Fixed Income Securities

Basic Features

Issuer/Borrower

- Supranational organizations, such as World Bank

- Sovereign (national) governments, such as China and Singapore

- Non-sovereign (local) governments, such as state of California

- Quasi-government entities, not a direct obligation of a country's government or central bank, such as agencies that are owned by government

- Companies, divided into those issued by financial companies and those issued by nonfinancial companies, such as corporate issuers

Maturity

- Maturity vs. Tenor/ Time to Maturity

- Money market securities

- one year or less

- Capital market securities

- more than one year

- Perpetual bond

- no stated maturity date

Par Value/ Face Value/Maturity Value/ Redemption Value

- The amount that the issuer agrees to repay the bondholders on the maturity date

- Chen's Question:

- Does the par value equal to the price the investor purchase the bond?

- Different PRICES/VALUES

Par value

Purchase price

Amortization value(book value)

Market value

Intrinsic value

Coupon

- Coupon is the amount of interest payments

- Annual coupon = coupon rate x par value

- Coupon rate/nominal rate is the interest rate that the issuer agrees to pay each year until the maturity date

- Chen's tips: It is not the same as interest income/expense in FRA

- Coupon frequency

- Coupon payments may be made annually, semi-annually,quarterly, or monthly, etc.

- Zero-coupon bond / pure discount bond: a bond pays no interest prior to maturity

Currency Denomination

- Dual-currency bonds

- Make coupon payments in one currency and pay the par value at maturity in another currency

- Currency option bonds

- Give bondholders the right to select one of two currencies for each payment in which they want to receive

- Can be viewed as a combination of a single-currency bond plus a foreign currency option

Bond Indenture

Bond Indenture / Trust Deed

- The legal contract that describe the form of bond, the obligations of issuer, and the rights of bondholders

- Legal identity of the bond issuer and its legal form

- Source of repayment proceeds还款来源

- Collateral & asset-backed

- Credit enhancements信用增强

- Covenants

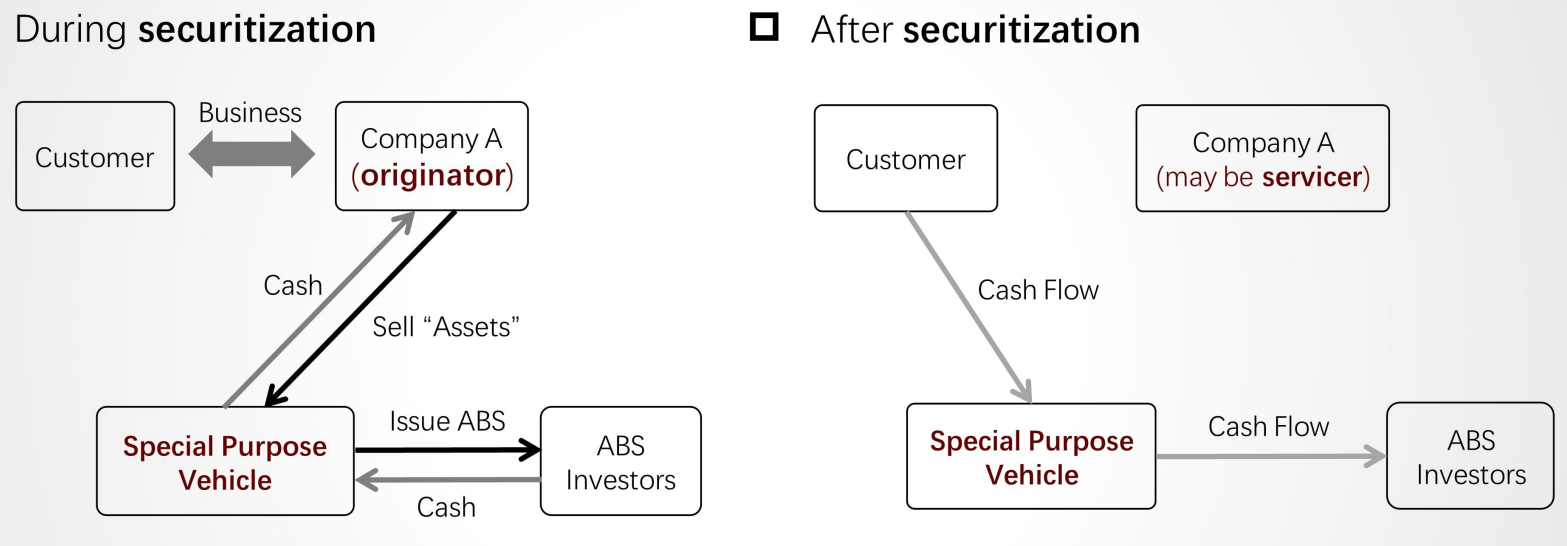

Securitization

- Securitized bond is issued by a separate legal entity which is called special purpose entities(SPEs)/ special purpose vehicles (SPVs)

- SPEs/SPVs is bankruptcy remote because the transfer of assets by the sponsor is considered a legal sale: once the assets have been securitized, the sponsor no longer has ownership rights

Source of Repayment Proceeds

- How issuer service the debt and repay the principal

- Supranational bond: 1) repayment of previous loans, 2) paid-in capital from its members

- Sovereign bonds: 1) tax revenues, 2) print money

- Non-sovereign government debt: 1) general taxing authority,2) cash flows of the project funded, 3) special taxes or fees

- Corporate bonds: cash flow from its operations

- Securitized bonds: cash flow from underlying financial assets

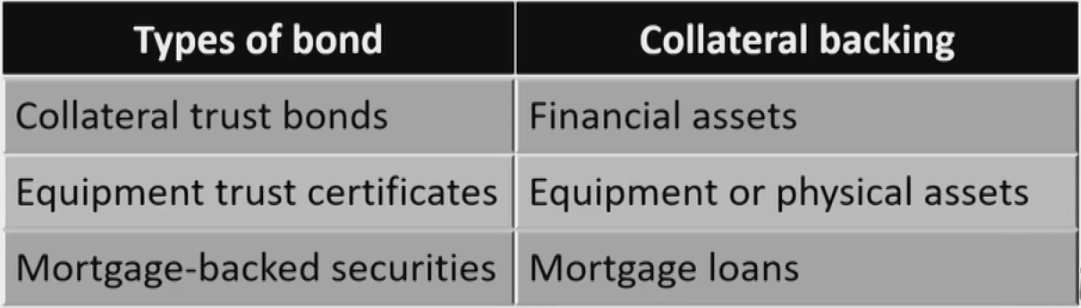

Collateral

- A way to reduce/alleviate credit risk, and decreases yield

- Secured bonds有抵押: backed by assets or financial guarantees pledged to ensure debt repayment in case of default

- Unsecured bonds无抵押: have no collateral, bondholders have only a general claim on the issuer's assets and cash flows

- Debentures无担保债券

Asset-Backed

- Asset-backed security

- Mortgage-backed security

- Others

- Covered bond

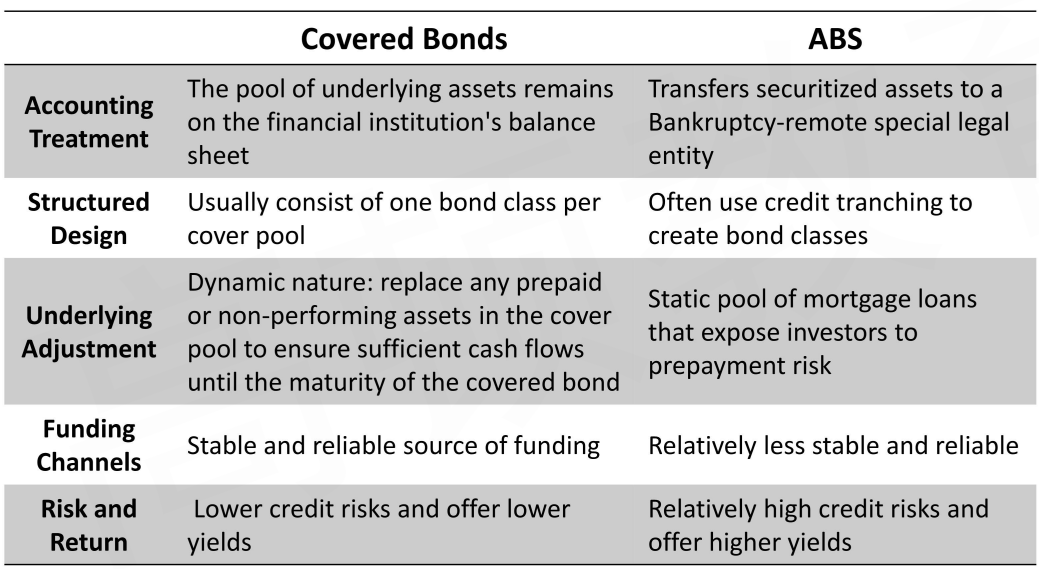

- Covered bond has lower credit risk than ABS

Covenants

- Legally enforceable rules that borrowers and lenders agree on at the time of a new bond issue

- Negative covenants: (can not)

Restrictions on asset sales

Restrictions on additional borrowings - Affirmative covenants: (should do)

Timely payment of principal and interest

Maintain financial ratios

Maximum and minimum - Negative covenants are costlier

- Negative covenants: (can not)

Credit Enhancement

- Variety of provisions used to reduce the credit risk and decrease the bond's yield

- Internal credit enhancement内部信用增强

- Subordination结构化: waterfall structure, tranches分级

- Over-collateralization提高抵押物: post more collateral than is needed to obtain or secure financing要求更多的抵押物

- Reserve accounts储备 (cash reserve / excess spread): more cash flow received from the assets used to secure the issue than the interest paid to investors储备金

- External credit enhancement外部信用增强

- Surety bond履约保证: reimburse investors for any losses incurred if the issuer defaults, by a insurance company比如找保险公司

- Bank guarantee银行保还: same as surety bond but by a bank由银行补偿lender

- Letter of credit信用证: promise to lend money to issuing entity for any cash flow shortfalls银行放贷给issuer

- Cash collateral account: issuer borrows the credit enhancement amount and invests the amount in highly rated short-term commercial paper外部提供储备金

Mitigate third-party(or counterparty) risk

Legal,Regulation and Tax

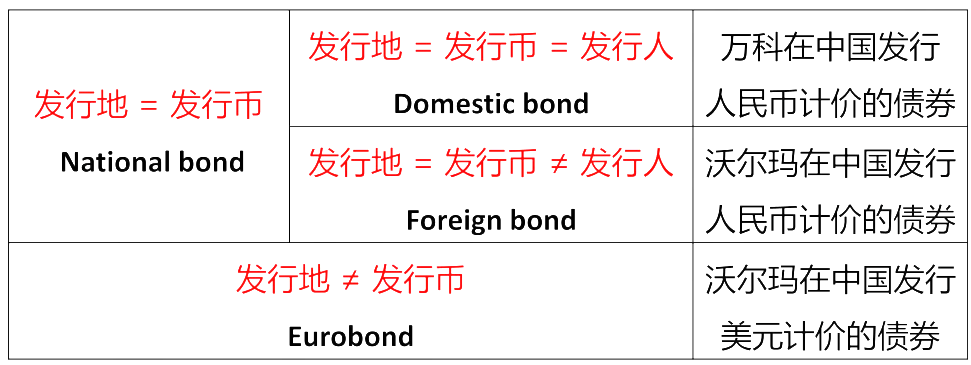

Sectors of Bond Market

- National bond markets: include all the bonds issued and traded in a specific country, and denominated in the currency of that country债券币种是市场币种

- Domestic bonds: issued by entities that are incorporated in that country

- Foreign bonds: issued by entities that are incorporated in another country(Yankee/panda/Samurai/kangaroo bonds)

- Eurobond market: issued outside the jurisdiction of any single country and can be denominated in any currency债券币种不是市场币种

- Eurobonds: issued and traded on Eurobond market

- Eurobonds: issued and traded on Eurobond market

- Global bond markets: consist of national bond markets and Eurobond market

- Global bonds: issued simultaneously in the Eurobond market and in at least one domestic bond market在多个市场发行的

Legal and Regulatory Consideration

- Bearer bonds不记名

- Does not keep records of who owns the bonds, only the clearing system knows who the bond owners are不知道谁持有

- Most Eurobonds are bearer bonds

- Registered bonds记名

- Ownership is recorded by either name or serial number

- Most domestic and foreign bonds are registered bonds持有人被记录在案

- Some investors may prefer bearer bonds to registered bonds, possibly for tax reasons

Tax Consideration

- Interest

- The income portion (interest) is generally taxed at the ordinary income tax rate

- Tax-exempt securities are exception

- Capital gain or loss

- Capital gains are usually taxed at a lower rate than ordinary income

- In some countries, there is a different tax rate for long-term and short-term capital gains

Original issue discount (OID) bonds

- A portion of the discount from par at issuance is treated as taxable interest income each year

