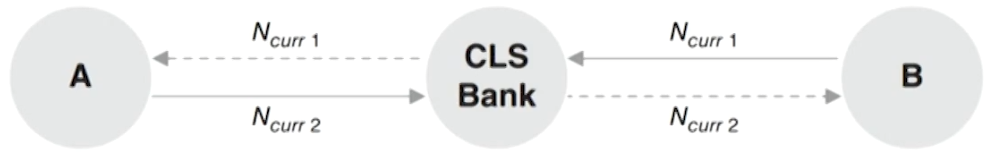

- Settlement risk: arises at settlement times due to timing differences between when each party performs its obligations under the contract.

- Occurs for only a small amount of time (days or even hours)

- A very large exposure (potentially 100% of the notional)

- Spot contracts现货合同; Fx markets 外汇市场

- Margin period of risk(MPoR): the risk horizon when collateralized/margined

- Collateralized bilateral OTC derivatives: 10 business days

- Centrally-cleared OTC derivatives: 5 business days

Institutions and transactions

- Large global banks have exposure to all asset classes

- Smaller banks may have more limited exposure

- End users may also have limited exposure

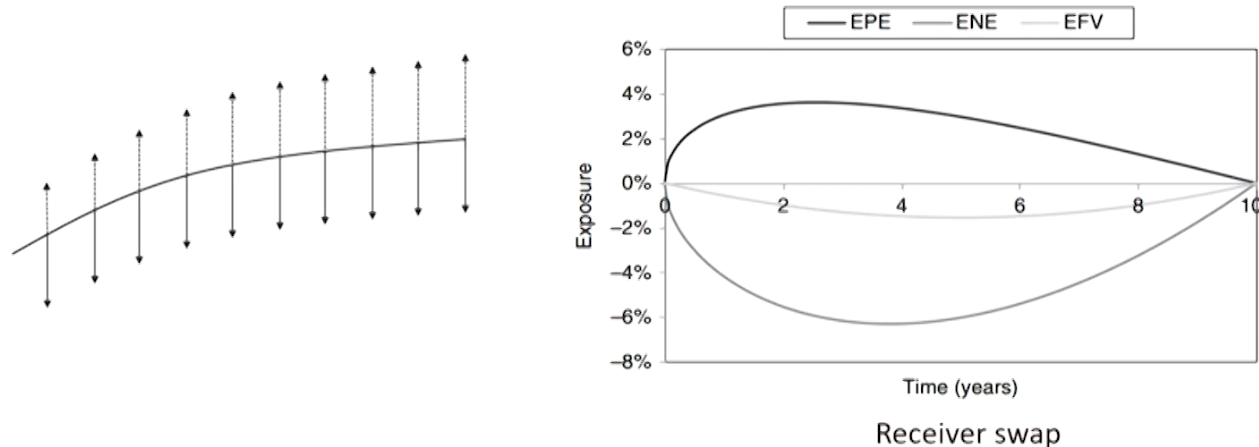

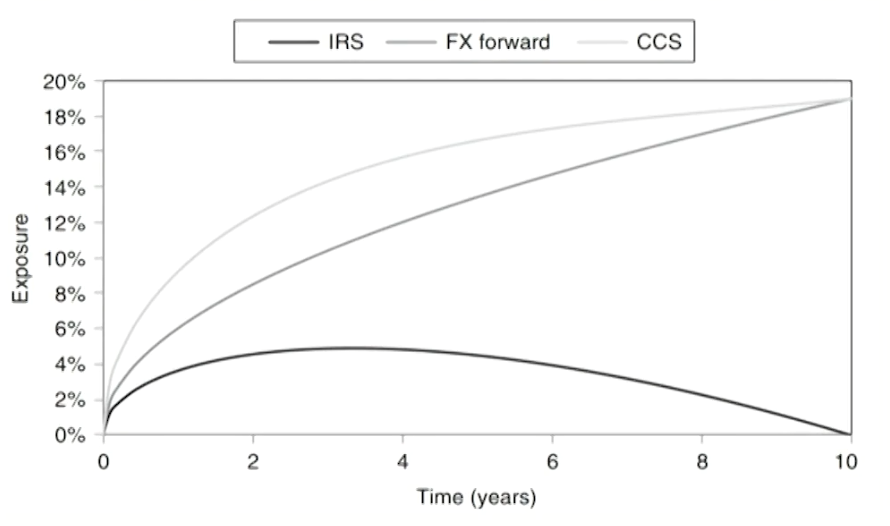

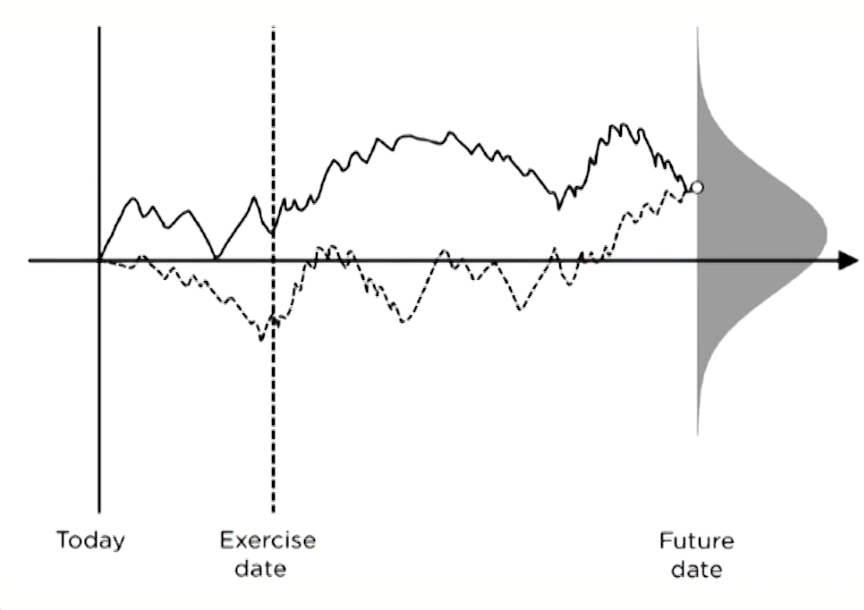

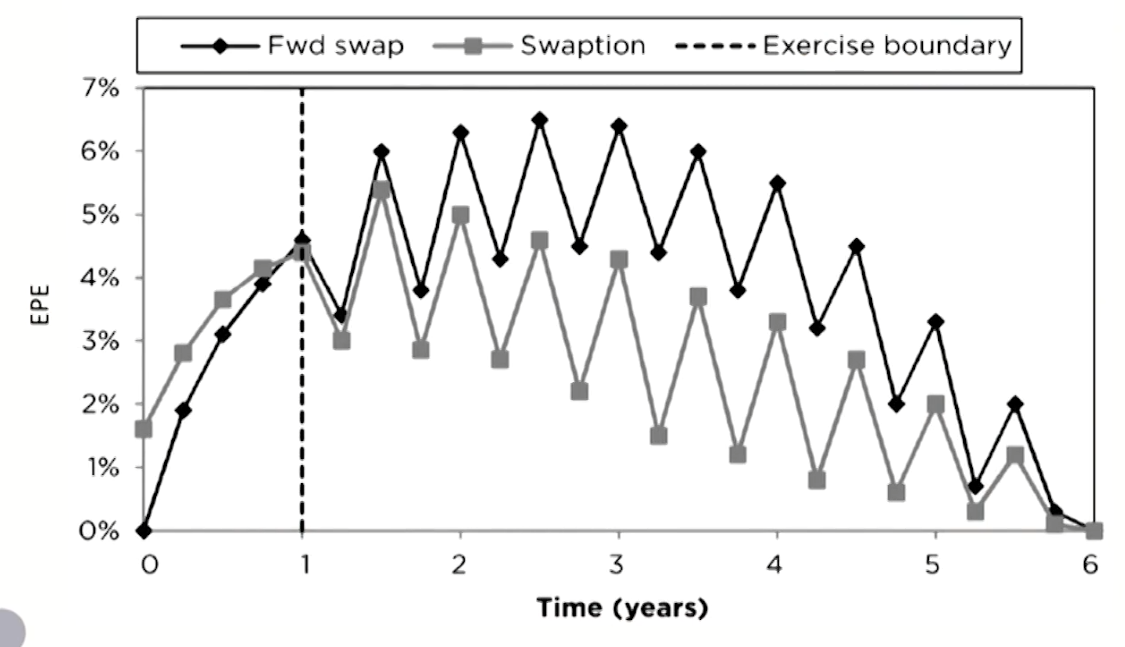

- Counterparty risk faced with CCPs may receive attention over the coming years