- There is no additional capital gains tax liability at maturity

Cash Flow Structure of Principal Repayments

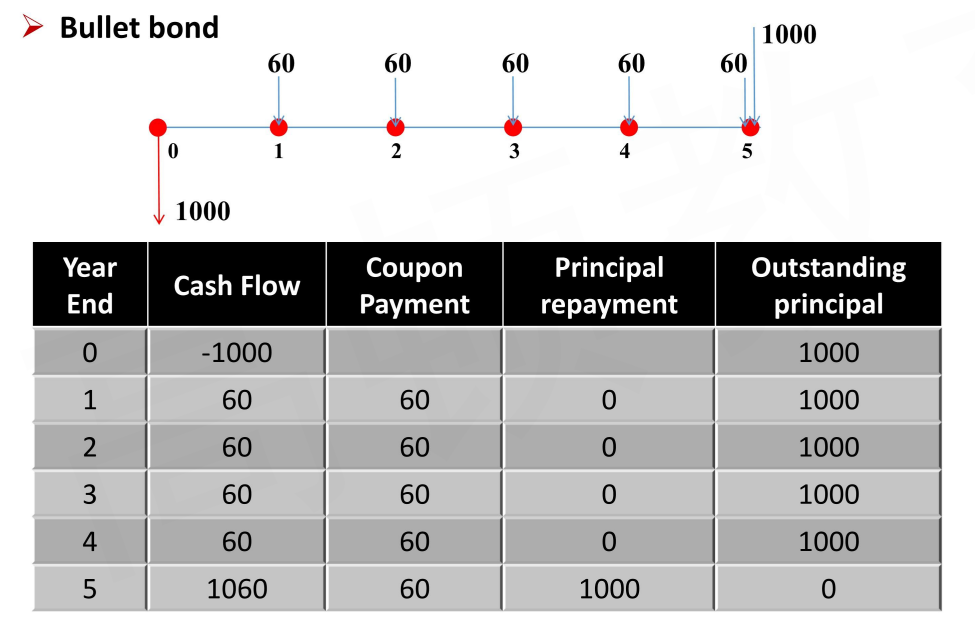

Plain Vanilla Bond / Conventional Bond

- Coventional bond's periodic interest payments and principal is paid at maturity

- Bullet bond:现金流集中在一个点

- Balloon payment: A large, lump sum payment that is a higher dollar amount than the regular periodic payment最大的一笔现金流

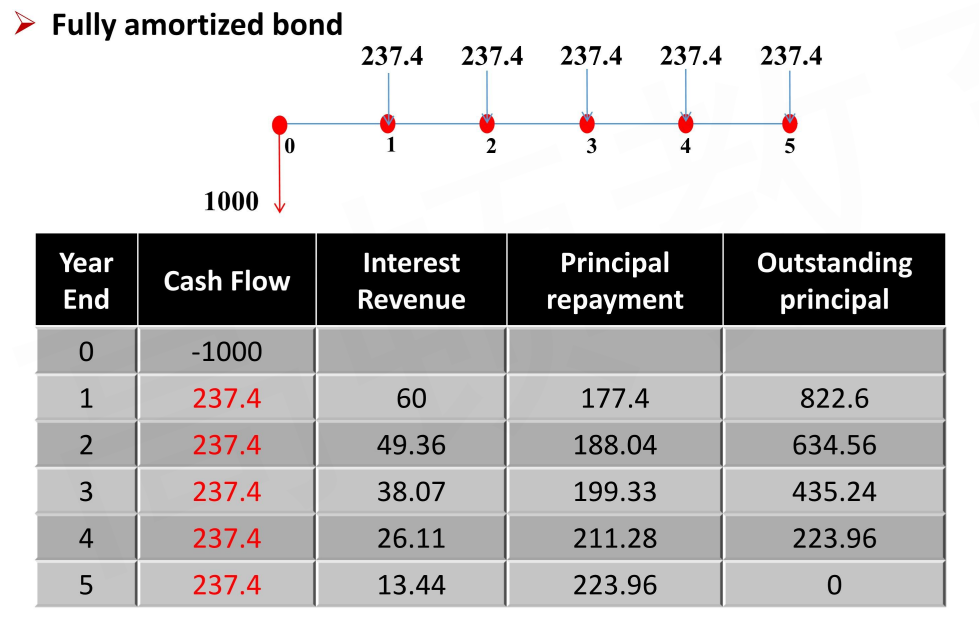

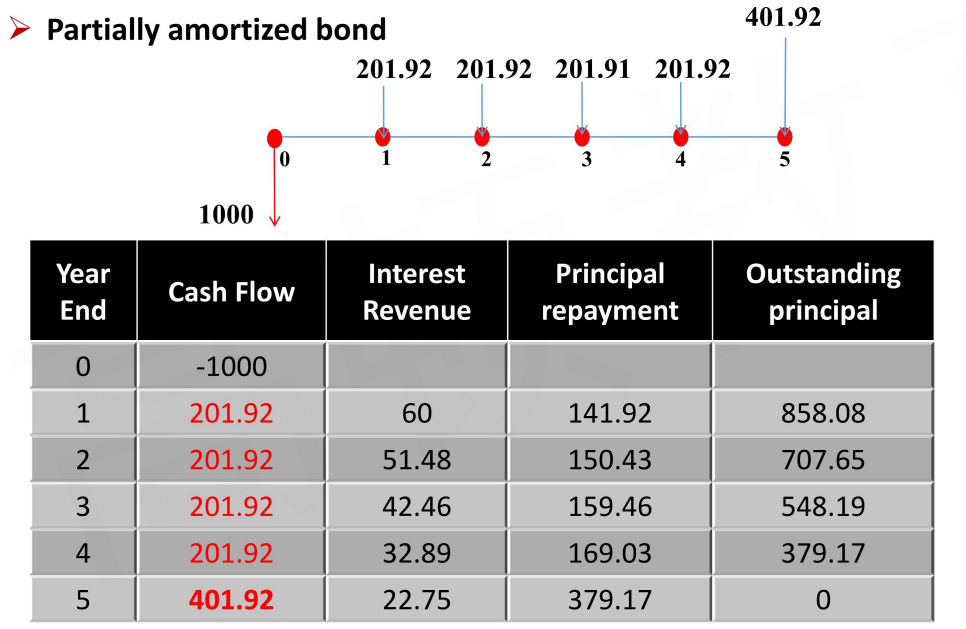

Amortizing Bond

- Amortizing bond has a periodic repayment schedule of principal

- Fully amortized bond: has a schedule that reduces outstanding principal to zero by the maturity date

- Partially amortized bond: only a portion of the principal is repaid by the maturity date

Balloon payment risk最后一期不还

Sinking Fund Provision偿债基金条款

- Sinking fund provision refers to an issuer's plans to set aside funds over time to retire the bond, retire amount is based on the provision

- Similar to serial maturity structure

- Example

- BM issues a 10-year bond with a par value of$100 million. The bond has a sinking fund provision, which requires that BM retires $20 million of the principal every year beginning in the sixth year.

- Advantage: less credit risk

- Disadvantage: more reinvestment risk

- Chen's question: When will the reinvestment loss take place?,

- Doubling option/accelerated sinking fund: allow company to redeem twice the amount required by the sinking fund provision

- Chen's question: When and why?

Cash Flow Structure of Coupon Payments

Fixed Rate Coupon Bonds

- Fixed rate coupon bond pays a fixed periodic coupon over a specified time to maturity票息恒定

- e.g. plain vanilla bond/conventional bond

Step-Up Coupon Bonds

- Step-up coupon bond's coupon increases by specified margins at specified dates票息逐步增加

- May have a call option赎回

- If the new higher coupon rate is larger than the market yield of the call price, then the issuer will prefer to call back the bonds

Floating Rate Notes

- Floating-rate notes do not have a fixed coupon, and coupon rate is linked to an external reference rate, such as LIBOR票息随着基准利率浮动

- Coupon rate = reference rate + quoted margin(spread)

- Almost all FRNs have quarterly coupons

- Reference rate reset periodically, quoted margin is usually constant

- Variable-rate note: the spread is not fixed

- Coupon payments are paid in arrears: based on previous period's reference rate以前一期的利率计息

- FRNs may include a floor or (and) a cap

- Floor prevents coupon from falling below a specified minimum rate

- Cap prevents coupon from rising above a specified maximum rate

- When a floating-rate security has both a upper limit (cap) and a lower limit (floor), the feature is called a collar

- Inverse or reverse FRN (inverse floater)与基准利率反向浮动

- Coupon rate = - reference rate + quoted margin

- Leveraged inverse floaters & Deleveraged inverse floaters

Index Linked Bonds

- Index-linked bond's coupon payments are linked to a specific index票息率与某个指数挂钩

- Inflation-linked bonds: coupon payments are linked to a inflation index(CPI,PPI)

- Different structure of inflation-index bonds

- Interest-indexed bonds: coupon rate is adjusted for inflation while the principal value remains unchanged面值不变,票息率随指数浮动

- Capital-indexed bonds: coupon rate remains constant, and principal value is increased by the rate of inflation票息率不变,面值随指数浮动

E.g.Treasury inflation Protected Securities(TIPS)

Benefits the issuer because sets a limit to the interest rate - Index-annuity bonds: fully amortizing with the periodic payments directly adjusted for inflation or deflation

- Indexed zero-coupon bonds: the payment at maturity is adjusted for inflation

- Treasury inflation protection securities (TIPS)

- Principe protected (change with inflation)

- Coupon rate does not change

- Coupon will change (because principal change)

- At maturity:

If adjusted par value (per bond) is greater than$1,000 at maturity, the holder receives the adjusted par value as the maturity payment

If the adjusted par value is less than$1,000, holders receive$1,000 at maturity as this is the minimum repayment amount

Other Coupon Structures

- Deferred coupon bonds / split coupon bonds几期后才能收到票息

- Pays no coupons for its first few years, may pay a higher coupon for the remainder of its life

- Zero-coupon bond can be thought as an extreme form只有本金

Earns interest on an implied basis

- Payment-in-Kind (PIK) coupon bonds实物支付债券

- Payments may be physical assets or financial assets

- Allows the issuer to pay interest in the form of additional amounts of the bond issue rather than as a cash payment

These bonds have higher yields because of a lower perceived credit quality from cash flow shortfalls or high leverage of the issuing firm

- Credit-linked coupon bonds票息率和主体信用状况挂钩

- Coupon changes when the bond's credit rating changes

- Rating decrease leads to high coupon rate, which may result in further deterioration of the credit rating

- Equity-linked notes (ELN)票息率和标的股票价格挂钩

- No periodic interest payments

- Final payment based on the return of an equity index

- Typically principal protected if no default

Can be thought of as a zero-coupon bond plus a call option on the equity index

Bonds with Contingency Provisions

Contingency Provision含权债券

- Contingency provision is the clause that allows for some action if the event or circumstance does occur

- Embedded option

- Contingency provision in indenture for bonds, provide issuers or bondholders the right, but not the obligation, to take some action

1.Callable bonds

2.Putable bonds

3.Convertible bonds

- Contingency provision in indenture for bonds, provide issuers or bondholders the right, but not the obligation, to take some action

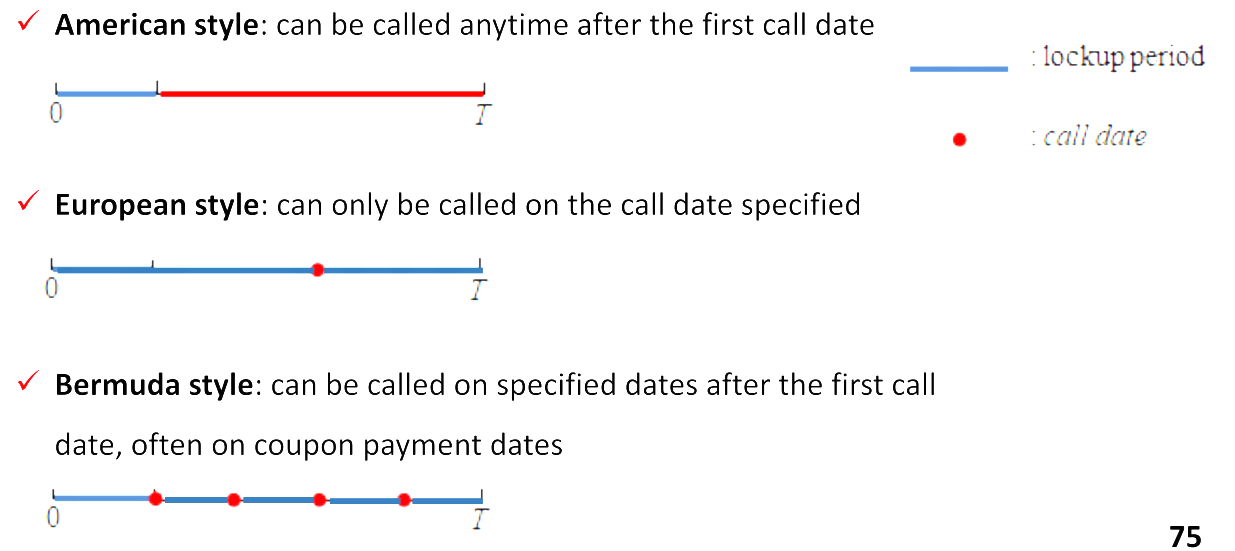

Callable Bond

- Callable bond gives the issuer the right to redeem all or part of the bond before the specified maturity date发行方能提前买回债券

- Call price: the price to redeem the bond赎回价格

Call premium: the amount by which the call price is above par - First par call date: the date at which the issue is first callable at par value

- Call price: the price to redeem the bond赎回价格

- Three styles of exercise for callable bonds

- Call provisions are beneficial to the issuer

- Can protect issuers against decline in interest rate

- Investors face more reinvestment risk

- The callable bond will have higher yield and lower price

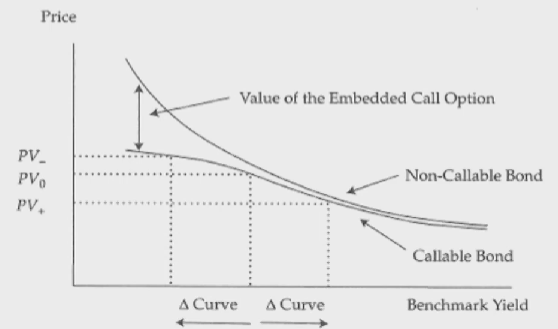

\mathrm{V}_{\text {Callable bond }}=\mathrm{V}_{\text {straight bond }}-\mathrm{V}_{\text {call option }} - The price appreciation of callable bond is limited价格-利率图有上限

Putable Bond

- Putable bond gives the bondholders the right to sell the bond back to the issuer at a pre-determined price on specified dates投资方能提前把债券卖给发行人

- Put price: the price to sell back the bond保底价格

- Put provisions are beneficial to the investors

- Can protect investor against increase in interest rate

- The putable bond will have lower yield and higher price

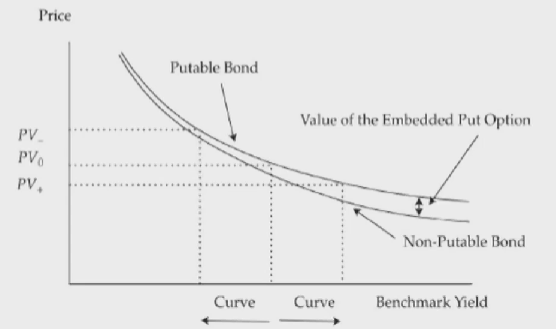

\mathrm{V}_{\text {Putable bond }}=\mathrm{V}_{\text {straight bond }}+\mathrm{V}_{\text {put option }} - Putable bond has a floor feature价格-利率图有底线

Convertible Bond可转换债券

- Convertible bond gives bondholder the right to exchange the bond for a specified number of common shares in issuing company数量对数量转换

- Hybrid security with both debt and equity features

- Conversion provisions are beneficial to bondholder

- If share prices increase, bondholders can exchange the bond for a specific number of shares of issue company

- If share prices decrease, bondholders can still receive coupon and principal payment of the straight bond

- Investors will ask lower yield, and pay higher price

\mathrm{V}_{\text {convertible bond }}=\mathrm{V}_{\text {straight bond }}+\mathrm{V}_{\text {option on equity }}- Conversion ratio: the number of common shares each bond can be converted into

- Conversion price = bond's par value / conversion ratio

- Conversion value = market price of stock × conversion ratio

- Conversion premium = bond price - conversion value

- Conversion parity

- At parity: conversion value = convertible bond's price

- Above parity: conversion value > convertible bond's price

- Below parity: conversion value < convertible bond's price

Callable Convertible Bond

- Callable convertible bond is the convertible bond includes a call provision

- The call option is for issuer, and the convertible option is for bondholder

- Some investors may prefer higher coupons than uncertain dividend, so early conversion may not be the first choice for them

- Callable convertible bond help the issuer to force the bondholders to convert their bonds into common shares before maturity

- Callable convertible bonds have to offer a higher yield and sell at a lower price than otherwise similar non-callable convertible bond,(Chen's Question: What is the pricing formula?)

Contingent convertible bonds或有可转换债券

- It can convert to common equity automatically if a specific event occurs触发特定事件后自动转股

Bond with warrants可分离交易可转换债券

- It entitles the holder to buy the underlying stock of the issuing company at fixed exercise price until expiration date权证可以按约定价兑换股票

- Warrant is an attached option rather than an embedded option债券和权证分离,可以分别交易

- The bondholder can buy the share at the fixed exercise price and still hold the bond权证兑换股票后,债券仍然存在

- The bond with warrants can be more attractive

Fixed-Income Markets

Market Classification

Classification by Type of Issuer

- Government and government-related sector

- Supranational (international) organizations

- Sovereign (national) governments

- Non-sovereign (local) governments

- Quasi-government entities

- Corporate sector

- Financial company

- Non-financial company

- Securitized sector

- securitization

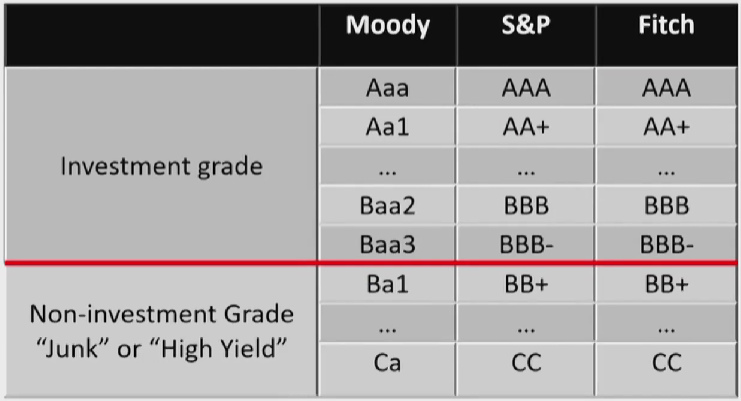

Classification by Credit Quality

- Investment grade

- Baa3 or above by Moody's Investors Service

- BBB-or above by Standard & Poor's(S&P) and Fitch Ratings

- Non-investment grade / high yield

- Below investment grade

Classification by original maturity

- Money market securities

- Capital market securities

Classification by coupon structure

- Fixed-rate bonds

- Floating-rate bonds

- London Interbank Offered Rate (LIBOR) is the most widely used reference rate for floating-rate bonds. It is a group of rates for different currencies and different borrowing periods ranging from overnight to one year

- LIBORs are based on expected rates for unsecured loans from one bank to another in the interbank money market

Primary Market and Secondary Market

Primary bond market

- Markets in which issuers first sell bonds to investor

- Public offering: any member of the public may buy the bonds

- Private placement: only a selected group of investors may buy the bonds

Public offering

- Underwritten offering: the investment bank(underwriter) guarantees the sale of the bond issue at an offering price, and takes the risk associated with selling the bonds

- Syndicated offering:a group, or syndicate, of investment banks underwrite the issuance

- Grey market(“when issued” market):Some bonds are traded prior to the offering date

- buys and resells, earning the spread

- Best efforts offering: the investment bank only serves as a broker and sell the bond issue for a commission

- Auction拍卖:an issuing mechanism that involves bidding and helpful for price discovery

- Commonly used by issuing government debts

- Major in developed bond markets

- Shelf registration上架注册: issuer prepares a single, all-encompassing offering circular that describes a range of future bond issuances, a under the same document

- Issue bond over time when issuer needs to raise funds and save fee

Secondary bond market

- markets in which existing bonds are subsequently traded among investors

- Organized exchange场内

- OTC markets场外

Dealers will post bid and ask price

- Settlement: the process that the bonds are passed to the buyer and payment is received by the seller

- Corporate bonds: third trading day after trade date(T+3)

- Government bonds: the nest trading day after the trade date(T+1)

- Money market securities:on the day of trade date

Government-Related and Corporate Bonds

Sovereign bonds国债

- Issued by national governments and backed by the taxing authority

- Can denominated in local currency or foreign currency

- It is common to observe a higher credit rating for sovereign bonds issued in local currency than for those issued in a foreign currency

- On-the-run最近发行的国债: most recently issued bonds, also referred to as a benchmark issue, more actively traded and more liquid交易更活跃

- Off-the-run不是最近发行的国债: replaced by a more recently auctioned issue

- Market prices of on-the-run issues provide better information about current market yields

- U.S Treasuries: sovereign bonds in the United States

- T-Bills: original maturity is one year or shorter

- T-Notes: original maturity is longer than one year and up to 10 years

- T-Bonds: original maturity is longer than 10 years

Non-sovereign bonds地方债

- issued by government below the national level such as provinces,regions, states, and cities

- GO(general obligation)/Tax-Backed Debt

- Support by taxing power of local government收税权利作为还款保证

- Almost no credit risk

- Revenue Bonds项目债

- Supported only through revenues generated by projects.项目收益作为还款保证

- Involve more risk, provide higher yield

Quasi-government bonds/Agency bonds: Federal Agency Securities

- Federally Related Institutions

- Ginnie Mae

- Government Sponsored Enterprises(GSEs)

- Fannie Mae

- Freddie Mae

Supranational bonds

- issued by supranational agencies (multilateral agencies)

- high credit quality and can be very liquid, especially large issues well-known entities

Corporate Debts

- Bank loans

- Bilateral loan: from a single lender to a single borrower一对一银行贷款

- Syndicated loan: from a group of lender to a single borrower一对多银行贷款

- Commercial paper商业票据

- Short term, unsecured promissory note没有抵押

- Traditionally, the largest and most stable companies issue low-cost commercial paper

- Directly placed (sold directly by issuer) or dealer placed (sold to investor through agents/brokers)

- Reissued or rolled over when it matures

- Source of interim financing for long-term projects长期项目的短期融资

- Corporate notes and bonds期限短,小于一年

- Serial maturity structure可以借新偿旧

- Term maturity structure

- Medium-term notes (MTNs)期限中等

- Various maturities (9 months to 100 years)

Structured Financial Instruments

Basic Features of Structured Financial Instruments

- Represent a broad sector of financial instruments which has a common attribute that they repackage and redistribute risks

- Categories of structured financial instruments

- Asset-backed securities (ABS)

- Collateralized debt obligations(CDOs)

- Capital protected instruments

- Yield enhancement instruments

- Participation instruments

- Leveraged instruments

Capital Protected Instruments

- Capital protected instruments offer full or partial capital protection最大可能保护本金

- Guarantee certificate保证凭证 is an example which is a combination of zero-coupon bond and call option

Investor will receive no less than 100% of the capital invested - Note the protection is only as good as the issuer of the instrument

- Guarantee certificate保证凭证 is an example which is a combination of zero-coupon bond and call option

Yield Enhancement Instruments

- Yield enhancement refers to increasing risk exposure in the hope of realizing a higher expected return保护票息利益

- A credit-linked note(CLN) is an example

- Issuers could transfer the effect of a particular credit event to investors

Participation Instruments

- A participation instrument is one that allows investors to participate in the return of an underlying asset参与到市场,与市场相关

- Floating-rate bond is an example which allow investor to participant in movement of interest rate

- Participation instruments usually do not offer capital protection

- Most participation instruments are designed to give investors indirect exposure to a particular index or asset price

Leveraged Instruments

- Leveraged instruments are created to magnify returns and offer the possibility of high payoffs from small investments有杠杆

- Inverse floater is an example:

- Inverse floater coupon rate = C-(L × R)

- C:maximum coupon rate

- R:the reference rate

- L:leverage

L > 1:leverage inverse floater

1 > L> O:deleveraged inverse floater

Short-Term Funding & Repurchase Agreements

Retail Deposits零售存款

- Demand deposits/Checking accounts活期存款: available to customers on demand, and typically pay no interest随时取款

- Saving accounts定期存款: pay interest but do not offer the same transactional convenience as demand deposits不能提前取款

- Money market account余额宝: offer money market rates of return and depositors can access funds at short or no notice随时取款

- An intermediate between demand deposit and saving accounts for depositor

Short-Term Wholesale Funds批发存款

- Central bank funds中央银行基金

- banks with reserve surplus loan money to banks with reserve shortage找同业借的钱,用来满足准备金要求

- Interbank funds同业借贷

- loans between banks

- Large-denomination negotiable certificates of deposit(NCD可转让存款凭证)主要资金来源

- Negotiable: not penalty if the depositor withdraws funds prior to maturity, can be sold in the open market prior to maturity可转让

- CD represents a specified amount of funds on deposit for a specified maturity and interest rate

Repurchase Agreement(Repo)

- The sale of a security with a simultaneous agreement by the seller to buy it back at an agree-on price (repurchase price) and future date(repurchase date)借钱未来还

- In practical, a repo can be viewed as a collateralized loan实质是有抵押贷款

- Overnight repo: the term is one day

- Term repo: the term is more than one day

- Repo to maturity: the term is until the final maturity date

- Reverse repurchase agreement / Reverse repo逆回购,给钱未来收

- Repo rate: the interest rate implied by two prices相当于利息率, The repo rate is higher when:

- Repo term is longer时间长

- Credit quality of the collateral security is lower抵押弱

- Collateral security is not delivered to the lender抵押物没有实际上的转移

- Collateral security is in low demand or high supply抵押物供给大于需求

- Interest rate for alternative sources of funds are higher整体利率水平高

- Repo margin / haircut抵押物价值超过借的钱,越大说明风险越高

- Negotiated between counterparties在合同里写明

Fixed-Income Valuation

Cash flow discount model

Pricing Bond with a Single Discount Rate

- Bond value is the present value (PV) of the promised cash flows

- If the market price is fair and have no arbitrage opportunity, then the market price should equal to the intrinsic value

- Market discount rate

- discount rate used in the PV calculation

- the required rate of return (required yield) by investors given the risk of the bond investment

\mathrm{P}=\sum_{\mathrm{t}=1}^{\mathrm{n}} \frac{\mathrm{C}_{\mathrm{t}}}{(1+r)^{\mathrm{t}}}+\frac{\mathrm{Par}}{(1+r)^{\mathrm{n}}}

Spot Rates

Spot Rates

- The spot rate is the discount rate of a single future cash flow such as a zero-coupon bond

- Spot rates are also named as zero rates

- Spot rates reflect the yields on zero-coupon bonds

Pricing Bonds with Spot Rates

- Use a sequence of spot rates that correspond to the cash flow dates to calculate the bond price

- A more fundamental approach to pricing bond, and it is the “no-arbitrage price"

\mathrm{P}_0=\mathrm{V}_0=\frac{\mathrm{CPN}_1}{\left(1+\mathrm{S}_1\right)}+\frac{\mathrm{CPN}_2}{\left(1+\mathrm{S}_2\right)^2}+\cdots \cdots+\frac{\mathrm{CPN}_{\mathrm{N}}+\mathrm{Par}}{\left(1+\mathrm{S}_{\mathrm{N}}\right)^{\mathrm{N}}}

- A more fundamental approach to pricing bond, and it is the “no-arbitrage price"

Spot Rate Curve

- The spot rate curve or spot curve is the graph of the relationship between spot rates and maturity

- It reflects the term structure of spot rates

- As the time passes, the spot curve changes continuously

Forward Rates

Forward Rates

- Forward market

- Agreement to the terms for the transaction is on the trade date,but delivery of the security and payment for it is deferred to a future date

- Forward rate is the interest rate on a bond or money market instrument traded in a forward market

- “2y5y” means "the two year into five-year rate”:The first number (2) refers to when to start the forward contract and the second number(5) refers to the tenor第二年开始五年间的年化利率

Relationship between Forward Rates and Spot Rates

- Implied forward rates (IFR, forward yields)

- a break-even reinvestment rate that are calculated from spot rates:

\left(1+z_A\right)^A \times\left(1+I F R_{A, B-A}\right)^{B-A}=\left(1+z_B\right)^B - IFR_{A, B-A} is a forward rate that starts in period A and ends in period B,its tenor is (B -A) periods → “Ay(B-A)y”

- a break-even reinvestment rate that are calculated from spot rates:

Pricing Bonds with Forward Rates

- Forward rates can be used to value a bond in the same manner as spot rates because they are interconnected

- Discount bond cash flows one period by one period with forward rates

\text{bond value}=\frac{C F_1}{\left(1+S_1\right)}+\frac{C F_2}{\left(1+S_1\right)(1+1y1y)}+\ldots \frac{C F_\tau}{\left(1+S_1\right)(1+1y1y) \ldots(1+(T-1) y1y)}

Maturity Structure of Interest Rates

- Spot curve/zero curve

- a sequence of YTMs on zero-coupon bonds

- Forward curve

- a series of forward rates, each having the same tenor

- Yield curve

- the relation between YTMs and maturity

- Par curve

- a sequence of YTMs such that each bond is priced at par value,is obtained from a spot curve

Yield Measures

Yield to Maturity(YTM)

- YTM is the internal rate of return of on the cash flow, it reflects the implied market discount rate

P=\sum_{t=1}^n \frac{P M T_t}{(1+Y T M)^t}+\frac{F}{(1+Y T M)^n}

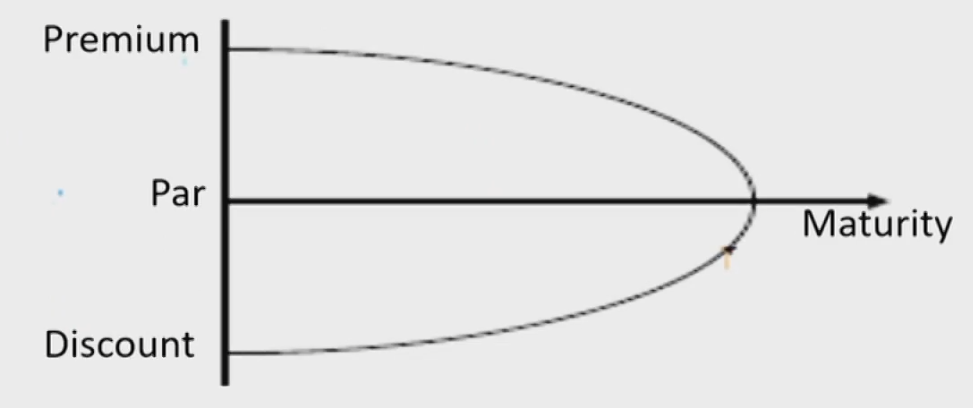

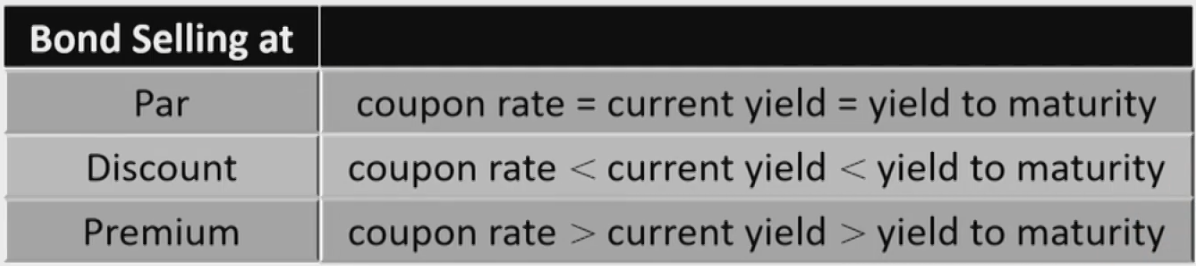

Bond Price and Yield

- A bond's price and YTM are inversely related

- A bond will be priced at a discount (premium) to par value if coupon rate is less (more) than its YTM

- At premium: coupon rate > YTM

- At par: coupon rate = YTM

- At discount: coupon rate < YTM

Tips from Accounting

- Constant-yield price trajectory

- Illustrates the change of bond carrying value over time if the yield keep constant

- "Pull to par" effect: if no default, bond price approaches par value as its time-to maturity approaches zero

Assumptions for YTM

- If the investor's actual return is just equal to YTM, there are three critical assumptions for YTM:

- The issuer makes full and timely coupon and principal payments

- The investor hold the bond until maturity按时足额还本付息

- The investor hold the bond until maturity持有至到期,或者提前以公允价格卖出

- The investor is able to reinvest coupon payments at YTM收到的现金以YTM再投资

Sources of Return

- Receipt of the promised coupon and carrying value of principal payments on the scheduled dates

- Reinvestment of coupon payments

- Potential capital gains or losses资本利得或损失 on the sale of the bond prior to maturity卖出债券

- Capital gain or loss = sales price - carrying value

Yield Measures for Fixed-Rate Bonds

- Yield measures typically are annualized收益率都是年化的

- For bonds maturing in more than one year, yields typically are annualized and compounded期限大于一年用复利年化利率

- Yield on instruments maturing in one year or less typically are annualized but not compounded期限大于一年用普通年化利率

BEY: bond equivalent yield; EAR: effective annual rate

- Street convention yield不考虑节假日等时的理论收益

- the IRR on cash flow assuming the payments are made on the scheduled dates, and neglect weekends and holidays

- True yield考虑节假日等时的理论收益

- the IRR on the cash flows using the actual calendar of weekends and holidays

- True yield never higher than street convention yield比如节假日钱取不出来

Yield Measures for Flioating-Rate Bonds

- Coupon rate = reference rate +/- quoted margin票息率

- Quoted margin: the specified yield spread over the reference rate, that compensate investor for the difference in the credit risk of the issuer and that implied by the reference rate

- Required rate of return = reference rate +/- discount margin要求回报率

- If quoted margin > required margin, FRNs will be priced at premium

- If quoted margin = required margin, FRNs will be priced at par

- If quoted margin < required margin, FRNs will be priced at discount

Yield Measures for Money Market Instruments

- Discount yield(e.g.,commercial paper, T-bills)

P V=F V \times\left(1-\frac{D a y s}{Y e a r} \times D R\right) \quad \mathrm{DR}=\frac{\mathrm{FV}-\mathrm{PV}}{\mathrm{FV}} \times \frac{\text { Year }}{\text { Days }} - Add-on yield (e.g., LIBOR, bank CD rates, Repo rates)

P V=\frac{F V}{\left(1+\frac{D a y s}{Y e a r} \times A O R\right)} \quad \mathrm{AOR}=\frac{F V-P V}{P V} \times \frac{\text { Year }}{\text { Days }} - Equivalent yield

\mathrm{BEY}=\frac{\mathrm{FV}-\mathrm{PV}}{\mathrm{PV}} \times \frac{365}{\text { Days }}

Other Yield Measures

- Current yield (income or interest yield)当期收益率

- the sum of the coupon payments分子是票息 received over the year divided by the flat price分母是不包括应计利息的价格

- Example: the current yield of a 2% semiannual coupon bond priced at 95 is:2/95= 2.11%

- Simple yield

- the sum of annul coupon payment plus straight-line amortization分子还考虑本金的直线摊销 of discount or premium, divided by the flat price

- Par bond coupon rate / Par rate

- the coupon rates for bonds of various maturities that would result in bond prices equal to their par values使得债券面值等于价值的票息率

\begin{aligned} & \text { Par }=\mathrm{PMT} /\left(1+Z_1\right)+\ldots \ldots .+(\mathrm{PMT}+\mathrm{Par}) /\left(1+Z_n\right)^n \\ & \rightarrow \text { Par rate }=\mathrm{PMT} / \text { Par }\end{aligned} - a sequence of YTMs such that each bond is priced at par value

- the coupon rates for bonds of various maturities that would result in bond prices equal to their par values使得债券面值等于价值的票息率

- Yield to call

- the IRR on cash flows assuming the embedded call option is exercised在不同日期行权时,含权债券的收益率。此时FV是约定的价值

- Yield to first call, Yield to second call在第一个或第二个行权日行权时,含权债券的收益率

- Yield to worst: the lowest of the sequence of yields-to-call and the yield-to-maturity计算所有行权情况得到的最小的YTC

Quote Conventions

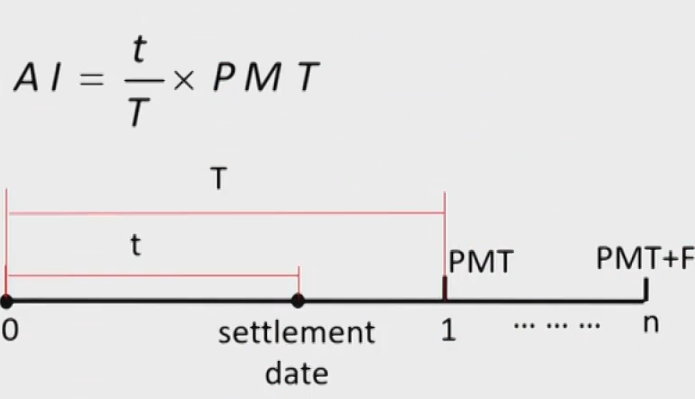

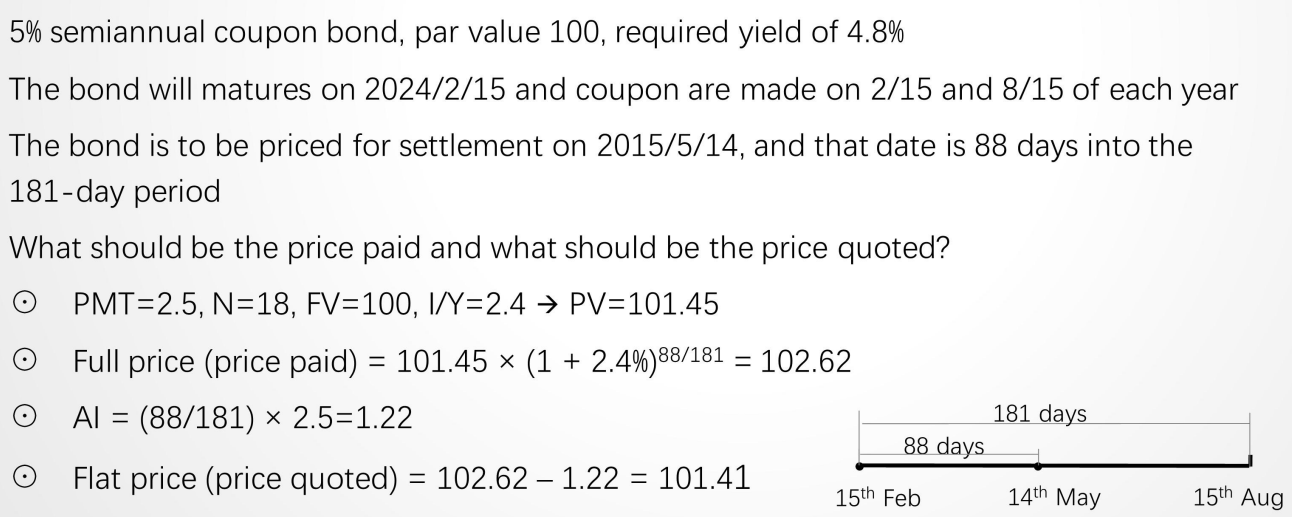

Accrued Interest

- the interest received by the seller when a bond trades between coupon dates

Clean Price and Dirty Price

- Clean Price/Flat Price

- the agreed upon price of the bond报价

- Dirty Price/Full Price

- the amount that the buyer pays to the seller, which equals the clean price plus any accrued interest交割价

- Full Price = Clean Price + Accrued Interest

- 折现到前一期

- 复利到现在(全价)

- 减去应计利息(净价)

Conventions for Quote

- Bond dealers usually quote flat price while the full price will be paid,and there can be a difference between them

- Conventions to count days: actual/ actual and 30/ 360

- Vary from market to market

- actual / actual is most common for government bonds

- 30/ 360 is often used on corporate bonds

Matrix Pricing

Matrix Pricing

- Matrix pricing is commonly used for bonds inactively-traded or not yet issued无法确定YTM

- Estimate the market discount rate and price based on the price of more frequently traded comparable bonds用类似债券的折现率代替

- Comparable bonds: similar times-to-maturity, coupon rates, and credit quality (totally, similar risk)

- Linear interpolation can be used when the maturities between the valued bond and the traded bond are different如果没有相同期限的数据,用线性插值确定该期限的YTM

- Matrix pricing may also be used to estimate the yield spread over the benchmark rate

- Benchmark rate is typically the yield-to-maturity on a government bond having the same, or close to the same, time-to-maturity

Yield Spread

Nominal Spread点变化

- Nominal spread is the difference in yield between different bonds Yield spread over benchmark: difference in yield between bonds and benchmark rates

- G-spread

yield spread over an actual or interpolated government bond公司债和国债YTM的差 - I-spread

yield spread of a specific bond over the standard swap rate in that currency of the same tenor公司债和swap rate的差

- G-spread

Z-Spread线变化

- Zero volatility spread (Z-spread, static spread)

- a constant yield spread over a government spot curve公司债和国债spot rate的差

- Implied assumption: the yield curve makes a parallel shift

P V=\frac{P M T}{\left(1+z_1+Z\right)^1}+ \frac{P M T}{\left(1+z_2+Z\right)^2}+\ldots .+\frac{P M T+F V}{\left(1+z_N+Z\right)^N}

Option-Adjusted Spread二叉树变化

- Option-adjusted spread (OAS)

- yield spread that remove the influence of embedded option移除内置期权的影响

- G-spread/I-spread/Z-spread

Credit risk

Liquidity risk

Option risk - OAS

Credit risk

Liquidity risk

- OAS = Z-spread - Option value(%)

- Callable bond → option value > 0 → OAS < Z-spread

- Putable bond → option value < 0 → OAS > Z-spread

Asset-Backed Securities

Securitization

Introduction of ABS

- Asset-backed security(ABS)

- Securities backed or collateralized by a pool of assets

- Securitized assets: assets used to create ABS, including mortgage loans, automobile loans, and receivables

- Mortgage-backed security(MBS)

- MBS is an asset-backed security, but often refers to securities backed by high-quality real estate mortgages

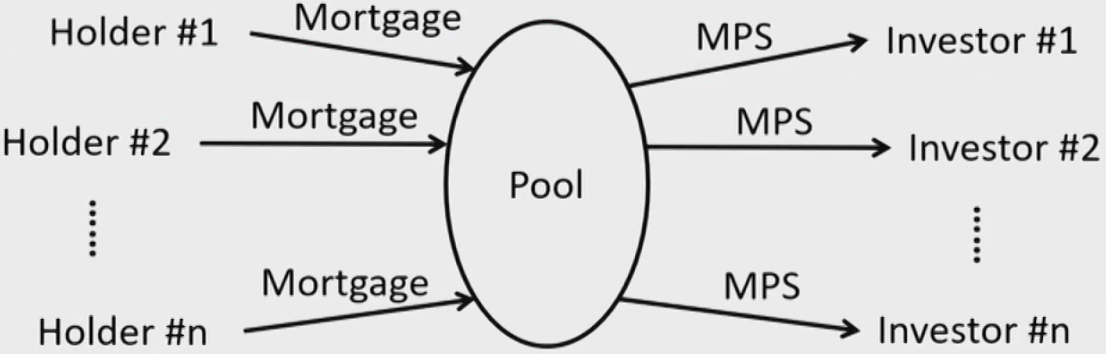

Securitization Process

- Move assets from the owner of the assets into a special purpose vehicle(SPV, SPE, SPC), then issue ABS backed by cash flows of the assets

- SPV buys the assets and issues ABS, and is a bankruptcy-remote vehicle破产隔离功能,银行不再受影响

- SPV plays a pivotal role in the securitization process in terms of protecting the rights of creditors investing in ABS

- Issuer/SPV

- Make issuance of the asset-backed securities

- Originator/Depositor

- Sold the collateral to Issuer

- Servicer

- Collect and distruibute payments

- Recovery of underlying assets

- Underwriter

- Sell securities to investor

- Sell securities to investor

Benefits of Securitization

- Due to disintermediation脱媒

- Lower funding cost of borrowers降低成本

- Enhance the risk-adjusted return of investors投资者有不同的风险旋转

- Increase the liquidity of financial asset提高流动性

- Increases the funds available for banks to lend

- Allows investors to achieve better legal claims on the underlying

- Allows investors to access asset classes matching their risk, return, and maturity profiles that are otherwise not directly available (Tranching)

Mortgage Loans

- Loan secured by the specified real estate property that obliges the borrower to make a predetermined series of payments to the lender

- Foreclosure丧失赎回权: allow the lender to take possession of the mortgaged property and then sell it in order to recover funds if the borrower defaults银行可以在断供后处置房产

- Loan-to-value ratio(LTV)

- the ratio of the amount of the mortgage to the property's value

- Lower LT → more borrowers'equity → less likely to default → more protection for the lender

- The interest rate on a mortgage loan is called the mortgage rate or contract rate房贷利率

- Fixed rate: the mortgage rate remains the same during the life of the mortgage

- Adjustable or variable rate: the mortgage rate is reset periodically

- Initial period fixed rate: mortgage rate is fixed for some initial period and is then adjusted

- Amortizing loans等额还债: the amortization of a loan means the gradual reduction of the amount borrowed over time

- Fully amortizing loan, the sum of all the scheduled principal repayments during the mortgage's life is such that when the last mortgage payment is made, the loan is fully repaid

- Partially amortizing loan, the sum of all the scheduled principal repayments is less than the amount borrowed (last payment called balloon)

- Interest-only mortgage:no scheduled principal repayment is specific for a certain number of years

- Prepayment option提前还款权利

- entitle the borrower to prepay all or part of the outstanding mortgage principal prior to the scheduled due date that the principal must be repaid允许多还按揭,使得贷款中本金减少,未来利息减少

- Prepayment penalty: stipulate monetary penalty when a borrower prepays within a certain time period

- Prepayment risk提前还款风险

- the uncertainty that the cash flows will be different from the scheduled cash flows due to the borrowers' prepayment

- Recourse loan有追索权

- The lender has a claim against the borrower for the shortfall between the outstanding balance and the proceeds received from the sale of the property如果资不抵债,银行可以继续讨债

- Less likely to default

- Non-recourse loan

- The lender cannot claim borrower's personal assets except for collateral property房产资不抵债,银行也无权要求补齐差额

- More likely to default

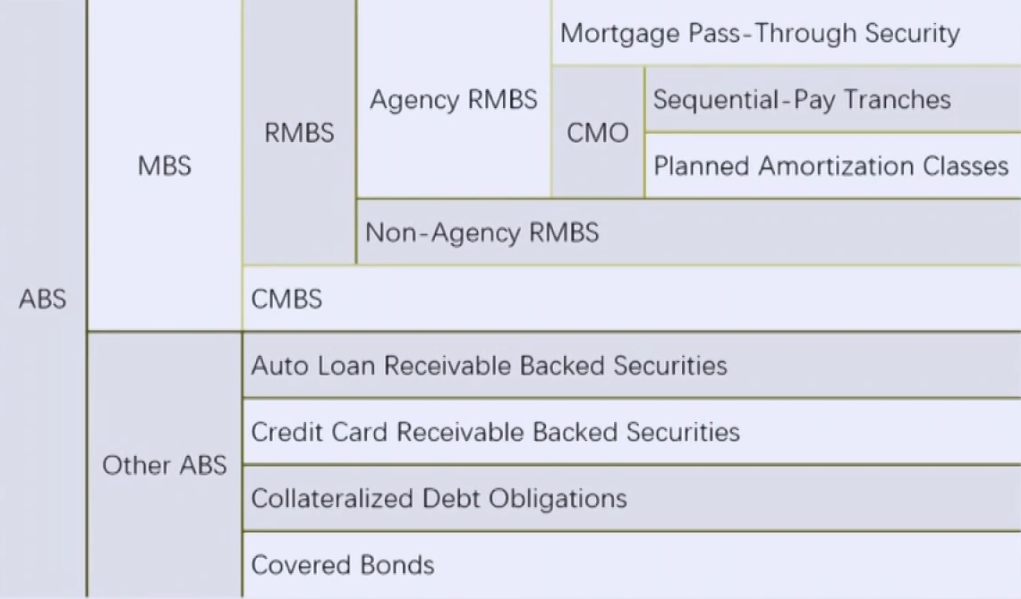

Classification of ABS

Residential MBS(RMBS)个人住房抵押贷款支持证券

- RMBS are backed by a pool of residential mortgage loans满足住宿需求

- Agency RMBS没有信用风险: guaranteed by a federal agency(Ginnie Mae) or by either of the two government-sponsored enterprises(GSE, i.e. Fannie Mae and Freddie Mac)

Ginnie Mae carry the full faith of U.S government

The two GSEs do not carry the full faith of US government, but are considered with high credit quality - Non-agency RMBS有信用风险: issued by private entities and are not guaranteed by a federal agency or a GSE

Maximum size of the loan

Maximum loan-to-value ratio

Loan documentation and insurance required

- Agency RMBS没有信用风险: guaranteed by a federal agency(Ginnie Mae) or by either of the two government-sponsored enterprises(GSE, i.e. Fannie Mae and Freddie Mac)

- Non-conforming mortgage

- Loans that fail to satisfy the underwriting standards

Non-Agency RMBS

- In order to obtain a favorable credit rating, non-agency RMBS often require one or more credit enhancements

- Internal credit enhancements信用增强

- Senior/subordinated structures

- Reserve funds: cash reserve or excess spread account

- Overcollateralization

- External Credit Enhancements

- Financial guarantee by a third party

Structuring of Non-Agency RMBS

- Redistribute the risk of mortgage-related products to different bond classes or tranches

- Time tranching: redistribute the prepayment risk associated with the collateral应对提前还款风险

- Credit tranching: redistribute the credit risk应对违约风险,如waterfall

- "Structuring" can not eliminate risk but redistribute risk只是重新分配给不同目的的投资者,总风险还是一样

- senior / subordinated structure → the prepayment happens, and junior tranche absorb the prepayments → the balance of junior tranche reduces → the credit protection to senior tranche reduces

- Shifting interest mechanism is a method for maintain high credit of protected tranches

- The mechanism will suspends payments to subordinated tranches if credit quality of senior is decreased

- The mechanism can be effectively used to maintain the desired level of credit risk protection, it comes at the expense of increase prepayment risk for the senior tranches

- Conforming mortgage

- Loans that satisfy the underwriting standards for inclusion as collateral for an agency RMBS

Commercial MBS(CMBS)商业住房抵押贷款支持证券

- CMBS are backed by a pool of commercial mortgage loans on income producing property贷款用于商业房产开发

- Commercial mortgage loans are typically non-recourse没有追索权 loans, and the lender will face credit risk

- Measures of credit quality:

Loan-to-value ratio, the lower the better控制贷款金额,要求足够的抵质押物

Debt service coverage ratio(DSC): net operating income(NOI,相当于盈利能力)/ debt service, the higher the better现金流还债能力,越大越好

- CMBS investors have considerable call protection尽量不让贷款人行使提前还款权利,因此提前还款风险小, which differs from RMBS and results in CMBS trading more like corporate bond和公司债类似

- Prepayment lockout如初期不允许提前还款

- Defeasance让贷款人买国债,票息用于还债,减少提前还款的必要性

- Prepayment penalty points提前还款惩罚,一般越早越严

- Yield maintenance charges提前还款的惩罚等于提前还款收益

- CMBS investors may face "balloon risk" because many commercial mortgages are balloon loans贷款人最后一期还款压力大导致风险

- The borrower may not able to make the balloon payment due to failure to refinance or sell the property to generate sufficient funds

- Those tranches with a higher priority will have a higher credit rating because loans defaults will first affect the lower tranches

- The lender will be forced to extend the term of the loan. So, the balloon risk is also referred to as extension risk for CMBS贷款展期导致对应的CMBS也展期

Mortgage pass-through security(MPS)抵押转手债券

- A security created when one or more holders of mortgages form a pool of mortgages and sell shares or participation certificates in the pool收益风险都转给下一家(投资者)

- Waterfall: the structure adopted in a securitization transaction

- Weighted average coupon rate(WAC)平均贷款利率,银行收到的利率

- weighting the mortgage rate of each mortgage loan in the pool

- Pass-through rate(net interest, net coupon)银行给投资者的利率,小于平均贷款利率

- the coupon rate that investors receive

- Mortgage rate on the underlying pool less the service and insurance fee

- Weighted average maturity(WAM)贷款平均到期时间,到期后贷款几乎还完

- weighting the remaining number of months to maturity for each mortgage loan in the pool

- Weighted average life(WAL)产品期限,小于贷款平均到期时间

- The convention-based average time to receipt of all principal repayments(scheduled principal repayments and projected prepayments)

- Gives investors an indication of how long they can expect to hold the MBS before it is paid off

Prepayment提前还款

- The scheduled reduction of outstanding principal is referred to as scheduled amortization

- A borrower can pay an amount in excess of the monthly required payment, which is called prepayments

- The ability of the borrower to prepay results in prepayment risk

- Prepayments reduce the amount of interest the lender receives over the life of the mortgage and cause the principal to be repaid sooner以后收到的利息少

- The reinvest return for the MBS investor may be lower市场利率低时倾向于提前还款,导致收款人面临再投资风险

Measurement of Prepayment Rate

- Single monthly mortality rate(SMM)

- A monthly measure of prepayment rate月度提前还款率

- Conditional prepayment rate(CPR)

- Corresponding annualized rate of prepayment rate年度提前还款率

- A CPR of 6% means that approximately 6% of the outstanding mortgage balance at the beginning of the year is expected to be prepaid by the end of the year

- \mathrm{SMM}=1-(1-\mathrm{CPR})^{1/12}

- Monthly prepayment月度提前还款金额 = SMM ×(mortgage balance剩余本金 - scheduled principal payment原计划偿还本金)

- 还的利息不变

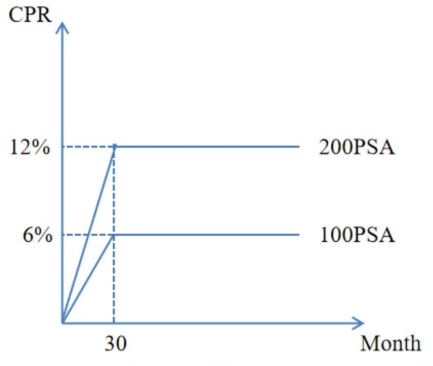

- PSA prepayment benchmark

- A monthly series of CPRs by Public Security Association (PSA), assuming prepayment rates are low for newly originated mortgages and then speed up as the mortgages become seasoned

- The benchmark is said to be "100 PSA":CPR increases by 0.2% per month up to 30 months

- Slower or faster rates are referred to as some percentage of PSA

Factors Affecting Prepayments

- Prevailing mortgage rates整体利率水平

- Spread between current mortgage rates and original mortgage rates

Most important factor

When rates fall, refinancing increases市场利率下降,倾向于提前还款 - Path of mortgage rates不仅受当前利率影响,还要分析利率的历史情况

refinancing burnout比如之前出现利率大幅下降,已经有很多人提前还款,导致这次利率下降的提前还款少

Know as path dependence路径依赖

Implication: Cannot value MBS with the binomial model不能用二叉树给MBS估值

- Spread between current mortgage rates and original mortgage rates

- Housing turnover房子周转率

- Increases as rates fall市场利率低,房子周转快

Housing becomes more affordable

More refinancing/prepayments - Increases as economic activity rises经济好转,房子周转快

Personal income increases → more refinancing/prepayments

- Increases as rates fall市场利率低,房子周转快

- Characteristics of underlying mortgages贷款本身特征

- Seasoning已经还了多久: Prepayments increase as loans season(modeled by PSA)越久越想提前还款

- Property location房子所在地区: Prepayments are faster in some locations, slower in others

Prepayment Risk

- Contraction risk缩期风险: when interest rates decline, the security will have a shorter maturity because home owners refinance at now- available lower interest rates

- 约定30年,预测26年,实际比26年还短

- Extension risk扩期风险: when interest rates rise, fewer prepayments will occur, and the security becomes longer maturity

- 约定30年,预测26年,实际比26年还长,但不超过30年(违约)

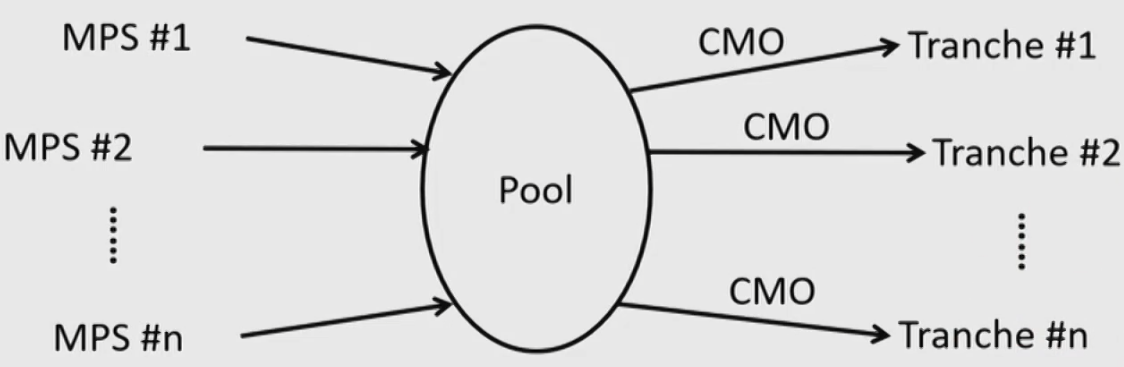

Collateralized Mortgage Obligations(CMO)担保抵押债券

- Securities that redistribute重新分配 the cash flows of mortgage-related products to various tranches

2. Backed by mortgage pass-through security(MPS)从pass-through改进而来,重新分配现金流和两种风险,投资者可以选择特定风险

Sequential-Pay Tranches顺序支付型CMO

- Sequential-pay tranches: each class of bond(the tranches)would be retired sequentially

- both tranches receive interest payments at a specified coupon rate评分收到的利息

- all principal payments are directed to Tranche A until it is completely amortized本金最先给到最上层

- principal payments would then accrue to Tranche B until it was fully amortized and the underlying pool was exhausted某一层本金还完,该层投资者出局,开始还下一层

- Z-tranche or accrual tranche

- last tranche to receive principal

- does not receive current interest until the other tranches have been paid off

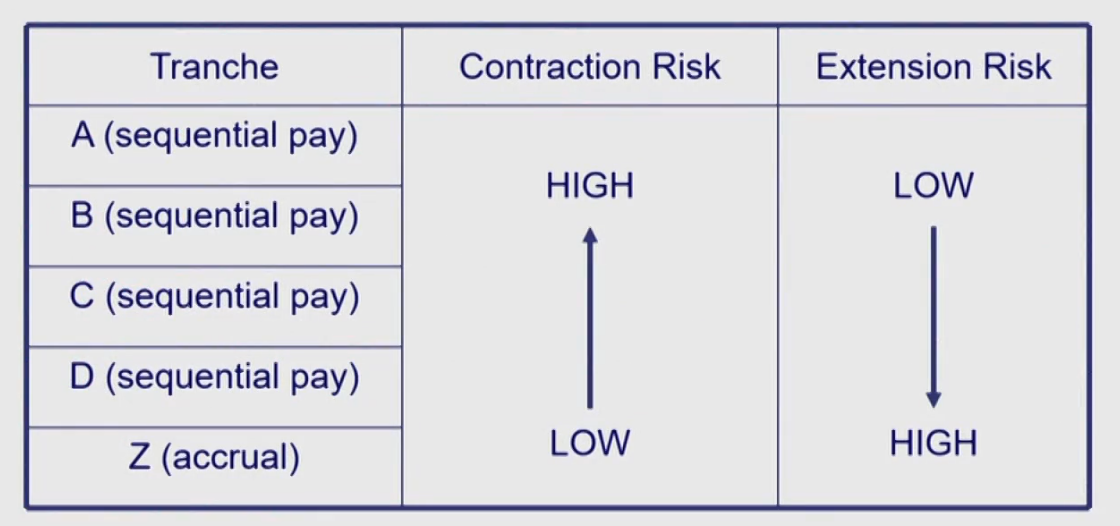

- Contraction and extension risk still exist with this structure, but they have been redistributed to between the tranches总风险不变,只是差异化地分配给不同层

- The short tranches, which matures first, offer more protection against extension risk

- The long tranches provide relatively more protection against contraction risk

- Z-tranche has little contraction risk, but with the highest extension risk

- Each sequential pay CMO tranche has mix of contraction and extension risk

Planned Amortization Class Tranches计划摊销型CMO

- Planned amortization class(PAC) tranches offer greater predictability of the cash flows as long as the prepayment rate is within a specified band(collar)在一定范围内为上层规避提前还款风险

- Have limited(but not complete) protection against both extension risk and contraction risk几乎能让投资者不会受到提前还款风险

- If the prepayment rate belongs to the collar, the PAC tranche would receive the payments as scheduled有稳定的预期现金流

- Support tranches/companion tranches absorb the prepayment risk first, and expose investors to greater prepayment risk下层给上层提供保护

- The certainty of PAC bond cash flow comes at the expense of increased risk to the support tranches下层面临更大的风险,现金流更加不确定,更容易出局

- When prepayment speeds fall and prepayments decrease, the support tranche has significantly more extension risk

- When prepayment speeds rise and prepayments increase, the support tranche has significantly more contraction risk

- The extent of prepayment risk protection provided by a support tranche increases as its par value increases relative to its associated PAC tranche底层的总价值越大,给上层的缓冲能力越强

- PAC II tranche

- The support tranche for a PACI tranche that has a PAC schedule of principal repayments

- PAC II tranches have higher prepayment risk(and average life variability) than PACI tranches

- But PAC II tranches have more prepayment protection (and less average life variability) than support tranches

- PAC/support structure: Redistributes contraction and extension risk

Floating-Rate Tranches

- Floating-rate tranches are constructed by a floater and an inverse floater combination from any of the fixed-rate tranches in a CMO structure

- 传给投资者的收益随标的物变动,投资者可以选择购买正向或反向变动的那部分

Other ABS

Auto Loan Receivable-Backed Securities

- Backed by auto loan and lease receivables贷款来源不是房子而是车

- The cash flows consist of regularly scheduled monthly loan payments(interest payment and scheduled principal repayments) and any prepayments也有提前还款风险

- Refinancing is not a major factor contributing to prepayment利率变动不是提前还款的主要原因

- Prepayment is more predictable and less dependent on interest rate change周转率是主要原因,比如车子撞报废于是提前还款

- All have some form of credit enhancement, often a senior/subordinated structure

- First line of loss protection:excess spread account

Credit Card Receivable-Backed Securities

- Backed by credit card receivables贷款来源不是房子而是信用卡

- The cash flows consist of finance charges罚息 collected, fees手续费, and principal本金 repayments

- Are non-amortizing loans with lockout period, during which the principal is reinvested and only finance charges collected and fees is paid to investors不是等额,并且不能提前还本金,收入是各种费用

- Principal cash flows can be altered only when early amortization provision is triggered触发提前摊销准备金后才能动本金,在这之前银行会用本金投资

Collateralized Debt Obligation

- A generic term to describe a security backed by a diversified pool of one or more debt obligations

- Collateralized bond obligation (CBO)

U.S. domestic high-yield corporate bonds

Structured financial products

Emerging market bonds - Collateralized loan obligation(CLO)

Bankloans

Special situation loans and distressed debt

- Collateralized bond obligation (CBO)

- Collateralized Debt Obligation CDO requires a collateral manager to buy and sell debt obligations for and from the CDO portfolio of assets to generate sufficient cash flows由经理打理资产池,确保给投资者稳定现金流

- Structure of a CDO includes senior, mezzanine, and subordinated/equity bond classes

- In typical structure, one or more of the tranches is a floating-rate security

- Asset manager uses interest rate swap to deal with the mismatch

- When fails pre-specified risk tests: deleveraged by reducing the senior bond class

Covered Bonds

- Covered bonds are senior debt obligations issued by a financial institution and backed by a segregated pool of assets that typically consist of commercial or residential mortgages or public sector assets

- Covered bonds are similar to ABS, but offer bondholders dual recourse to both the issuing financial institution and the underlying asset pool银行对投资者提供双重保证,池子出事了银行也可以直接给投资者发钱

- Redemption regimes exist to align the covered bond's cash flows as closely as possible with the original maturity schedule in the event of default of a covered bond's financial sponsor

- If payments from hard-bullet covered bonds do not occur according to the original schedule, a bond default is triggered and bond payments are accelerated

- Soft-bullet covered bonds delay the bond default and payment acceleration of bond cash flows until a new final maturity date

- Conditional pass-through covered bonds convert to pass-through securities after the original maturity date if all bond payments have not yet been made

Fixed Income Risk and Return

Interest Rate Risk

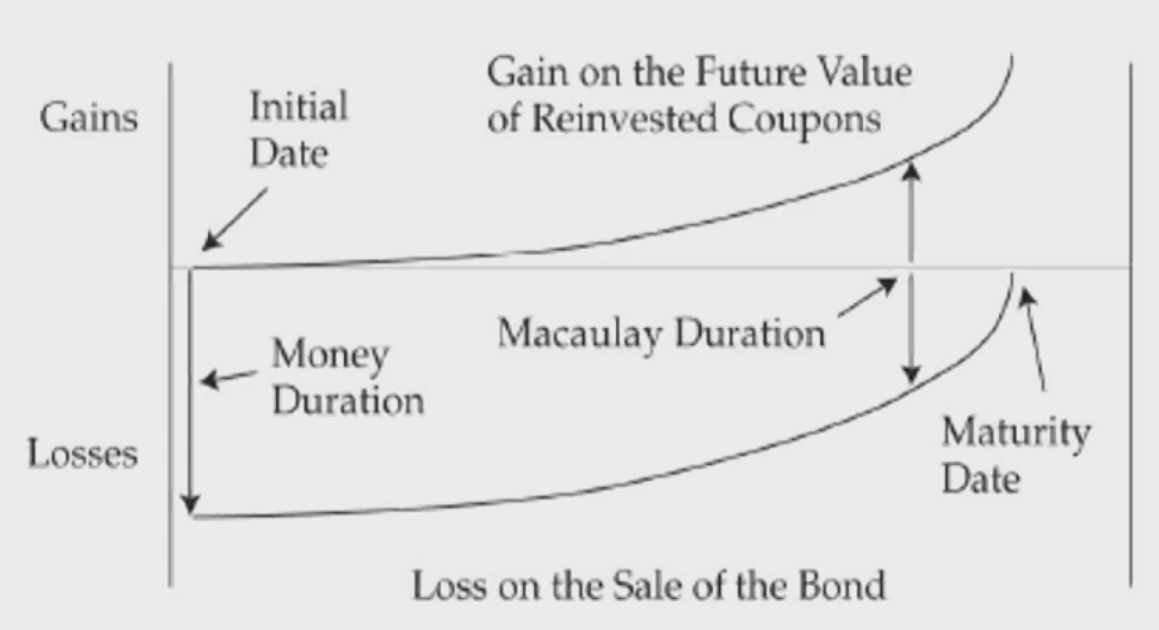

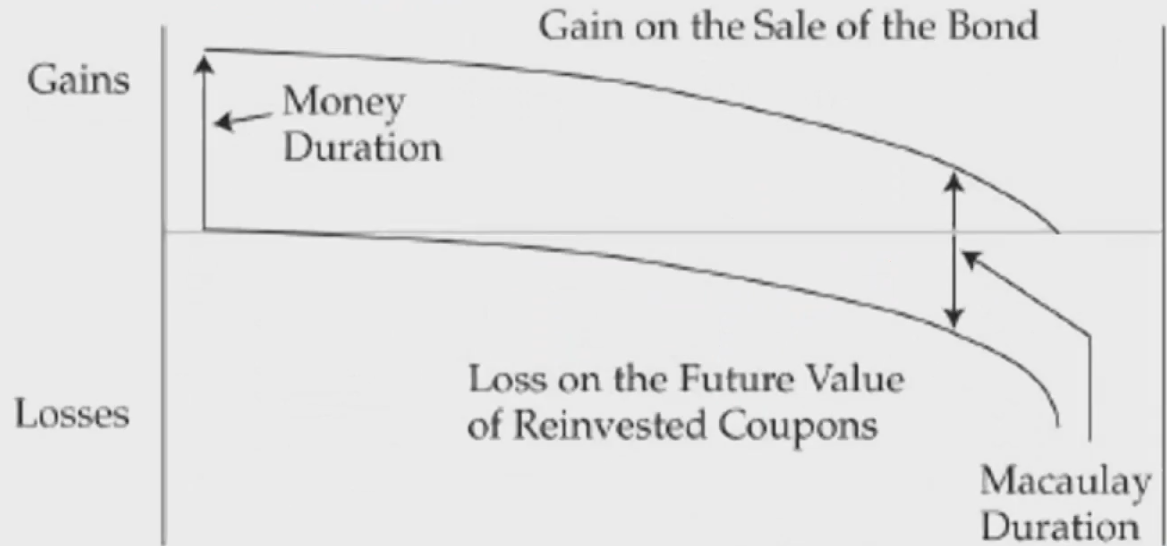

- Interest rate risk on fixed-rate bond investment is the risk that interest will change which affects the reinvestment of coupon payment and the market price if the bond is sold prior to maturity

- Coupon reinvestment risk: uncertainty about income from reinvesting coupon payments

- Increase when interest rates go up

- Decrease when interest rates go down

- Market price risk: uncertainty about bond price

- Decrease when interest rates go up

- Increase when interest rates go down

- Two investors holding the same bond (or bond portfolio) can have different exposures to interest rate risk if they have different investment horizons持有债券多久时间后卖掉债券

- Market price risk matters more, when the investor has a short-term investment horizon.持有时间长,受再投资风险大

- Horizon yield is negatively related with interest rates

- Coupon reinvestment risk matters more, when the investor has a long-term investment horizon.持有时间短,受价格变动风险大

- Horizon yield is positively related with interest rates

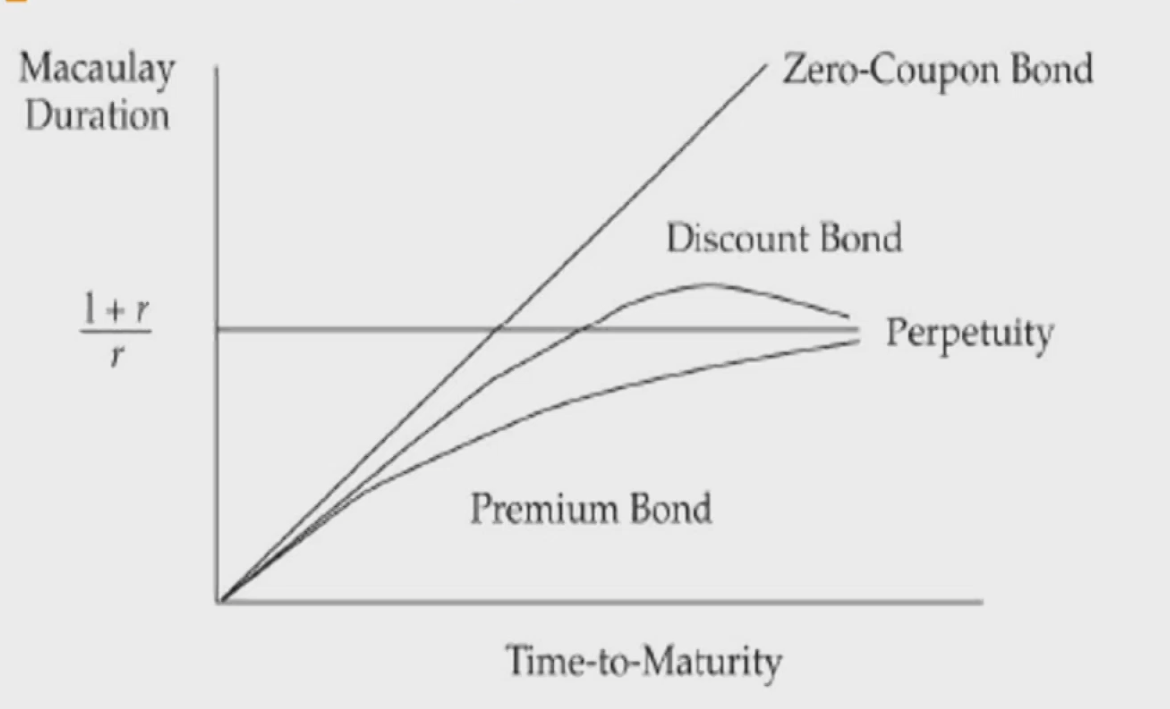

Macaulay Duration

Macaulay Duration

- Macaulay duration is the weighted average time to receipt of the bond's promised payments, where the weights are the shares of the full price that correspond to each of the bond's promised future payments现金的平均回流时间

MacDur=\frac{\sum_{t=1}^n t \times \text { PVCF }_t}{\sum \text { PVCF }_t} - MacDur is measured in terms of time periods

- Macaulay duration reflects the investment horizon for which coupon reinvestment risk and market price risk offset each other

- Assumption: There is a one-time "parallel shift" in the yield curve that occurs before the next coupon payment date

Interest Rate Risk & Investment Horizon

- When interest rates rise:

- When interest rates fall:

Duration Gap

- Duration gap is bond's Macaulay duration minus investment horizon

- When duration gap < 0

- reinvestment risk dominates market price risk

- When duration gap = 0

- reinvestment risk offsets market price risk

- When duration gap > 0

- market price risk dominates reinvestment risk

Modified Duration

- Modified duration is a formula that expresses the measurable change in the value of a security in response to a change in interest rates

ModDur=\frac{MacDur}{1+年收益率/年付息次数}- Modified duration is used to determine the percent change of a bond's price when there is a 100-basis-point (1 percent) change in its YTM收益率变动1%,债券价格变动的百分比

- Modified duration follows the concept that interest rates (YTM) and bond prices move in opposite directions

- ModDur provides linear estimate of the percentage price change for a bond given a change in its YTM

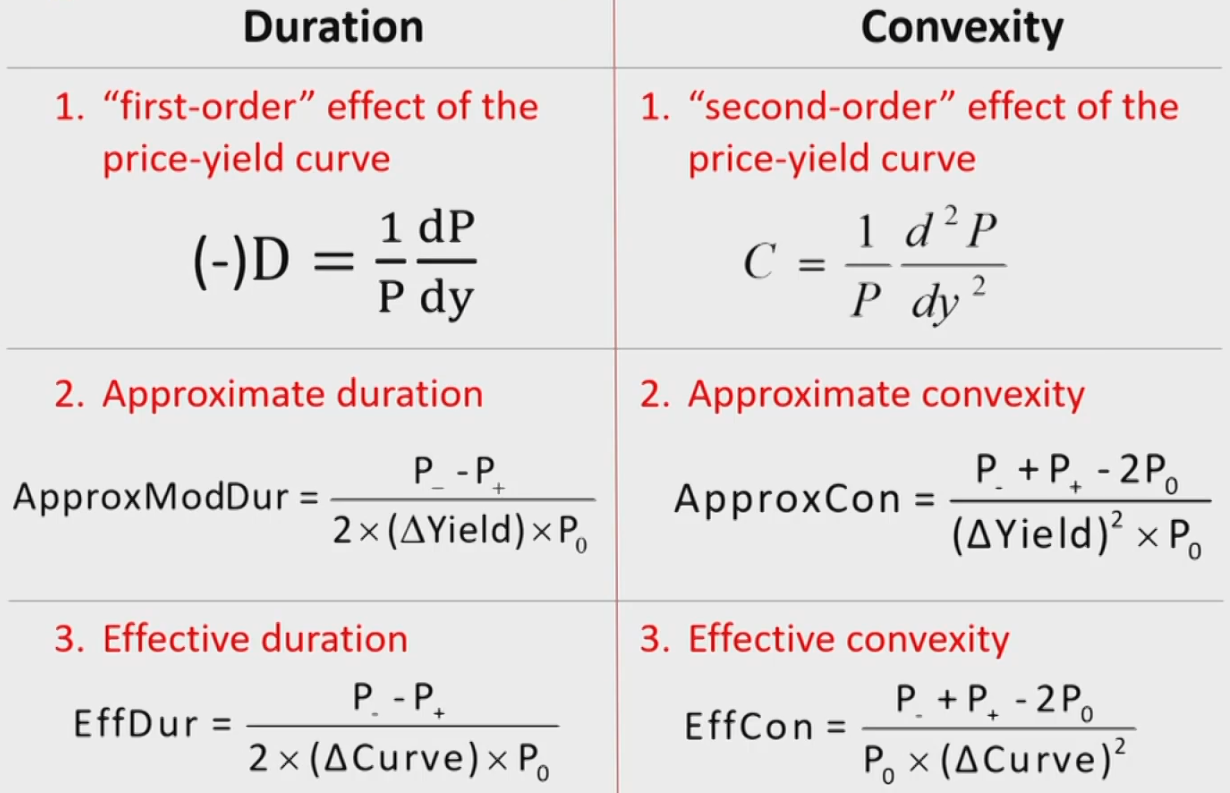

\% \Delta Price \approx -ModDur \times \Delta Yield - Approximate modified duration: an alternative approach to calculate modified duration

ApproxModDur=\frac{P_{-}-P_{+}}{2\times\Delta\text{Yield}\times P_0}

Properties of Duration

- Longer time-to-maturity usually leads to higher duration

- Higher coupon rate leads to lower duration

- Higher yield-to-maturity leads to lower duration

Term Structure of Yield Volatility

- The relationship between the volatility of bond YTM and time-to-maturity

- Longer term bond yields often tend to be less volatile长期债券价格波动率往往小一些

- resulting form a downward-sloping term structure of yield volatility因为短期利率波动性大,长期利率波动性小

- The bond price changes are products of two factors:

- the impact from the change in the YTM

- the number of basis points in the YTM

- Shorter-term bond may have more price volatility than a longer-terp bond because of higher yield volatility

Bond Portfolio Duration

- Two methods to calculates the portfolio duration:

- Method 1: "as a whole"

- Theoretically correct but difficult to use in practice

- Method 2: the weighted average of the individual bond durations

- Portfolio duration = w1D1 + w2D2 + ... + wnDn

- Limitations: implicitly assume a parallel shift in the yield curve必须是平行移动

Dollar Duration

Money Duration / Dollar Duration

- Money duration/dollar duration is a measure of the price change in units of currency given a change in its YTM收益率变动1%,债券价格变动多少

Price Value of a Basis Point

- Price value of a basis point(PVBp, DV01) is the money change in full price of a bond when its YTM changes by one basis point(0.01%)

- P V B P=P \times D \times0.01\%

- P V B P=\frac{P_{-}-P_{+}}{2}

P_{-} and P_{+} are the full prices calculated by decreasing and increasing the YTM by 1BP

Effective Duration

- Effective duration reflects the sensitivity of bond's price to a change in a benchmark yield curve收益率曲线平移1%,债券价格变动的百分比

EffDur=\frac{P_{-}-P_{+}}{2\times\Delta \text { Curve }\times P_0} - Measures interest rate risk in terms of a parallel shift in the benchmark yield curve

- Used for bonds with embedded option due to uncertain future cash flowand absence of well-defined YTM含权债券应当使用有效久期

Key Rate Duration / Partial Duration

- Key rate duration is a measure of a bond's sensitivity to a change in the benchmark yield curve at a specific maturity segment收益率曲线某个点变动1%,债券价格变动的百分比

- Useful to identify "shaping risk" for a bond

e.g., the yield curve becoming steeper or flatter - Useful to measure bond's sensitivity to nonparallel shift of the benchmark yield curve非平行移动

- Useful to identify "shaping risk" for a bond

Analytical Duration and Empirical Duration

- The approach taken before to estimate duration using mathematical formulas is often referred to as analytical duration

- Empirical duration uses historical data in statistical models that incorporate various factors affecting bond prices

- Analysts must consider the correlation between benchmark yields and credit spreads when deciding whether to use empirical or analytical duration estimates

- For a government bond with little or no credit risk, we would expect analytical and empirical duration to be similar because benchmark yield changes largely drive bond prices

- Interactions between benchmark yield changes and spreads would tend to offset each other, particularly during stressed market conditions, making empirical duration significantly lower than analytical duration

Convexity

Benefits of greater convexity

- The more convex bond outperforms the less convex bond in both bull (rising price) and bear (falling price)markets凸度大有优势,价格高

- For the same decrease in YTM, the more convex bond appreciates more in price

- For the same increase in YTM, the more convex bond depreciates less in price

- If the positive attribute is priced in, the more convex bond would have a higher price and a lower YTM

\% \Delta Price^{\text {Full }} \approx[-ModDur\times \Delta Yield ]+[\frac{1}{2} \times Con \times \Delta Yield^2]

Credit and Liquidity Spread

- The YTM on a corporate bond is composed of a government benchmark yield and a spread over that benchmark

- A change in the bond's YTM can originate in either component or a combination of the two

- Bond's spread has two major components

- Premium for credit risk

- Premium for lack of liquidity

- The impact on a bond's value of a change in spread:

\% \Delta Price^{\text {Full }} \approx[-ModDur\times \Delta Spread]+\left[\frac{1}{2} \times Con \times \Delta Spread^2\right]

Illustration

- Money duration

- \text { MoneyDur = ModDur } \times \text { Price }^{\text {full }}

- \Delta \mathrm{P}^{\text {Full }}=(-) \text { MoneyDur } \times \Delta \text { Yield }

- Money convexity

- \text { MoneyCon = Convexity } \times \text { Price }

- \Delta P^{\text {full }}=[- \text { MoneyDur } \times(\Delta \text { Yield })]+\left[\frac{1}{2} \times \text { MoneyCon } \times(\Delta \text { Yield })^2\right]

- \mathrm{D}_{\mathrm{P}}=\sum_{\mathrm{i}=1}^{\mathrm{n}} \mathrm{w}_{\mathrm{i}} \mathrm{D}_{\mathrm{i}},\mathrm{C}_{\mathrm{P}}=\sum_{\mathrm{i}=1}^{\mathrm{n}} \mathrm{w}_{\mathrm{i}} \mathrm{C}_{\mathrm{i}}

- The factors that lead to greater convexity和久期一模一样

- longer time-to-maturity

- lower coupon rate

- lower yield-to-maturity

- For bonds with same duration, the one that has the greater dispersion of cash flows has the greater convexity久期一样,现金流越分散,凸度越大

Callable Bond

- Embedded call option leads to lower effective duration, especially when interest rates are low, due to shorter expected life

- Callable bonds often have negative convexity(concavity), especially when interest rates are low

Putable Bond

- Embedded put option leads to lower effective duration, especially when interest rates are high, due to shorter expected life

- Putable bonds often have higher positive convexity, especially when interest rates are high

Fundamentals of Credit Analysis

Credit Risk

Credit Risk

- Credit risk is the risk of loss resulting from the borrower(issuer of debt)failing to make full and timely payments of interest and/or principal

- Expected loss = Default probability × Loss severity

- Default risk/default probability: the probability that a borrower default

- Loss severity/loss given default: the portion of a bond's value (including unpaid interest) an investor loses

Loss severity = 1 - Recovery rate

Credit-Related Risk

- Spread risk基差风险 is the risk of yield premium to "default-risk free" bonds ,such as U.S. Treasury bonds

- Credit migration risk/downgrade risk信用评级恶化风险: bond issuer's creditworthiness deteriorates, or migrates lower, causing the yield spreads wider and the price lower

- Market liquidity risk: the price at which investors can actually transact buying or selling may differ from the price indicated in the market

- Relative to a comparable, default-free bond, yield spread is composition of the credit spread and liquidity premium

- Yield spread = Credit spread + Liquidity premium

Yield Spread

- Factors that influence the level of yield spread

- Credit cycle

- Broader economic conditions

- Financial market performance overall, including equities

- Broker-dealers' willingness to provide sufficient capital for market making

- General market supply and demand

- Lower quality issuers typically experience greater spread volatility

- Return impact from spread changes is driven by two main factors

- modified duration

- magnitude of spread change

- For small spread change

\text{Return impact} \approx -ModDur \times \Delta Spread - For larger spread change

\text{Return impact} \approx[-ModDur\times \Delta Spread ]+[\frac{1}{2} \times \operatorname{Con} \times \Delta Spread^2]

Seniority Ranking清偿顺序

- Seniority ranking refers to the priority of payment, or priority of claims

- First Lien Loan

- Senior Secured debt/Second lien debt

- Senior Unsecured debt

- Senior Subordinated debt

- Subordinated debt

- Junior Subordinated debt

- Cross Default Provision交叉违约条款

- When a company defaults on one of its several outstanding bonds,provisions in bond indentures may trigger default on the remaining issues as well只要公司有债券违约,就视为该公司所有债券违约

- Priority of claims is not always absolute清偿可能有特例,导致不按顺序

- Potential violation of seniority ranking

- All impaired claimants get to vote to confirm the plan of reorganization

- There may be disputes in reorganization, and resolution of these disputes takes time and incurs expenses

- To avoid the time, expense, and uncertainty over disputed issues,the claimants have a strong incentive to negotiate and compromise

- Pari Passu

- All creditors at the same level of the capital structure are treated as one class同一层的清偿是等价的

- This provision is referred to as bonds ranking pari passu ("on an equal footing”) in right of payment

Credit Rating

Credit Rating

- There are three major credit rating agencies: Moodl S&Pand Fitch

- Rating agencies will typically provide both issuer and issue ratings,particularly as they relate to corporate debt

- Issuer rating评级发行人: address an obligor's overall creditworthiness

- Issue rating评级债券: specific financial obligations of an issuer and take into consideration such factors as ranking in the capital structure (e.g., secured or subordinated)

- Risks in relying on agency ratings

- Credit ratings can be very dynamic评级变动太频繁

- Rating agencies are not infallible评级机构可能不靠谱

- Other types of so-called idiosyncratic or event risk are difficult to capture in ratings特定风险没有被捕捉

- Ratings tend to lag market pricing of credit评级机构的反映有延迟

Notching评级微调

- Credit ratings on issues can be moved up or down from the issuer rating以主体评级为基础,根据债券实际情况微调得到债券评级

- Issuer credit rating usually applies to its senior unsecured debt

- Notching is less common for highly rated issuers than for lower-rated issuers发行人评级越高,微调越低

- For lower-rated issuers, higher default risk leads to significant differences between recovery rates of debt with different seniority rankings, leading to more notching

General Principles of Credit Analysis

Traditional Credit Analysis-4Cs Analysis

- Capacity还款能力

- Ability of the borrower to make its debt payments on time

- Collateral抵押物

- The quality and value of the assets supporting the issuer's indebtedness

- Covenants条款

- The terms and conditions of lending agreements that the issuer must comply with

- Character发行人的管理层

- The quality of management

Capacity analysis

- Industry structure - Porter's five forces model

- Industry fundamentals

- Company fundamentals

- Competitive position

- Track record / Operating history

- Management's strategy and execution

- Ratios and ratio analysis

- Profitability盈利能力 and cash flow(e.g.EBIT, EBlTDA): The higher, the better

- Leverage杠杆率 (e.g. debt/capital, debt/EBITDA): The lower, the better

debt = short-term debt + long-term debt

capital = debt + equity - Coverage保障倍数 (e.g.EBITDA/interest, EBIT/interest): The higher, the better

Collateral analysis

- Only when the default probability rises to a sufficient level do analysts typically consider asset or collateral value

- The key point is to assess the asset value relative to the issuer's level of debt (seniority ranking)

- Other factors to be considered

- Intangible assets

- Amount of depreciation relative to capital expenditures

- Equity market capitalization

周期性强,杠杆高,信用风险越大

供应商多,对债务承受能力越大

Covenants analysis

- Strong covenants protect bond investors, and weak covenants pose additional risks to bond investors

- Affirmative covenants: obligated to do something

- Negative covenants: limited in doing something

Character analysis

- Assessment of the soundness of management's strategy

- Management's track record in executing past strategies, particularly if they led to bankruptcy or restructuring

- Use of aggressive accounting policies: tax strategies, off-balance-sheet financing, recognition of revenue prematurely

- Any history of fraud or malfeasance:a major warning flag to credit analysts

- Previous poor treatment of bondholders

Special Consideration in Credit Analysis - High Yield Debt

- The higher risk of default means more attention must be paid to recovery analysis(or loss severity),and is more in-depth with the following special considerations:

- Greater focus on issuer liquidity and cash flow

- Detailed financial projections

- Detailed understanding and analysis of the debt structure

- Understanding of an issuer's corporate structure

- Covenants

- Equity-like approach to high yield analysis用权益办法分析垃圾债

Special Consideration in Credit Analysis - Sovereign Debt

- Two key issues for sovereign analysis are:

- Government's ability to pay

- Government's willingness to pay关注还款意愿

- Credit of sovereign debt in its local currency is always at least as good that in foreign currency, due to the sovereign's ability to "print money"to repay debt within its own economy

- Important considerations in sovereign credit analysis:

- Political and economic profile

Institutional effectiveness and political risks

Economic structure and growth prospects关注人口是否增长 - Flexibility and performance profile

External liquidity and international investment position

Fiscal performance, flexibility, and debt burden

Monetary flexibility

- Political and economic profile

Special Consideration in Credit Analysis - Municipal Debt市政债

- Usually can be classified as general obligation (GO) bonds and revenue

bonds- GO bonds: unsecured bonds issued with the full-faith and credit of the issuing government, and supported by the taxing authority of the issuer

Credit analysis of GO bonds has some similarities to sovereign debt analysis, but have no ability to use monetary policy - Revenue bonds: issued for specific project financing (e.g. toll roads,bridges, airports)

Higher risk than Go bonds because they are dependent on single source of revenue

- GO bonds: unsecured bonds issued with the full-faith and credit of the issuing government, and supported by the taxing authority of the issuer

- Credit analysis of revenue bonds is a combination of project analysis and financial analysis around the project

- Project analysis: need, economic base, projected utilization

- Financial analysis: similar to corporate bond analysis

Debt service coverage ratio(DSCR):a key credit metric, the higher the DSCR, the stronger the creditworthiness